According to the American Life Insurance Guide ©️Report, 在U.S. Novel Coronavirus OutbreakDuring this period, more and more people on the sidelines made up their minds and applied for life insurance.

For many applicants, in addition to the most basic "protection" function, what purpose can life insurance help us achieve?There are still many questions in my mind.In this article, the American Life Insurance Guide lists the five functions that American life insurance products can provide us.The following is the full text.

1. Guarantee

InsurGuru Insurance Institute pointed out that the most traditional purpose of purchasing life insurance is to manage the risks that may be faced in the future now, and through this risk management measure,Gain inner peace and tranquility.If we have an accident that triggers the claim conditions, we, or our family and children will receive the insurance company's compensation.

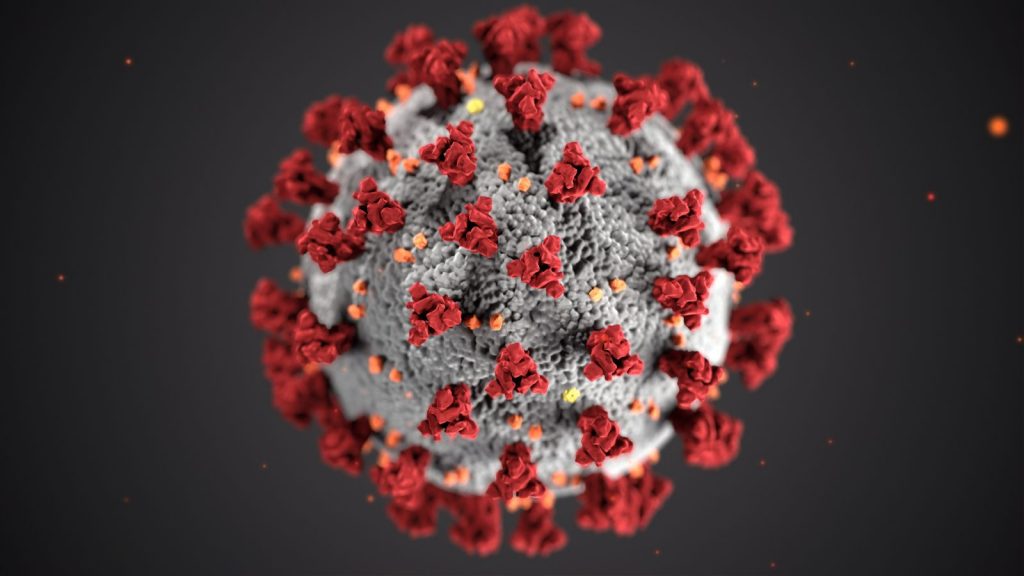

Modern life insurance provides a more comprehensive coverage of variousMajor diseasesProtection.The new coronavirus epidemic also reminds us that no one can resist disease and death.

(>>>Recommended reading:[Evaluation] What are the antemortem benefits of life insurance for cancer stroke and heart disease claims?)

2. Accumulate cash value

The cash value life insurance account can snowball through the "compound interest" method for up to 10 years and 20 years to realize the accumulation of cash value.Modern life insurance policies are enhancedPolicy accountof"Financial management"Property, provides more choices and combinations to increasePolicy incomeCircumstances created another independent market area for life insurance.

"Life insurance" goes beyond the traditional function of "protection" provided by life insurance, and the function of accumulating cash value has become a feature that modern consumers pay attention to.

(>>>Recommended reading:Can U.S. insurance be used for financial management? 5 popular science questions and answers about insurance financing)

3. Protect the principal from the risk of market decline

After a 10-year bull market, optimistic people believe that the U.S. stock market will only rise, not fall.From March 2020, the U.S. stock market has shown its other side, and many people’s pension accounts have been cut in half due to multiple circuit breakers.

People will only ask a question when they have already suffered such an irreparable loss:Is there any insurance product that can avoid this situation again in the future?Some cash value insurance products provide a protection function for principal in the event of severe market turbulence-without losing principal as the market falls.At the same time, when the market pulls back to rise, it can also provide the ability to follow the rise.

(>>>Recommended reading:How to guarantee not to lose money in a bear market?)

(>>>Recommended reading:How to protect our pension account from loss?)

4. Retirement income

While working hard and working hard, we are also preparing for retirement in the years to come.Usually, people need to save from their daily income and accumulate for a long time to achieve their retirement goals.But we are often still worried: "People are alive, but the money is not enough."

We hope that when we retire, we can have a continuous and uninterrupted lifetime income.Insurance plays a major role in this goal.We use the "snowball" method to accumulate cash value life insurance accounts, which can provide continuous income withdrawal for our retirement life.andAnnuity Insurance Account, Is a solution adopted by governments of various countries, specifically to provide us with life-long income.

(>>>Recommended reading:[Science Post] How to use life insurance to increase your retirement income?)

5. Philosophy of Personal Banking

First of all, American insurance companies will proactively inform in the product introduction that cash value insurance productsNot an investment product, nor a trust.But in reality, people usually compare well-designed cash value insurance policies to "personal bank" or "personal trust".Easy to understand.

Many insurance account products are flexible. Just like the bank account we open, policyholders can deposit money into the insurance account on a monthly, quarterly, and half-yearly cycle, and even deposit and withdraw at any time.It provides a source of cash flow that we can provide to ourselvesBorrow money, And then choose whether to repay*.

When a claim is settled, we can specify whether the insurance company will manage and transfer funds to a specific beneficiary or beneficiary institution in a lump sum or in installments.

Article summary

in the text,American Life Insurance Guide©️Shared some uses of insurance products and explained,From the traditional idea that “insurance” is the “exchange of security” with money, to today's “insurance” is a low-risk method of “cash value accumulation”.The functions and target markets of American life insurance have undergone significant changes.This change in market concept is precisely matched with the continuous improvement of the average life expectancy of American residents and the diverse development of modern social structures and lifestyles.

American Life Insurance, as a flexible financial tool, is used in addition to "providing comprehensive protection."Wealth accumulation""Supplementary retirement incomeIn addition to the above-mentioned fields, it is also widely used in estate planning and inheritance, company management planning, and welfare planning for small and medium family enterprises.

When actually carrying out relevant wealth planning, with professionalInsurance plannerOrfinancial consultantIn-depth communication and understanding can help us better understand the market situation and product characteristics, and achieve the effect of getting twice the result with half the effort.The American Life Insurance Guide also provides "U.S. Life Insurance Strategy Guide, Insurance Strategy and Common Misunderstandings(XNUMX) (XNUMX) (XNUMX)" for the reference of policyholders. (End)