受COVID-19疫情影响,IRS将2020年4月15日的报税和交税截止日期延期到2020年7月15日,给了广受影响的民众一口喘气的机会。

7/15/2020倒计时进行中,很多人听说IRS会将再次延期到10/15/2020,这究竟是误传,还是确有其事?

As of 7/10/2020,Haven't heard anything from the IRS about the extension.APRIL CHENThe accountant reminds everyone on 7/15/2020Complete the tax return before, or use 4868Form application extension.At the same time, I also shared the following tips on tax filing for the 2020 tax season.

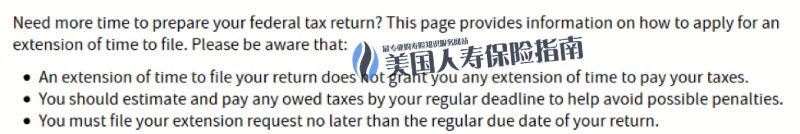

1:Apply for an extension, only postpone the submission of tax forms(Tax Return)Time, no extension of tax payment (Tax Money)time.

In other words, after applying for extension using Form 4868, taxpayers can submit their tax forms on 10/15/2020.Without any late filing penalty (Late Filing Penalty).However, if the final result of the taxpayer's tax form is that the tax bureau needs to pay the tax, the tax must be submitted before 7/15/2020 to avoid late payment penalty & interest (Late Payment Penalty & Interest).

The following is the original text of the IRS official website:

2: How to apply for extension?How to submit Form 4868?

Traditional method:Click on the link, Print Form 4868, fill in personal information, and mail it to IRS before 7/15/2020.The form in the link informs the IRS of the mailing address.

It is worth reminding that when you mail, please use CERTIFIED MAIL to keep the mailing certificate.In the unlikely event that the tax bureau fails to receive it and a fine is incurred, you can have evidence to prove that you have submitted the extension on time.

Self-help method:Use the free electronic service provided by IRS and major tax filing software companies below to submit the electronic form 4868.

Click to visit the IRS free application link

Click on the link to visit the IRS free application extension

The third method:Contact your accountant to help apply for an extension.The accountant will advise you whether you need to submit some taxes based on your previous tax forms to avoid late payment of tax penalties and interest.

3: How to pay taxes in advance to avoid late payment of tax penalties when it is postponed?

Traditional method:When mailing Form 4868, write a check to UNITED STATES TREASURY, including your estimated tax amount.At the check MEMO, write the taxpayer’s social security number and “2019 FORM 4868”.Mail the check with Form 4868 to the IRS.

It is worth reminding that when you mail, please use CERTIFIED MAIL to keep a copy of the mailing certificate and check.

Self-help method 1:使用IRS DIRECT PAY, No need to register, just use your bank account to pay online.

Self-help method 2:Register an ELECTRONIC FEDERAL TAX PAYMENT SYSTEM (EFTPS) account, bind your bank account information, and pay online.

advantage:It can be used to pay advance tax and other IRS taxes, and it can easily check historical submission records.Click here to start registration.

Self-help method 3:Use a credit card to pay, no registration required.Disadvantages: There are handling fees.Click onStart paying here .

The fifth method:Contact your accountant to help apply for an extension.The accountant will advise you whether you need to submit some taxes based on your previous tax forms to avoid late payment of tax penalties and interest.Accountants have professional tax filing software to help you submit taxes.

4: What to do after the postponement?

Of course, it is time to collect tax information and prepare to complete the tax return declaration. Accountant APRIL CHEN reminds you, don’t wait until 10/15/2020.At that time, there will be no more extensions to apply for.Especially taxpayers with overseas (outside the U.S.) reporting needs,Such as FBAR overseas financial account, FORM 8938 overseas financial assets, FORM 5471 overseas company shares, FORM 3520 overseas gift, etc., must, must, must, do not miss the deadline.

5: The last point of postponement reminder:

If you are not sure whether you have declared all the forms that should be declared, you can apply for an extension before submitting the tax form to protect yourself until 10/15/2020.

In case after the deadline, if you find that your relatives overseas have secretly donated a large sum of money to yourself but forget to declare, it will be too late before 10/15/2020. (Finish)