OnAmerican Life Insurance GuideIn the actual work of community brokers, we will provide tailor-made financial protection planning packages for different Chinese clients, and clients will also raise and share their doubts about insurance and wealth management related issues.

Among them, in the "protective" policy market, financial insurance consultantsHeatherI sorted out and shared with us the 3 most representative and frequently asked questions by customers:

- Is term life insurance the cheapest and most cost-effective insurance product?

- I heard that the cost of whole life insurance will soar after the age of 70, and the premium is terribly high. Is it true?

- Will life insurance with additional coverage for cancer, stroke and heart disease be more expensive?Ordinary insurance does not cover anything. Will insurance that only provide pure death claims have a relatively low premium cost?

In order to dispel the doubts in the minds of policyholders and avoid falling into preconceived cognitive traps such as "heard", "friends", "others" and other preconceived cognitive traps, our team has drawn charts for these three questions to help readers understand better The operating philosophy of the U.S. policy account is to safeguard one's vital interests.

Q1: Is term life insurance the cheapest life insurance product?

BeorNo.Term life insurance, This type of product is a purely consumer product. Regarding the characteristics of this type of product, weProceed hereThe detailed introduction.

The reason for answering "yes" isIf the budget is limited, it is clear that it does not intend to carry out long-term financial planning, but only seeks a guarantee or a specific function in the short term-such as risk management for 30-year housing loans.Then term life insurance is a good tool.

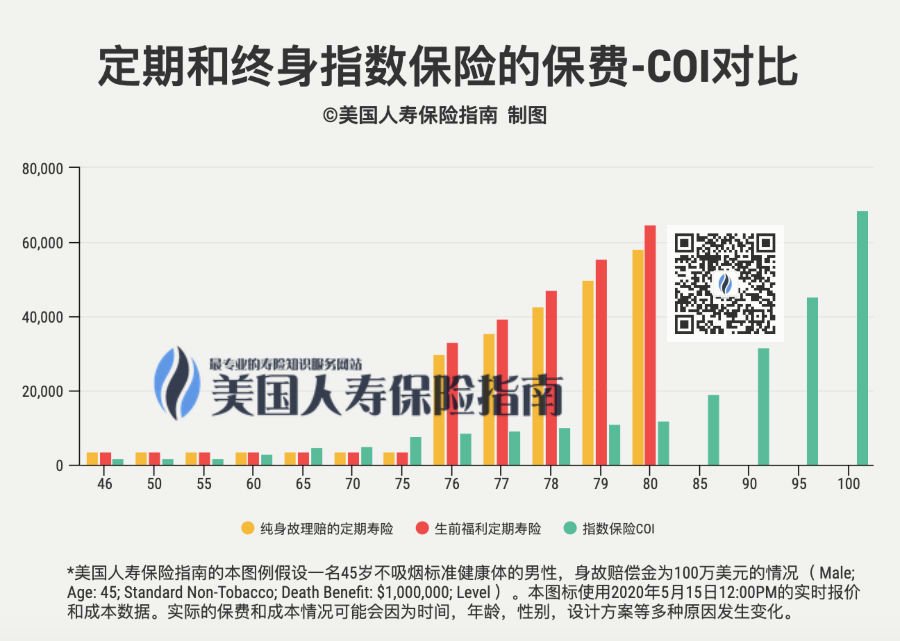

(Comparison chart of premium prices between term life insurance for death claims and term life insurance with ante-mortem benefits)

(Comparison chart of premium prices between term life insurance for death claims and term life insurance with ante-mortem benefits)

As shown in the comparison above,The same insurance company, A copyOnly provide death claimsTerm life insurance products,The premium for one year is $3,483, AnotherAlso provideWelfareMajor illness compensation (such as cancer, etc.)Term life insuranceProduct, the premium price for one year is$ 3,631 USD.The price of both is only$12/month difference.However, the trigger conditions for compensation have changed dramatically.In contrast, the latter can be said that the benefits paid in exchange for $12 are more.

Reasons for answering "No", You have to look at Q2 first.

Q2: I heard that the cost of life insurance will soar after the age of 70, and the premium is scary. Is it true?

fake.Furthermore,The facts may be completely contrary to your imagination.To illustrate this situation, we have drawn the following chart.For the life insurance compared in the chart, I especially chose the one that "I heard that the cost of insurance is very high."Exponential life insurance.The following products are all issued by the same insurance company.

In the above picture, we purely from the perspective of buying "protection", we compare term life insurance, a consumer product, withLife insurance policyThese types of financial accounts are deadlifted together for comparison.Before the insured is 65 years old, there is no advantage in the premium cost of term life insurance.On the contrary, it shows that the younger the policyholder, the lower the annual COI cost of holding a lifetime policy account..

At the age of 75, 30 yearsTerm life insurance expiresUp.At this time, if the physical condition permits and the insurance company is still willing to continue underwriting, there is indeed a new round of surge in annual premiums, but the protagonist is "term life insurance."The annual premium price directly increased from more than 3 to 10 times, Soaring to$29,917(Death Claim Term Life Insurance) and$33,211(WelfareType term life insurance).

And the correspondingIndex insuranceThe COI cost of the annual premium is $8,567.

Over time, the annual renewal cost of term life insurance continues to soar, reaching a peak at the age of 80, and the annual renewal cost is around $6.Therefore, after retiring at the age of 65, our health begins to decline. When our family needs comprehensive protection most,Term life insurance has become the most expensive life insurance product.

At the same time, after the age of 80, insurance companies no longer accept term life insurance applications due to the high risk of compensation (some insurance companies do not underwrite term life insurance for those over 70 during the new coronavirus epidemic).In other words, you can't buy it with money.

And look at it the other way aroundWhole life insuranceIn addition to providing life-long protection and compensation, the cost of insurance does not reach just over $100 at the age of 6.If you use a good design plan when opening the policy account, plus the monitoring and professional maintenance in the first 20 years, the annual premium cost will be covered by the cash value income.It is an inevitable event(Click to view [Insurance Policy Evaluation] Account Operation Principle).

Q3: Will life insurance with extra coverage for cancer, stroke and heart disease be more expensive?Ordinary insurance does not cover anything. Will life insurance that only provide pure death claims have relatively low premiums?

will not.

For consumer products, extra protection against cancer, stroke, and heart diseaseTerm life insurance is more expensive, This has been illustrated in the chart of Q1.

But forWhole life insuranceFor this type of financial account, comparisons across insurance companies simply cannot be completed.

First, because the precise algorithms of each insurance company are different, the design ideas are different, and the products are not comparable; secondly, each insurance company also strives to seek differentiation and avoid being compared; therefore, it wants to be under a completely fair condition It is impossible to test and compare.

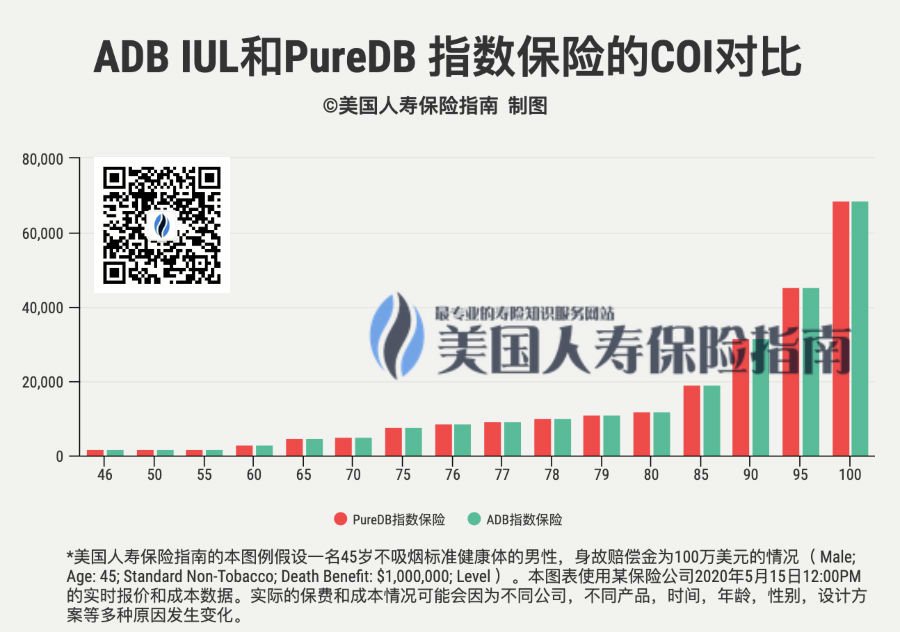

But there are exceptions to everything. Our team finally discovered a "magic" financial insurance group.In this company, it provides both pure death claimsLife insuranceProduct (PureDB IUL), later under the pressure of market competition, additionalBenefits payable before deathLife insurance products (ADB IUL).Comparing two products under the same company can be regarded as a relatively fair cost difference situation. The results are shown in the figure below.

After comparing and analyzing the cost of our insurance policy,Found that there is no difference in the cost of COI insurance between the two.This finally found a good answer for Q3.

Article summary

We hope that through the sharing of FAQs and professional knowledge, we can help interested customers to clear the fog in the insurance application process, avoid entering into the misunderstanding of insurance application, and avoid the waste of time and financial loss.

At the same time, we also know that from the perspective of the policyholder,Using US financial insurance policies for comprehensive protection and wealth inheritance planning is not an overnight cognitive process.Our growth experience, life wisdom, and financial abundance often lay the foundation for the depth and breadth of our acceptance and understanding of a new thing.

Life insurance in the United States is just a widely used modern financial tool to help people of different incomes and different ages reintegrate their wealth.We have shared below the wonderful video of an interview with economist Chen Zhiwu in the "Thirteen Invitations" column on May 2020, 5. Perhaps Mr. Chen's insights on financial tools can help each other's growth.

(The movie is 44 minutes long, click to play, please wait patiently for 10s to load)

When you are young, you have the least money in your life, but it is precisely when you need to spend the most money. How to solve such contradictions will definitely require financial products to reconfigure these situations.

Financial products provide some tools for free people in a free society.Arrange for the future in advance, and there are various risks that can be thought of in all aspects.No matter what happens in the future, whether it is a famine or a time of misfortune, keep your personal freedom, protect your personal rights and interests, and protect your own dignity to the maximum, so as not to resort to others for help.This is why financial markets are important.

(End of the article)