To help certain families, especially older (60 years and older) policyholder family members understandLarge insurance policyRelated costs, core insurance points,American Life Insurance Guide©️Invited Insurance ColumnistHeather Xiong CFP®️, through the sharing of different planning schemes, clarify the underlying logic of different wealth inheritance insurance products, and help policyholders determine the product scheme that is more suitable for their own needs.

To help certain families, especially older (60 years and older) policyholder family members understandLarge insurance policyRelated costs, core insurance points,American Life Insurance Guide©️Invited Insurance ColumnistHeather Xiong CFP®️, through the sharing of different planning schemes, clarify the underlying logic of different wealth inheritance insurance products, and help policyholders determine the product scheme that is more suitable for their own needs.

/ Body /

In this article, I will answer "How much does it cost to buy $1000 million in insuranceThis question further helps insured families identify a core issue in wealth inheritance:

- What is the "certainty" of wealth inheritance insurance

What is the premium for Whole Life?

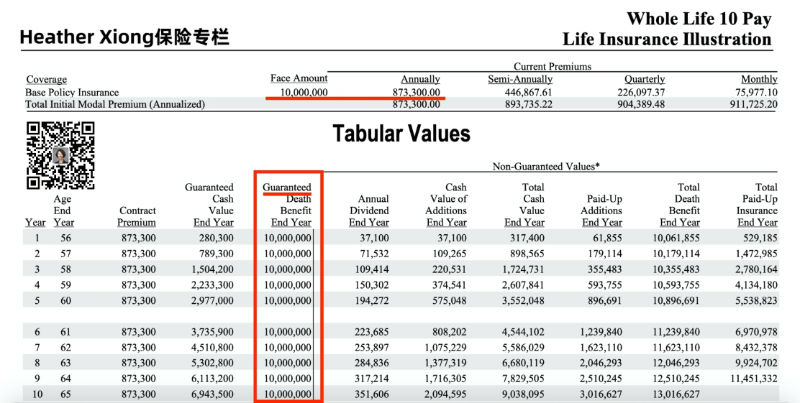

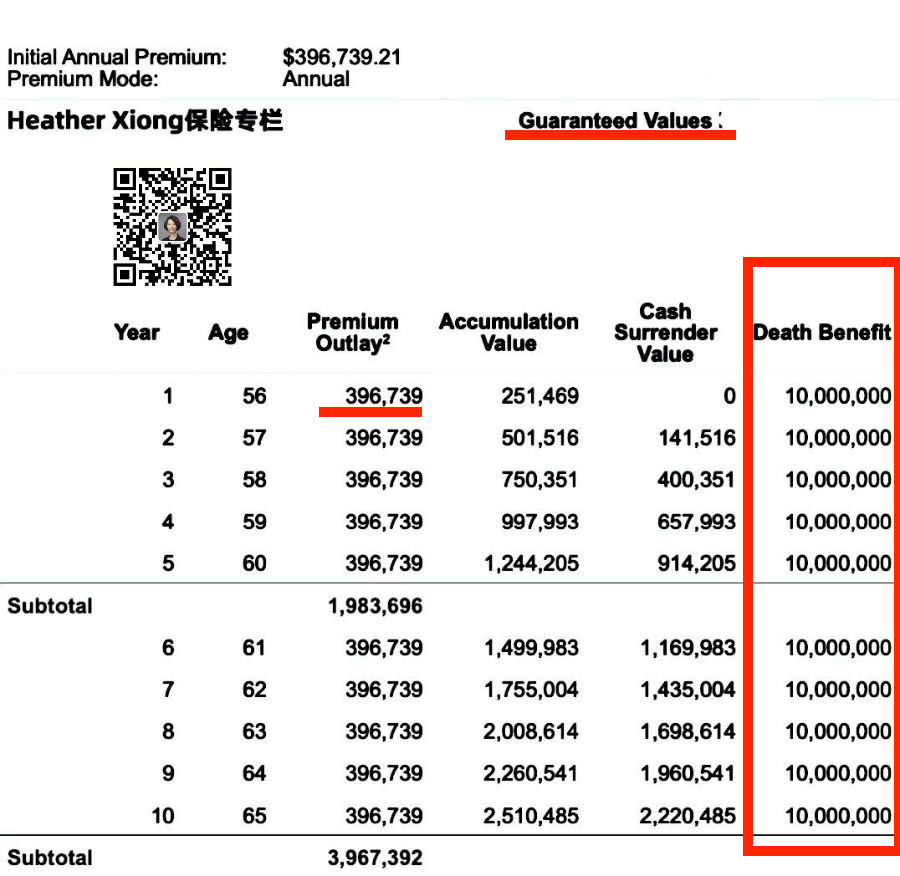

I have a $1000 million inheritance, paid in 10 yearsSavings Participating InsuranceTake the standard plan of the policy as an example, as shown in the figure below.

The red horizontal line at the top of the document indicates that a lifetime savings participating policy with an insured amount of $XNUMX million,Annual premiums of $87 are required.

What did the money buy?Listen to me in detail.

The "certainty" of insurance – what is Guaranteed?

The red square part shows the case of "Guaranteed" - meaning "guaranteed", or "sure", and I marked it with a red horizontal line.

This is an extreme case required by insurance regulations that must be demonstrated - the guarantee that the insurance company can determine the claims promise to give in the "worst" scenario.

What this means here is that at the time of insuring we are sure,As long as the agreed premium ($87) is paid in full every year, as long as the insured dies during the whole lifetime (Whole Lifetime), the insurance company will make claims according to the contract and guarantee to pay $3 million to the insured designated by the insured ofBeneficiary.

For policyholders whose core pursuit of insurance protection claims is not the use of insurance for investment and wealth management, it is crucial to understand the "certainty" of US dollar insurance.This "certainty" is the biggest cost of insurance.

"Certainty" is the biggest cost of insurance

For a healthy, 55-year-old male policyholder, buying this "certainty" through savings-participating insurance requires an annual deposit of $87 in premiums, accumulating a total of more than $10 million in premiums over 870 years.This cost is not a small household expense for any family.

At the same time, using more than $870 million in premiums to leverage the $1000 million "guaranteed" wealth inheritance fund, the relative leverage is relatively low.

If the insured family does have this need for wealth inheritance, in addition to usingPremium loanIn addition to raising funds, what other insurance solutions can we use to achieve our goal of wealth inheritance at a lower cost in the form of "guaranteed" contracts?

What are the premiums for Enhanced Protection Life Insurance?

For the same policyholder, I adopted an upgraded insurance design plan that guarantees claims until the age of 100, and compared the plans. The specific values are shown in the figure below.

50% lower price for "certainty"

Compare the "Guaranteed" part of the official insurance plan (plan) document - that is, what the insurance company guarantees.We can see from the horizontal line marked in the red part that using the upgraded whole-life universal insurance policy, the annual premium corresponding to a sum assured of US$1000 million is:$39.

Relative to the above $87, the purchase of "certainty" through this insurance plan, itsPremium cost savings of over 50%.

Accumulated nearly 10 million premiums in 400 years to leverage $1000 millionGuaranteed Wealth Inheritance Fund, for the age of 55-65,The leverage efficiency of capital has been significantly improved.

Certainty: Insurance benefits promise guaranteed until age 100

The insurance price is so much cheaper by half, will the corresponding insurance benefits be discounted?This may be a concern for many policyholders.

By showing the red box "Guaranteed" - the insurance company determines the "guarantee" part, we can see that the insurance companyWealth inheritance funds (death benefits) also provide a "guarantee" to the age of 100.

In other words, when we apply for insurance, we will make sure that as long as the agreed premium is paid in full every year ($39),Then before the insured dies before the age of 100, the insurance company will pay the claims according to the contract and guarantee to pay 1000 million US dollars to the designated personBeneficiary.

Article summary

"Certainty" is one of the core commodities and services sold by insurance companies.We buy life insurance from insurance companies for wealth inheritance, to a large extent, is to buy a "certainty".

In this article, I briefly analyze and compare the two different operating principles of traditional and modernLife insurance, the basic insurance plan under the same wealth inheritance needs,And compared the premium prices of the two, first explained the principle of "certainty", and then showed that from the perspective of purchasing "certainty", choosing differentInsurance design plan, the resulting difference in premiums.

Compared to more than 100 years ago, modern Americans are living significantly longer and the financial makeup of households has changed dramatically.Born more than 80 years ago, savings-participating life insurance provides a broad spectrum of certainty, but due to its high price and lack of flexibility, it may not meet the protection insurance needs of many modern mainstream families. - Heather Xiong CFP®️

The design market of protection-based insurance schemes between savings-participating insurance and cash value index insurance has been continuously learning and learning for 50 years.Savings Participating InsuranceThe "guarantee" feature of , introducesIndex insuranceThe "leverage" function of the two, and the advantages of the two are neutralized, thus opening up a unique market segment in the US dollar insurance solution market.

通過Insurance Financial AdvisorWith reasonable selection of products and customized plan design, this emerging policy strategy provides a more budget-friendly new option for older policyholders who pursue the “certainty” of wealth inheritance. (End of full text)

(>>>Recommended reading:Evaluation|Ace vs. Ace, the ultimate evaluation of savings dividend insurance Vs index insurance is open to the public )

(>>>Recommended reading:Review | How Much Does a $100 Million Policy Cost?Participating insurance, index insurance, universal insurance price PK )

(>>>Recommended reading:Guide|What is the Illustration (design plan) when applying for life insurance?What are the controversies and highlights?)

*The plan icon in the article, the numbers are only used for education and information sharing and exchange, not the actual contract content of the policy and the promise of the insurance company, and have no corresponding legal effect.For the actual situation, please consult a professional life insurance financial advisor, and the English policy text shall prevail.