American Life InsuranceNote to Editors of the Guide:Some of our friends bought life insurance in Hong Kong before moving to the United States, but now they are in a dilemma.In order to prevent our readers from being troubled by similar problems, we use the IRS legal terms to talk about, if you have plans to move to the United States, or have already moved to the United States, why not recommend buying insurance from other countries and regions.

Think twice before buying non-American life insurance products

Think twice before buying non-American life insurance products

The IRS does not give the same treatment to life insurance products in other countries or regions

forPeople who intend to immigrate to the United States, or have immigrated (green card holders, citizens), or have become US tax residents (other visa types, residence permits)The crowdIn other words, it’s not suitable to buy other countries or regionsSavings dividendsFunctional life insurance.Because these policy products may not be compliant with the IRSClauses 7702 and 7702GProvisions,Not only did they not enjoy "tax-exemption" treatment, but they also had cumbersome tax inspection and tax payment links.

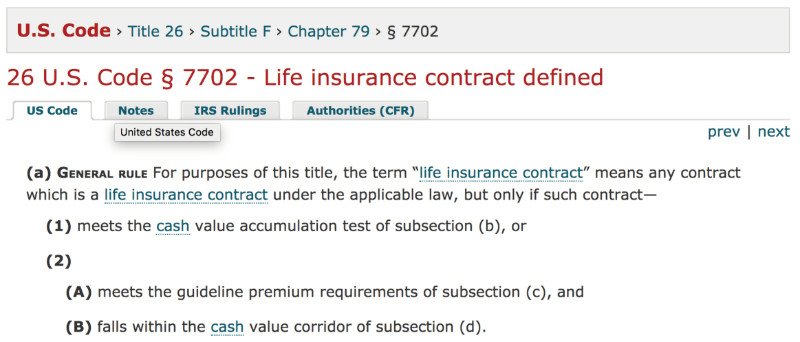

Specific definition of clause 7702

Specific definition of clause 7702

What is Section 7702 of the IRS?

Section 7702 of the IRS defines the life insurance contracts that the federal government can recognize and how to levy taxes. Clause 7702 limits the amount of death compensation and the total amount of policy benefits, and defines the standards that can be regarded as "life insurance" products under the framework of federal tax purposes.It applies to life insurance contracts issued after 1985.

simply put,Clause 7702, which stipulates the maximum amount of money the policyholder can put in a life insurance policy, tax-free.

The legal provisions strictly distinguish between life insurance products and investment products

In the past few years, life insurance products in Hong Kong have been highly praised, and there are many friends who go to Hong Kong to buy life insurance.However, it should be noted that insurance in Hong Kong is a product designed to adapt to Hong Kong's tax laws and does not have the same requirements.Therefore, the money that customers put in, often more thanIRS Section 7702Maximum value allowed.At this time, the insurance product you originally purchased called "life insurance" has become an investment product called "Modified Endowment Contract" from the perspective of the US tax law. Pay capital gains tax.

Since it is not life insurance, there is no way to talk about the advantages of "delayed tax payment", "tax exemption", "enjoy tax incentives" and so on.Then, when you become a US tax resident, you will face the problem of paying taxes.

You need to pay taxes regularly and the procedures are complicated

The IRS stipulates that U.S. tax residents who purchase insurance products outside the U.S. are required to pay additional taxes on insurance premiums. This tax is called "Foreign Insurance Taxes."

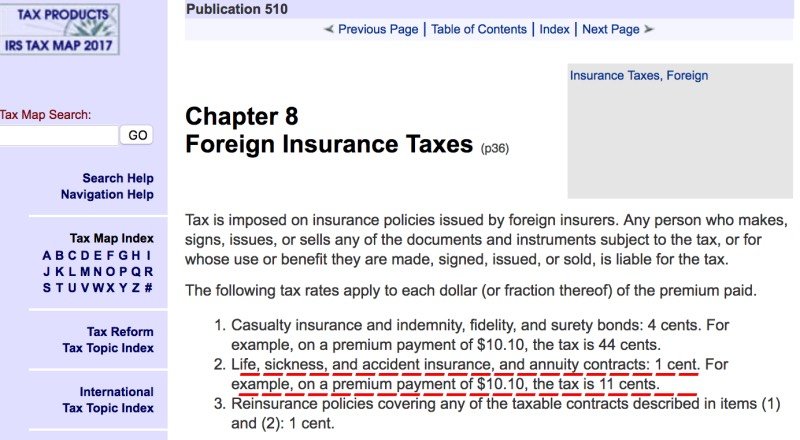

IRS Official Tax Code Explanation of Foreign Insurance Taxes and Fees

IRS Official Tax Code Explanation of Foreign Insurance Taxes and Fees

This means that from the moment you become a US tax resident, if you are paying premiums for an overseas insurance policy, the IRS will require you to fill out a form every quarter, and you need to file a tax return every quarter.The specific tax rate, according to the IRS standard, if the premium is $10.10, then the tax is 11 cents.

Stunning tax rate for long-term holding

At the same time, for non-U.S. life insurance policy products that do not meet the definition of Regulation 7702, if the cash value part of the policy has dividends, it is regarded as personal capital gains in the eyes of the US government and requires personal income tax.

Calculated based on the federal tax of 18%, assuming that the annual return on investment is 6.00%, if you start at the age of 35, put $1,000 into the policy every month, invest $12,000 every year, and continue to pay for 25 to 60 years, then at the age of 60 , You will pay $64,507 in taxes and fees more than the cash value of a completely tax-free policy.If you reach the age of 80, you will pay an extra $38 in taxes and fees if you consider the policy’s cash value tax exemption and tax payment.

Accept the supervision of the Overseas Accounts Act

Finally, in accordance with the US government’s "Foreign Account Taxation Act (FATCA)", insurance policies with the function of saving dividends are counted as overseas financial accounts and need to be declared.

FATCA, which has come into effect, is called "Fatty Coffee Clause" in Taiwan

FATCA, which has come into effect, is called "Fatty Coffee Clause" in Taiwan

If there is an overseas insurance policy but it is not declared truthfully, once the U.S. government finds it, every financial account or insurance policy that has not been declared will be fined 30 US dollars.After notification by the IRS, if there is no declaration within 30 days, a fine of 6 per XNUMX days, up to a maximum of XNUMX U.S. dollars.

Various other factors

Life insurance is a mid-to-long-term plan, and surrendering the insurance halfway means a lot of loss.If a Chinese person bought life insurance outside the United States many years ago, after immigrating to the United States or becoming a U.S. tax resident, he would find that he was faced with the above-mentioned problems: Should he continue to maintain the insurance policy at the expense of the above-mentioned tax problems, or would he have the pain?This is a dilemma.

In addition, in addition to tax incentives, etc.Many significant advantagesOutside, just inPremium costIn this regard, no country is more competitive than the US insurance policy.Reflected in the premium price, which isAmerican Life InsuranceInsuredInsurance premiums are much lower than other countries and regions.

In summary, forPrepare to immigrate to the U.S., or have immigrated (green card holder, citizen), or have become a U.S. tax resident (other visa types, residence permits)), products designed by U.S. insurance companies in accordance with U.S. tax laws may be a better choice. (over)

>>>Recommended reading:What exactly is 7702 Insurance, 7702 Retirement Plan?