IUL index insurance is a successful model in the past 10 years

According to the report, LIMRA predicts that in 2019, sales in the US personal life insurance market will increase by 4% to reach $150 billion.The driving force for the rise is mainly due to high employment rates, increased disposable income, and bond interest rates.

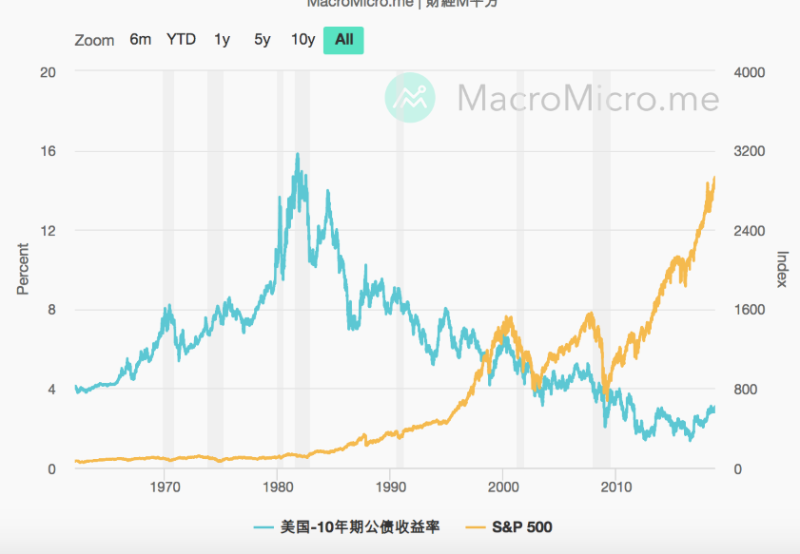

In the past ten years, due to low interest rates and the strong performance of the stock market, index universal insurance products (IUL) have become a model of market success. LIMRA still predicts that in 2019, IUL product sales will increase, but the driving force for the increase will change. LIMRA predicts that the stock market will slow down while the benchmark interest rate will gradually rise.

Artificial intelligence technology drives industry progress

With the help of technology, LIMRA predicts that artificial intelligence technology will continue to help many companies in the industry grow.

Some insurance companies have already applied artificial intelligence toChat customer service robot 和 Automatic review and issuance of insurance policieson.The management of most companies has seen that artificial intelligence will play an extremely important role in the business in the next three years.Artificial intelligence technology is a natural extension of the predictive modeling discipline. The company will seek available technologies to develop and use the large amount of data accumulated by the company.

Multi-employer plan expands life insurance market capacity

LIMRA said that this year, the opportunity for the industry to enter into private enterprise employee retirement plans will also increase.This is due to increased interest in multi-employer plans (MEPs) and the rise of the FinTech industry.

Recent initiatives by the federal government, such as President Trump’s executive order to expand the number of small businesses that can provide multi-employer plans (MEPs), and the new regulations proposed by the Department of Labor to expand the multi-employer plans (MEPs), are also increasing. The life insurance industry has paved the way for the opportunity to enter the retirement plan for private enterprise employees.

LIMRA believes that the growth of Supplemental Benefits/Plans will slow down.Due to the increasing popularity of high-deductible health plans (HDHPs), the subsequent Supplemental Benefits/Plans have also risen.

Because high deductible health plans (HDHPs) expose employees to great expenses and risks, many people turn to Supplemental Benefits/Plans to deal with major illnesses, hospital liability claims insurance and accident insurance.

In October last year, Caesars Health News reminded that sales of high-deductible health plans (HDHPs) have reached their peak and will begin to enter a downward trend. LIMRA believes that if this trend has begun and will continue, then Supplemental Plans will also decline.

It is worth mentioning that in the earliest version of the briefing report, LIMRA also predicted the term life insurance in the next 3 years (Term), universal insurance (Universal Life), savings and dividend insurance (whole life), exponential universal insurance (IUL),Investment universal insurance(VUL) Growth rate.But a few hours later, LIMRA replaced this piece of content.

LIMRA

LIMRA, a worldwide research, learning and development organization, is the trusted source of industry knowledge for over 850 financial services firms. LIMRA provides its members with the latest insight and analysis on retirement, insurance and distribution, helping them develop effectively business strategies that impact the bottom line.

(American Life Insurance Guide Edit report)