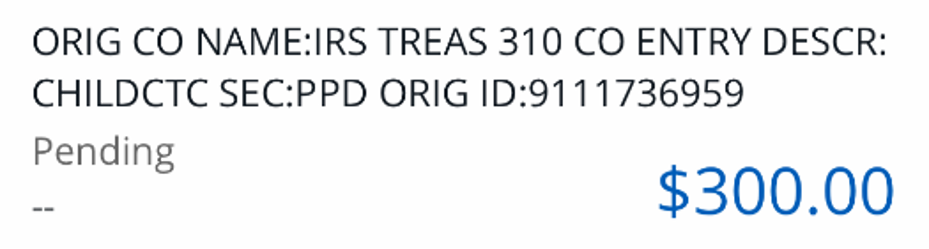

On July 2021, 7, many taxpayers’ bank accounts received" IRS TREAS 310 CO ENTRY DESCR: CHILDCTC $300", as shown in the screenshot of the bank account record in the following figure:

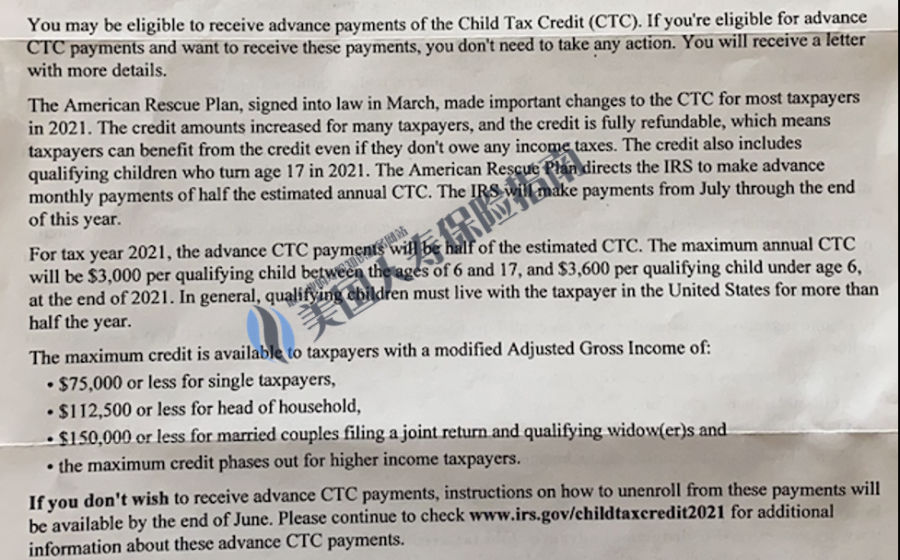

In June, the IRS also sent a letter to the taxpayer informing the credit.Many people already know that this is the third child tax credit approved by the American Rescue Plan Act in 6 for children under the age of 2021.

In June, the IRS also sent a letter to the taxpayer informing the credit.Many people already know that this is the third child tax credit approved by the American Rescue Plan Act in 6 for children under the age of 2021.

In this article, Accountant Chen Fei shared with you the specifics of this Child Tax Credit (commonly known as the US Child Tax Credit).Why did some parents not receive it?What should I do if I have not received it?Is this money taxable?

Child Tax Credit has a long history, American Rescue Plan ActBefore the release, For each eligible family, each child under the age of 17 can enjoy up to $2,000 credit, of which $1400 can be refunded directly, and $600 can only be used to deduct the tax that should be paid and cannot be refunded directly.

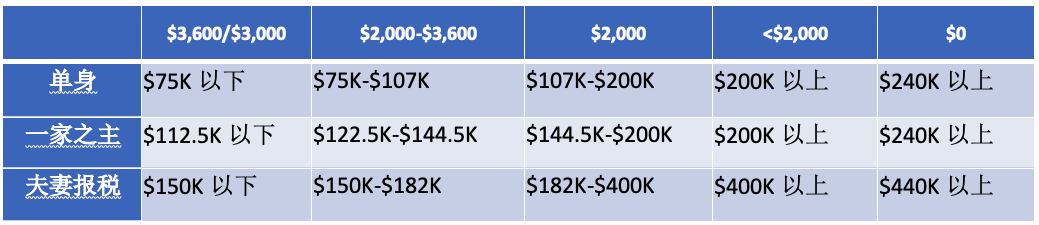

- If the income from the tax return exceeds $200,000 (the income from the joint tax return of husband and wife exceeds $400,000), this credit will gradually decrease to none as the income increases.

- The tax form requires at least $2,500 of work income

- The child has not reached 17 years old before the end of the year

- The child has a US identity and a social security number (ITIN does not meet)

In other words, there are the following situations in which this "red envelope cannot be received:"

- If the child is on the visa only ITIN, which does not meet this credit.

- If the child reaches 17 years of age at the end of the year, it is not eligible.

- If the child meets the conditions, the family does not have any income from work, and it does not meet the requirements; the family income is too high and gradually decreases or even none.

- If the child meets the conditions and the family has work income, it does not exceed the upper limit. After other deductions are used, without personal income tax, they may only get a part of the credit, but not all of them.

Therefore, it’s not that your friend’s family has children, but your family also has children, so you can get all the credits of $2,000.

Of course, the conditions 1, 2, 3, and 4 mentioned above are not all the conditions stipulated by the IRS. We only list the factors that mainly affect your credit.

The above is the old system before 2021. Take a look at it patiently.Let’s talk about the new regulations in 2021.

- $2,000提高到$3,600 (1-5歲小孩)或者$3,000 (6-17歲小孩)

- The upper age limit is raised from 16 to 17 years old, that is, children entering the age of 2021 at the end of 17 are eligible

- $1400 is refunded directly, $600 can only be deducted for tax, and it can be refunded in full when it becomes $3,000 or $3,600, and it will not be reduced because the income is not high and does not need to pay taxes.

- No minimum work income requirement

- From 7/15/2021, according to the income of the tax form in 2020, it will be issued monthly, up to a maximum of $300 per month

- Tax income will affect the amount of Credit you get

7: Other conditions remain unchanged

Sum up, read this for impatient readers, that is, if other conditions are met

- If you do not have any income from work, credit will not be affected.

- If your income is low, you don’t need to pay taxes and your credit will not be affected.

- If your income exceeds the above requirements, you will not get the highest credit.

Here comes the question about the 2021 U.S. child tax deduction...

- I have not received the money, what should I do?

- I received less than $300, what should I do?

- My child was just born in 2021 and did not receive the money. What should I do?

- My child will be born after July 2021. Can I still get credit?

- I didn't file my tax return in 2020. I only got US status in 2021. Can I get credit?Etc., etc

First of all,The credit currently issued is based on your tax form for 2020 in the tax bureau records.

Secondly, this Credit will be recalculated based on the actual situation of your tax return for 2021, with more refunds and less supplements.

At last,This is a tax credit and there is no need to pay tax for it.

Knowing the above three points, I believe that you should be able to relax.It's yours. I haven't received it now. I should receive it next year.It’s not yours. I received it now, and I have to return it next year.I believe everyone has the answers to the above and other related questions.I'm going to have a few words.

1: As long as the child is born on 12/31/2021, you can get credit for the whole year.It will not be calculated based on the month.At present, the credits for the whole year are distributed to everyone on an average monthly basis in advance.

2: If you meet the conditions and did not receive it, and you want to receive it now, you can go to the tax bureau website to apply.https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021

Of course, because the tax bureau has been slow to process tax forms this year, and there are still many people whose tax forms have not been processed, the tax bureau will not have your tax return status, and you have not received credit now.In this case, you may need to pay attention to whether the tax bureau has sent you a letter for you to process, or it may simply be because the tax bureau is slow and has not processed your tax form.

3:只要您2022年申報2021年的稅表,只要您12/31/2021拿到美國身份,您都可以於2021年稅表上申請這個credit。

4: If you used child credit to deduct tax before, you will now receive this credit every month. You may have to expect that the tax refund amount for next year will be reduced by the corresponding amount.You may need to pay taxes next year because you got some credits in advance.

5: If your income in 2020 meets the conditions, you will get credit now, and your income will increase in 2021, causing you to get more than you should have received, and you may need to make up your credit next year.

If you have more questions about this Child Tax Credit, you can refer to the website of the tax bureau.

(After the full text, this article was originally contributed by Chen Fei Certified Public Accountants, edited and published by LifeTank©️)

Disclaimer: The information provided in this article is for general reference only.This information does not constitute and is not intended to constitute legal advice, and you should not act or fail to act based on any information provided in this article.Please consult your own consultant for your specific situation.The author/company does not assume any legal responsibility.

Disclaimer: The information provided in this article is for general reference only.This information does not constitute and is not intended to constitute legal advice, and you should not act or fail to act based on any information provided in this article.Please consult your own consultant for your specific situation.The author/company does not assume any legal responsibility.