(Click on the picture to visit the topic of the 2020 US Presidential Election)

With the fierce competition in the 2020 US presidential election, the tax reform proposal between the current President Trump and the presidential candidate Biden has recently become a topic of concern to everyone.

What is the difference between Biden's tax reform proposal and the existing "Tax Cuts and Employment Act TCJA"? Which families have the greatest impact?What is the specific impact?Faced with the huge uncertainty in the election year, how can we prepare financially?These three topics are the main content discussed in this article.

Part of Biden's tax reform policy

For every family, personal income and taxation are our top priorities.

OnPayroll taxaspect1, Biden proposed,For groups whose annual taxable income exceeds $40, Levy a 12.4% social security payroll tax.

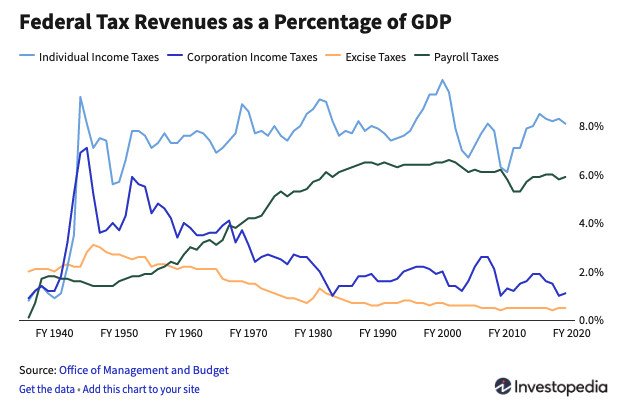

(Since 1950, payroll tax has increased rapidly, and corporate tax has fallen the fastest)

(Since 1950, payroll tax has increased rapidly, and corporate tax has fallen the fastest)

OnPersonal Income TaxOn the one hand, the plan is to restore the maximum personal tax rate of 39.6% (now 37%), which will affect individuals whose taxable income exceeds $518,400, or families whose income exceeds $622,000.

And forCapital gains taxAspect, forIndividuals earning more than $100 million, Capital gains and dividends are taxed at the highest individual tax rate.Example: If your income exceeds $100 million, you already need to pay taxes at the highest tax rate of 39.6%.At this time, all of our income from investment gains will follow the individual and be taxed at 39.6% (the current capital gains tax standard is 20%).

In addition, for those who choose "Itemized Deduction"-usually the rich-Also plans to set a 28% tax deduction limit.

More on Biden's tax reform proposalBylaw, You can click here to view.In a nutshell, Biden's tax reform proposal will have a significant impact on the income of high-income or high-net-worth families.

$30 off annual income

According to a report by TPC, a research institution on tax policies and regulations2, If the tax reform proposed by Biden takes effect in 2021, thenU.S. households with incomes above $17, Will bear most of the consequences of the tax reform, and this group accounts for 20% of the US population.

The wealthy group, which accounts for 1% of the US population, has been hit even harder.

For this 1% of wealthy families with an annual income of more than $83.7,The average income after taxes will be reduced by $30.The average after-tax income of almost households fell by 17%.

For 0.1% of super-rich families (with an annual income of more than $370 million), on average, they need to bear an additional $180 million in taxes, which is almost a quarter of their after-tax income.

The above-mentioned families, in addition to the significant impact on income tax, areInheritance of wealth, The wealth left to children will also be greatly impacted.

The rollback of inheritance tax

In 2017, the IRS Internal Revenue Service issued"Tax Cuts and Employment Act TCJA" will passThe inheritance tax exemption of $500 million has more than tripled, and the latest personal exemption for inheritance tax in 2020 has also been adjusted to $1158 million.

In the 2020 U.S. election, Trump proposed,The "generous" inheritance tax exemption will be extended in 2025 without changing the existing rules for calculating the principal of the estate.

Biden proposed,The plan is to immediately return the inheritance tax and gift tax exemption to the previous state of $500 million, and plug the existing inheritance and wealth inheritance "loopholes".Such a policy will affect high-net-worth familiesWealth planningAnd children acceptInherit wealth, Have a major impact.

Wealth inheritance planning during the U.S. election

Coupled with the inflation index, a lifetime allowance of $600 million per person is sufficient for most people.However, for families with a net worth of more than $600 million (couple of $1200 million), you need to prepare in advance.

Regardless of whether Biden is elected, one thing is certain: the new president will have to take office as early as 2021.therefore,How can high-net-worth families rush to save the $2021 million lifetime tax exemption that each of us now has before the potential new tax reform plan takes effect in 1158, and it will becomeInheritance of wealthThe top priority.

In addition, in the process of wealth inheritance, Biden plans toWealth inheritance processAmendments to the calculation method in, although the specific calculation method and rules have not yet been released, this will be possible for the younger generation of wealth inheritors.Faced with a situation where the government takes a share of the inherited wealth.

Article summary

From the tax reform proposals and slogans of the candidates of the two parties, we can see the different positions of the two presidential candidates.To sum up, Trump’s tax policyHigh-income, high-net-worth familiesIs more advantageous, and Biden seeks fromHigh-income, high-net-worth familiesIn the wealth, balance the government’s debt and income.

Although facing the huge uncertainty of the final result of the 2020 US presidential election, the starting point of each family for wealth accumulation and inheritance is exactly the same-no matter who is elected, beware of the government extending its hand to our wallet At this point, all people have reached the same goal by different routes and remain vigilant at all times.

In this process, we can understand the specific content of different tax reform proposals on the one hand and the potential impacts that follow.On the other hand, you can seek professionalLife insurance brokerWith the assistance of an independent financial adviser to understandAmerican wealthAccumulation andinheritedIn the process, what financial planning choices do we have — just asAmerican Life Insurance Guide©️One point that has been repeatedly emphasized: In a highly developed free market economy, our problem is often not that we have no choice, but that there are too many two-way choices we face. (Finish)

appendix

01. "Comparing Biden's and Trump's economic policies", 09.18.2020, Janet Nguyen, Marketplace.org.

02. "Biden Would Raise Taxes by $4 Trillion Over 10 Years, Mostly on The Highest-Income Households", 03.05.2020, Howard Gleckman, TaxPolicyCenter(TPC).