(American Life Insurance Guide 06/05/2023 News)Market share data of U.S. life insurance brands in the first quarter of 2023*Released recently by Wink Inc.Through the interpretation of Q2023 data in 1, American Life Insurance Guide©️ will help policyholders and investors understand:

- An insurance brand with a relatively high market share in the US market;

- What are the reasons for US residents to choose different life insurance accounts?

- What is the average annual premium for insuring savings for U.S. residents?

American Life Insurance Guide©️The quarterly data Chinese interpretation report is one of the important reference indicators for individuals, families and businesses in the Chinese-speaking community to purchase and configure American life insurance.

🏆2023Q1 overall sales champion: National Life Insurance Company

National Life Group®️ Index Insurance Product Line Overview

| FlexLife | PeakLife | SummitLife |

|

|

|

National Life Group®️ The sales volume of various index insurance products (Click on the image above to view some product reviews), accumulatively achieved a market share of 14.4% in the index insurance market.

🏆Quarter best-selling index insurance: Financial Foundation IUL

List of Transamerica®️ Index Insurance Products

| Financial Foundation IUL insurance product cover | ||

|

Issued by Transamerica®️Financial Foundation IUL insurance account(Product evaluation), in the first quarter of 2023, it will continue to maintain the crown of "the best-selling insurance product in the quarter".

officially changed its name toCorebridge FinancialOfAIG Life Insurance, continued to maintain its leading position in the Direct Response market during the quarter.

The following are specific data reports for different insurance market segments:

1. Index insurance: "Financial management" is the core demand

Index insurance, English called Indexed Universal Life, usually referred to as IUL.

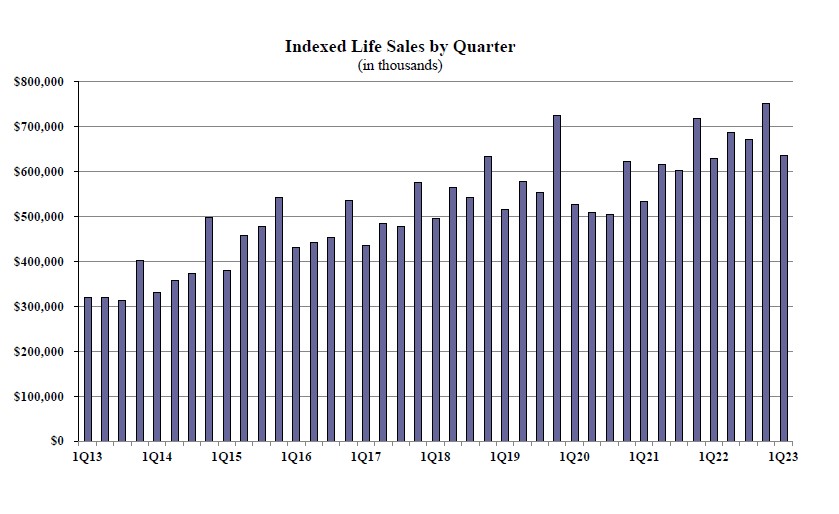

The premium sales of index insurance accounts in Q2023 of 1 will be US$6.35 million, and the accumulated premiums paid will decrease by about 15% month-on-month.

From 2012 to 2023, the historical trend chart of the premium payment and deposit amount of the index insurance account is shown in the following figure:

(2023Q1 Index Insurance Premium Trend Chart©️Winkintel)

(2023Q1 Index Insurance Premium Trend Chart©️Winkintel)

How much premium do policyholders pay on average each year?

- During the third quarter of 2023,The average annual premium paid per index policy is $12,266.

Why do policyholders choose index insurance?

-80.3% of policyholders hope to apply insurance for "cash value accumulation"(Cash Accumulation)'.

In the field of index insurance markets,National LifeTaking advantage of the sales advantages of its various index insurance products, it will continue to rank first in the overall sales volume in 2023Q1.Transamerica Life, Nationwide Life, Pacific Life, and Sammons Financial (North American Life and Midland Life) followed closely behind.

According to2023Q1 market share, The following isIndex life insurance company brand Top5, The following is the specific content of the list.

Life Insurance Brand Ranking Top 5

- 🏆National Life Group / National Life Insurance (Evaluation)

- Transamerica/ National Life Insurance (Evaluation)

- Nationwide/ National Life Insurance (Evaluation)

- Pacific Life Companies / Pacific Life Insurance (Evaluation)

- Sammons Financial Companies / North American Life Insurance (Evaluation)

Quarterly best-selling index insurance product

🏆Sales champion - Transamerica FoundationIUL

American Life (Company Evaluation) IssuedFFIULproduct(Product Evaluation), continued to be the highest-selling index insurance product in the IUL market segment during the quarter.

2. Universal Life Insurance (UL): The advantage of "guaranteed continuous protection"

Traditional universal life insurance, also known as fixed-rate universal life insurance, is called Universal Life in English.

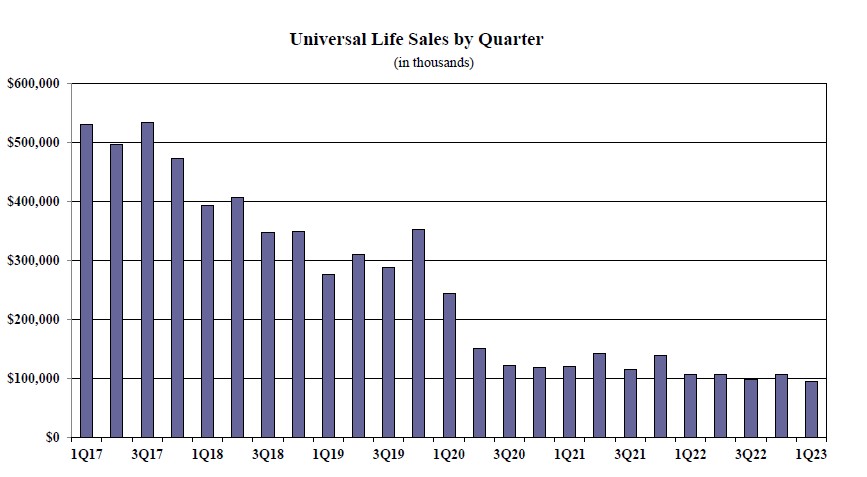

(2023Q1 UL Universal Life Insurance Premium Trend Chart©️Winkintel)

(2023Q1 UL Universal Life Insurance Premium Trend Chart©️Winkintel)

The premium sales of universal insurance in Q2023 of 1 will be about 9400 million US dollars. Judging from the historical trend chart of the insured amount, it continues to maintain a downward trend.

"Guaranteed Uninterrupted Insurance" GUL Insurance Products, is the main reason for policyholders to purchase this type of insurance.

How much premium do policyholders pay on average?

- In 2023Q1,The average annual premium paid for each UL policy is $4,690.

Why do policyholders choose universal insurance?

-50.4% of policyholders because"Guaranteed to keep(No Lapse Guarantee)'demand.purchased this policy.

3. Participating insurance: Consideration of "end-of-life expenses"

Participating Insurance, Also known asSavings dividend insurance, called Whole Life in English.

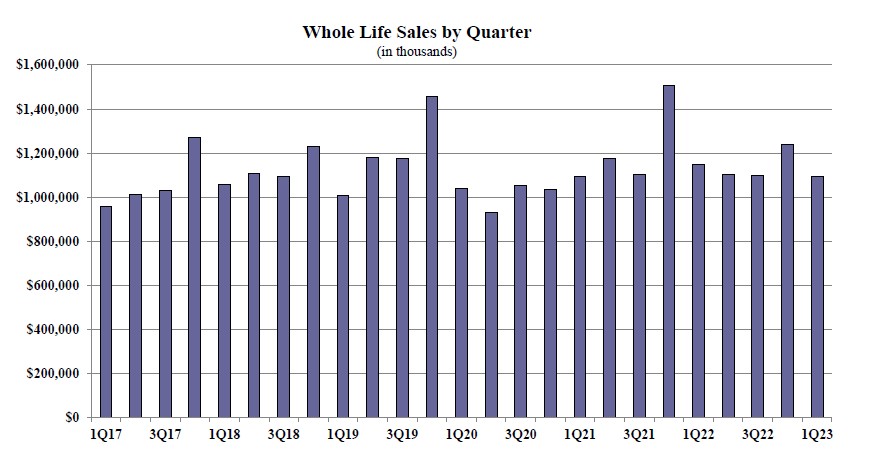

Whole Life(Savings dividend insurance)2023年Q1的保費銷售額約為10億美元,環比下降了12%,和去年同期相比下降了5%。

The figure below shows the trend of the total amount of historical premium payment in the U.S. savings dividend insurance account from 2017 to the beginning of 2023.

(2023Q1 Participating Life Insurance Premium Trend©️Winkintel)

(2023Q1 Participating Life Insurance Premium Trend©️Winkintel)

How much premium do policyholders pay on average?

- During the fourth quarter of 2023,Average annual premium per policy is $4,127.

Why do policyholders choose participating insurance?

-62.5% of policyholders because of the consideration of "Final Expense”And chose to buy savings and dividends insurance.

Article summary

American life insurance products, usually refers to a financial account with cash value opened in an insurance company, and the policyholder enjoys the corresponding tax benefits and variousClaims benefits, Widely used in retirement income planning, dollar asset allocation, life-long welfare protection, financial planning, corporate executive benefit planning, and estate planning and other fields. (full text)

At the same time, the principle of "LBYB – Learn Before You Buy" - "Learn Before You Buy" proposed by American Life Insurance Guide ©️, and through the sharing of insurance academies and insurance cases, helps Chinese families around the world fully understand the dollar asset type. Knowledge of life insurance to get the products and services you really need. (End of full text)

(>>>Related reading:Data|2022 Q4 Top 5 best-selling insurance products and life insurance brands and companies in the United States)

(>>>Related reading: Data|Account opening premium increased by 138%, 2022Q3 ranking of the best-selling annuity insurance brands in the United States)

(>>>Related reading: Data|2022Q1 American Life Insurance Brand and Product Market Sales Ranking Top 5)

(>>>Related reading: Data|2021Q2 American Life Insurance Brand and Product Market Sales Ranking Top 5 )

(>>>Related reading: Data|2021Q1 American Life Insurance Brand and Product Market Sales Ranking Top 5 )

(>>>Related reading: Data| 2019Q4 U.S. Life Insurance Market Ranking Top 5 and Insurance Data Report )

(>>>Related reading: Data|2020Q4 U.S. Index Life Insurance Market Ranking Top 5 )

(>>> Recommended reading:Evaluation|Increase in revenue by $186 million, professional design and planning Vs wrong way of insurance )

(>>>Related reading:Statistics|Which American annuity insurance is the best-selling in 2021Q3?Ranking of American Annuity Insurance Companies )

(>>>Recommended reading:Data|Top 2021 best-selling annuity insurance brands in the United States in 4Q5 )

(>>>Recommended reading:Data | 2022Q1 ranking list of the best-selling retirement annuity insurance products in the United States )

(>>>Recommended reading:Insurance Strategy|How to take the first step?4 common topics that insurance advisors must discuss)

(>>>Recommended reading:(Picture) What is the annual statement for dollar life insurance?What is the interest calculation of the annual policy income?)

About LifeTank©️ – LBYB

LBYB – Learn Before You Buy, is TheLifeTank.com – American Life Insurance Guide©️A guiding concept for individuals and families to configure financial insurance.In view of the extremely diversified financial instrument attributes of American life insurance and annuity insurance, the application of such products in the field of wealth accumulation and inheritance has surpassed traditional consumer insurance products.The impact of lack of corresponding basic knowledge education and one-sided education can be harmful to your interests after many years.Before applying for an insurance policy, American Life Insurance Guide©️ encourages consumers and investors to learn and understand the basic operating principles and functions of such financial products in advance, and seek professional assistance, so as to obtain solutions that can truly protect their families and wealth.

*"First QUARTER 2023 LIFE INSURANCE SALES", Wink Inc, 06/01/2023