Various investigations and reports constantly remind that Americans are always ill-prepared for retirement.The Social Security Bureau also confirmed in the official document,Don't regard social security retirement pension as the main source of income after retirement. The topic of this issue of insurRetire©️ Retirement column is,In order to maintain the quality of our retirement life, how much money is enough?

Different people and different organizations have different theories and answers to this question.But when life happens in reality, there are too many variables and unexpected things.Even if we plan for these things before they happen, the plan may change accordingly.but,On the long journey of life, a plan is better than an unplanned one..

(>>>Recommended reading: gadgets|The American Personal Pension Smart Calculator, how much do I need to save every month?)

"10 times income" and "retirement 4% rule"

How much money do we need to retire?One of the most commonly used quick calculation methods is,Before the age of 67, we need to save 10 times the annual income of the year before retirement.

For example, if you are in the year before retirementAnnual income is $15, Then your best savings for safe retirement is $15 x 10 = $150 million USD.

The second way to calculate retirement savings goals is from our currentMonthly living expenses, or annual living expensesSet off-if we can figure out that our current monthly living expenses are 8000 US dollars, then when we retire, we need 80% of the monthly basic expenses-8000*80% = 6400 USD, Which adds up to$7.

Some retirement planning practitioners like to use the third method,4 rules of retirement,"4%",Four percent rule.

The 4 Retirement Rule, also known as the XNUMX% Rule, is a calculation method used to take money from the retirement savings account after retirement to create a continuous income cash flow.According to the introduction of TD Ameritrade®️,The "retirement 4" ruleAfter retirement, the assets of $100 million can be withdrawn at a frequency of $4 per year to provide continuous income cash flow.

(>>>Recommended reading:How much do Americans of different ages save for retirement?)

Start planning

For those of us planning to retire, the first step isDetermine our savings target amount和make a plan.

There is a specific number that reminds us of the existence of this goal every day. Such an approach can indeed help us achieve the goal more likely.Another benefit of making a plan is that it can provide us with a measurable progress goal.

"Hoard" as much money as possible for the goal. After forming a habit, it is like completing a nurturing game. We have more and more deposits, and our sense of satisfaction will also increase.

A concept of financial management is: "It is best to start young and maintain a reasonable ratio of savings to income. IfWe are only in our early 20s, we can start from 10%;For saving groups that start after middle age, they may need to consider saving 25% or more of their income and increase their contributions as their income increases.'

United Capital's Blumenthal believes that investors need to "allocate investment targets, rebalance asset portfolios, and allow time to do its magic."

(>>>Recommended reading:What exactly is the "bucket strategy" for retirement pensions?Is it the best retirement withdrawal strategy?)

When you are young, use a portfolio of securities, and when the retirement age is approaching, allocate the portfolio to bonds and cash. In this way, through retirement, the goal of the portfolio has been shifted from providing “growth” to providing “income”, and The risk is also reduced.This is the classic method of transforming "wealth accumulation" to "wealth preservation".

Of course, even in the later stages of this approach, risks still exist.But the vast majority of people will choose to reduce their participation in the stock market, give up the potential returns of the stock market, and instead focus on controlling the risks of retirement assets as their main goal.

(>>>Recommended reading:Bank of America report: How much money do post-90s generations in the United States have now saved?)

Normality: reasonable, unexpected

Life is impermanent and many things happen.The actual cost of health care when we retire is also unknown.According to research estimates by HealthView Services,A 65-year-old healthy couple may spend approximately US$260,000 in medical insurance during their retirement..

In reality, we will inevitably encounter some life changes, which may include future unemployment, or the possibility of working hours shorter than expected, or the failure of investment in certain years, etc., which will cause retirement assets Will be less than expected.In addition, a large amount of one-time retirement expenses may also cause serious damage to our cash flow.

Some people need to take time off to take care of sick relatives or elderly parents. Rising University Tuition Fees, Is another cost, the cost between each family varies greatly.

One possible solution is not to retire completely,Still looking for a part-time job.This is not only financially necessary, but also beneficial to our body and mind.We must admit that work provides a channel for us to maintain links with the social environment.

(>>>Recommended reading:How to use index insurance to carry out the 2-in-1 planning of parents' "retirement planning" and "children's education fund"?)

(>>>Recommended reading:After selling a house for cash, popular science and comparison of 2 lifetime cash flow retirement income plans (Figure))

Article summary

Due to many factors in the social environment and the market, we may successfully achieve our retirement savings goal, or we may fail.

Whether it is success or failure, the result depends on the decision we make.The purpose of regular retirement financial planning and auditing is to identify and manage the risks we face according to our different life stages.

In the long period before retirement, what we should do most is to build enough financial tools and risk management methods for ourselves. When we encounter various "reasonable and unexpected" events in our future life, we have Enough options to face calmly.

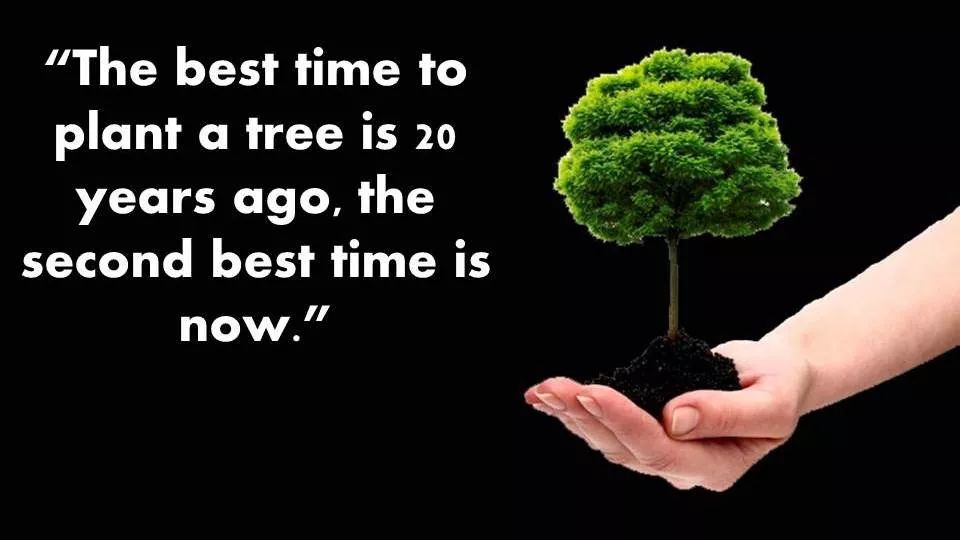

Finally, this sentence may be the best answer to the question of planning for retirement.

"The best time to plant a tree is twenty years ago, followed by now."

(>>>Recommended reading:How to use life insurance to increase our income after retirement?)

(>>>Recommended reading:Inflation shocks the 4 laws of retirement, how much does 100 million retirement assets shrink every year?)