(American Life Insurance Guide 09/09/2019 訊)Fidelity 富達投資在2019年第二季度統計了公司旗下的401K退休賬戶,超過$100萬美元的百萬富翁數量創歷史新高。

The number of millionaire retirees exceeds 19

The number of millionaire retirees exceeds 19

The report pointed out that millionaire accounts holding Fidelity 401k retirement plans exceeded 2019 in the second quarter of 196,000.A Fidelity company spokesperson said that in order to achieve such a retirement savings milestone, you must accumulate your investment year after year.

據Fidelity官方消息,退休百萬富翁賬戶在2019Q2達到196,000人,相比去年的168,000人足足提高了17%。

Fidelity Investment Group is the largest in the United StatesIndividual retirement accountService providers help manage the retirement pension accounts of more than 3000 million individuals or families in the United States.

Saving a retirement account is a social consensus

According to Fidelity's data, the average total pension in retirement accounts has now reached six figures. The post-80s to post-00s groups are still in the early stagesRetirement planAmong,Individual retirement accountThe average balance is $29,000, and those born in the 50s and 60s have an average retirement account balance of $198,000.

In general,截止2019年Q2,401K退休賬戶的平均值是10萬美元,個人退休賬戶IRA的平均值是11萬美元。

Research shows that one-third of retirement account holders have increased their savings in the past year.At present, excluding the contribution of employers, the average investment rate of 1K accounts has reached a record high of 3%.

(>>>Recommended reading: gadgets|The American Personal Pension Smart Calculator, how much do I need to save every month?)

$100 million is not enough?New target of $170 million

Katie Taylor, vice president of Fidelity, said that based on experience,The simplest goal of saving money is to save 10 times your annual income before retirement, Is more ideal.Although $100 million is the "small retirement goal" that all of us want to achieve, the more ideal pension amount depends on our income and lifestyle.

Therefore, a pension of $100 million is not the golden standard for most people.

According to Charles Schwab, another 401-person XNUMXkRetirement accountAccording to the survey, Americans today are more inclined to save up to $170 million before retirement. Americans participating in the survey save an average of $8,788 in retirement each year.

How much should we save? insurRetire©️Retirement CollegeFound the advice given by professional institutions.

Pension saving advice for all age groups

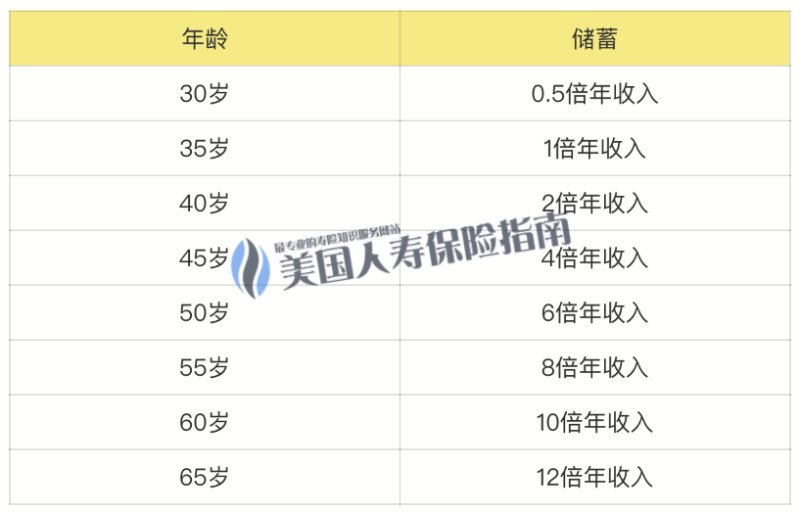

How much money should we save for people of different ages is more reasonable?

T. Rowe Price (T. Rowe Price) released a simplest calculation and evaluation method for all ages. Other companies have similar forms. We can quickly calculate whether we have enough money.