Are life insurance premiums paid in one lump sum, 1 years, 10 years, or lifetime?

Certain life insurance companies also offer the option of paying premiums until the age of 65 and paying premiums until the age of 100.Faced with so many options for paying premiums, which one is best for us?

It is obvious that the best way to pay premiums depends on our own financial situation and the purpose of insurance.The premium payment plan that is suitable for you may not be used by me at all.

Therefore, it is important to understand how our life insurance premiums can be paid, what premium options we have, and what advantages and disadvantages we have.American Life Insurance GuideThe professionals in the community combine case and industry public data to help policyholders understand the following:

- Which premium payment methods can I choose?

- How to pay premiums is the most popular?

- Can't the premium be changed after the insurance?

Which premium payment methods can I choose?What are the advantages and disadvantages of each

Which premium payment method we use depends on our motivation or purpose when we apply for insurance.

Seeking the accumulation of assets may be the goal of some policyholders.

Depositing sufficient premiums in a shorter period of time can increase the growth and accumulation potential of insurance assets.

以Savings Participating Insurance-Whole Life InsuranceFor example, a 10-year premium planning plan is more effective in accumulating the cash value of the account than a 20-year premium planning plan.

Universal whole life insurance with very flexible premium payment mode-such asGuaranteed insurance, Investment insurance, orIndex insurance——The policyholder can even pay in the first yearAs much as possibleIn order to achieve the fastest accumulation of cash value, to complete the accumulation of policy assets.

(>>>Related reading:Popular Science Post|Why I want to deposit more premiums, but I am not allowed?)

Seeking lifetime protection may be the goal of other policyholders.

Then with the passage of inflation and time, using relatively less "money" and matching the leverage of the market to buy a fixed amount of protection is also a "defensive" premium payment strategy.

We can choose to extend the premium to 20 years, or pay until 65 years old-a lotWhole LifeThe policy also provides a plan to pay until the age of 100-to monitor the health of the policy account, which can reduce the annual payment cost and create more cash liquidity for us.

Buying life insurance for children or grandchildren is an "eternal" theme.

Some parents and grandparents,Usually choose a plan that pays off in 10 to 20 years, To buy life insurance for children or grandchildren.

The advantage of this is that after 10 to 20 years, the children and granddaughters will have grown up.At this time, the child’s insurance policy account has been paid in full, or the cash value in the insurance account has begun to roll up. If the child needs to spend money——Whether it is used as the first money to buy a house or as a wedding money, the insurance policy can provide the required funds.

What is the most popular and common premium payment cycle?

According toWantong Mutual Finance(Mass Mutual)The data,The premium payment method paid in 10 years,It seems to be the most attractive to people at the moment.

In the New York area, traders working on Wall Street generally hope to retire after 10 years of work, or semi-retire, but if they retire, what about their future income?So they need to find a retirement income product, and then take advantage of the 10-year window of work to deposit the retirement funds they need in the future.

The premium plan paid in 10 years has become the most attractive payment method.

Can’t I change it if I choose to pay the premium for 10 years?

forSavings and Dividend Insurance, Under the three major guarantees, it feels like a monolithic one for policyholders.

But with savings and dividend insurance as the issuerLife insurance company, Will still give policyholders a certain degree of flexibility.

No matter what premium payment plan we choose when applying for insurance, we can adjust RPU (Paid-Up w/ Reduced Coverage)-the designated management of policy annual dividends-to passively reduce premiums or reduce the payment cycle.

For example, when you applied for a savings and dividend policy, you chose the option of paying premiums until the age of 100. However, as the insurance company's dividends and management proceed, you do not need to continue to deposit premiums by the age of 65.

(>>>Related reading:Knowledge Post|What is the use of Paid-Up Addtion of Savings Participating Insurance for me? )

Universal whole life life insurance provides more customizable "flexibility".

Private Insurance Client Advisor of North America Hummingbird Life Heather, Provides us with a premium planning case of an asset management policy to illustrate this problem.

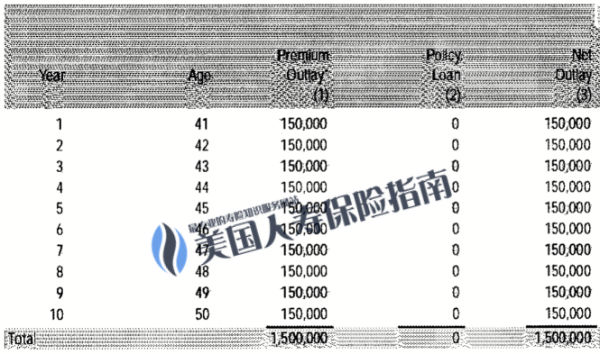

The original plan proposal of the plan was to deposit $15 in premiums every year for 10 consecutive years.

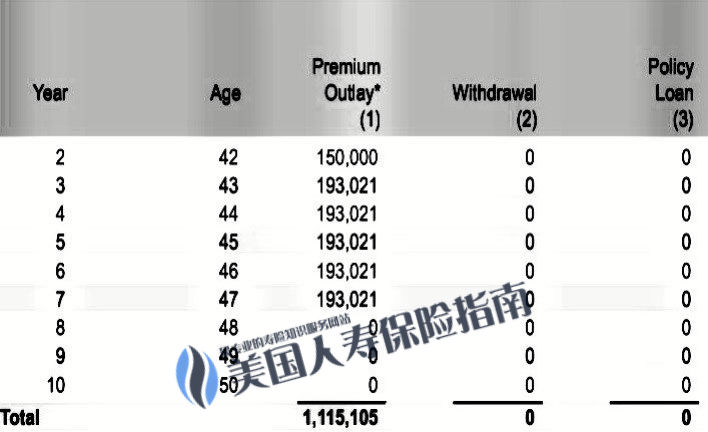

After two years of premium payment and interest calculation, the policyholder hopes to shorten the time for premium payment, and also hopes to increase the premium a little bit every year, which will be taken care of by the designated insurance company.

afterInsurance companyThe calculation and adjustment of the insurance policy gives the maximum deposit limit. The insurance premium for the third year can be calculated from原定的15萬,增加到19萬3千零21美元。保費繳存的時間,也從10年期調整為7年期。

The insured can choose to pay according to the original plan or pay the premium according to the new proposal according to his family’s financial status and subjective wishes, thus having moreInitiative and flexibility.

An excellent asset management insurance policy selection and design maintenance plan can provide policyholders with additional premium liquidity and flexibility.

Article summary

"General experience, if you just buy a guarantee, such asBuy lifelong critical illness protection, Or buy an insurance claim and leave it to the children, then the time for paying the premium can be delayed as long as possible. It can be paid in 20 years, until the age of 65, or even until the age of 100. " Heather Say, "If you want higherInternal rate of return on policy account, Then the sooner the payment is made, the sooner the OverFund—for example, savings and dividend insurance paid in 10 years, or 5 years, or even an index insurance paid in advance provided by individual insurance companies, can reach our goal faster. "

Finally, different families, different environments, and different needs correspond to different life insurance products and corresponding planning schemes.

American Life Insurance GuideThe principle of LBYB (Learn Before You Buy) has always been emphasized, and the life insurance guide community website also providesInsurance College.Insurance Product Center.Insurance product evaluation.Insurance strategy guideA large number of topics are provided for policyholders' reference.When we have a certain basic knowledge, please be sure to seek the assistance of professional life insurance policy planners or insurance broker consultants who only charge professional service fees to find products and solutions that can truly better fulfill our needs. (End of full text)

(>>>Recommended reading:Insurance Strategy|How to take the first step?4 common topics that insurance advisors must discuss)

(>>>Recommended reading:(Picture) What is the annual statement for dollar life insurance?What is the interest calculation of the annual policy income?)

(>>>Recommended reading:Buying a house 3 steps vs buying insurance 3 steps?What should I do if I suspect my insurance account will be terminated?)