(American Life Insurance Guide 04/10/2023 News)The U.S. insurance industry AG-49A regulations have been further revised and will be enforced on May 2023, 5. The core change is,The insurance company's product sales plan is no longer allowed to show policyholders the situation of specific index-weighted additional fixed dividends,This move may greatly impact the US insurance wealth management market.

What is AG-49A?What does it have to do with me?

AG-49A is a regulation issued by the American Society of Actuaries (Actuarial Guideline 49-A) to limit the use of excessive interest rate assumptions in certain types of life insurance products.

In the 2019 US Life Insurance Guide "Amendments to AG49 Regulations”According to the report, AG-49A stipulates a series of rules and restrictions to control the use of excessive interest rate assumptions in insurance products, including guaranteed rate and non-guaranteed rate products.This is to ensure that insurers can provide more accurate and robust expectations of interest rates and earnings when selling these products to consumers.

Specifically, AG-49A specifies various calculation and reporting requirements, including specifying standards for different interest rate assumptions and restricting insurers from using excessive interest rate assumptions.

The implementation of this regulation has had a profound impact on the development and sales of life insurance products, because it requires insurance companies to make more prudent and accurate assessments of their interest rate assumptions, and for policyholders, it also provides a sufficient degree of Protect.

In the follow-up report in 2020, TheLifeTank also conducted a report titled"Heavyweight|The US Insurance Regulatory Commission took action, is the new AG49 regulation a boon for insurance financial policyholders? "special report.

Why the constant revisions to the AG-49 regulations for the insurance industry?

There are policies and measures to counter.

The insurance company soon discovered that there was a "loophole" in the revised AG-2020 regulations in 49: If the insurance company provides an uncapped benefit in the policyVolatility Control Index, and then give the policyholder a fixed annual dividend.Then the number of the product proposal is in compliance, and at the same time it becomes relatively "more attractive" to the policyholder.

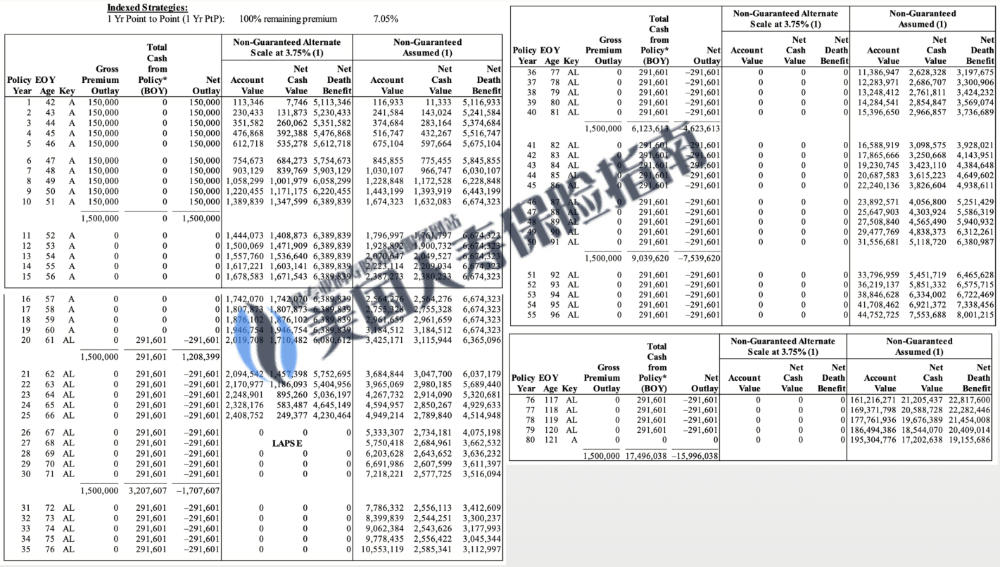

Scheme Suggestion Numerical Case Illustration Demo

Scheme Suggestion Numerical Case Illustration Demo

Immediately afterwards, from 2020 to 2023, new terms and new indices began to appear frequently in the insurance market.newVolatility Control IndexIntroduced into the insurance market, some insurance companies will default to the presentation method, fromS&P 500 Index, changed to a new index-weighted fixed dividend.

With the blessing of compliance values, more "beautiful" PPTs began to emerge in the market.

In the previous column report of the American Life Insurance Guide Network, it was pointed out that the sales of the global insurance industry in recent years seem to be escalating into a trend of "PPT war".

in"What are the controversies and highlights of the life insurance plan proposal"In the discussion, the columnist of the American Life Insurance Guide community pointed out that "some life insurance companies began to targetCalculus display systemOptimize the design, change the design of insurance products in turn, such as providing non-guaranteed annual dividends, etc., to adapt to the regulatory regulations of the proposal, improve the effect of digital display, and indirectly allow sales staff to speak well on PPT while abiding by the law s story.The result of this is that today's market competition seems to have been upgraded to a "PPT war". ” ——TheLifeTank.com

In this PPT war, the supervision of various countries has become the core line of defense to protect policyholders and investors.The US Insurance Regulatory Commission NAIC has been taking constant actions within a few years, revising and implementing the AG-49 regulations in three stages.

What are the benefits of the new regulations for policyholders?

Under the constraints of new regulations, in order to maintain market competitiveness and allow the value of policy proposals to be recognized by policyholders or investors again, insurance companies face two choices:

Regardless of which point, it is a great benefit to policyholders or investors.

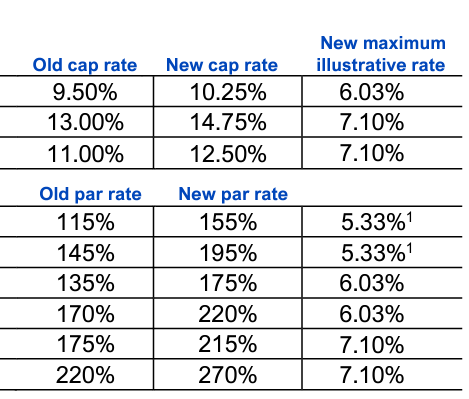

As of the press date, large insurance companies have successively issued internal circulars to increase policyholders’ policy cap rate of return and revenue participation rate, in order to compete for market share.

The new and old yield indicators of an insurance company have increased significantly

The new and old yield indicators of an insurance company have increased significantly

Which insurance products and insurers are not affected?

Policies sold before May 2023, 5 are exempt from the restrictions and impact of the new regulations on demo systems.

At the same time, some insurance companies and existing insurance products that have not adopted the above strategies for numerical demonstration will not be affected by the new AG-49A regulations.

These insurance brands include, but are not limited to:

(The full text is being updated continuously)