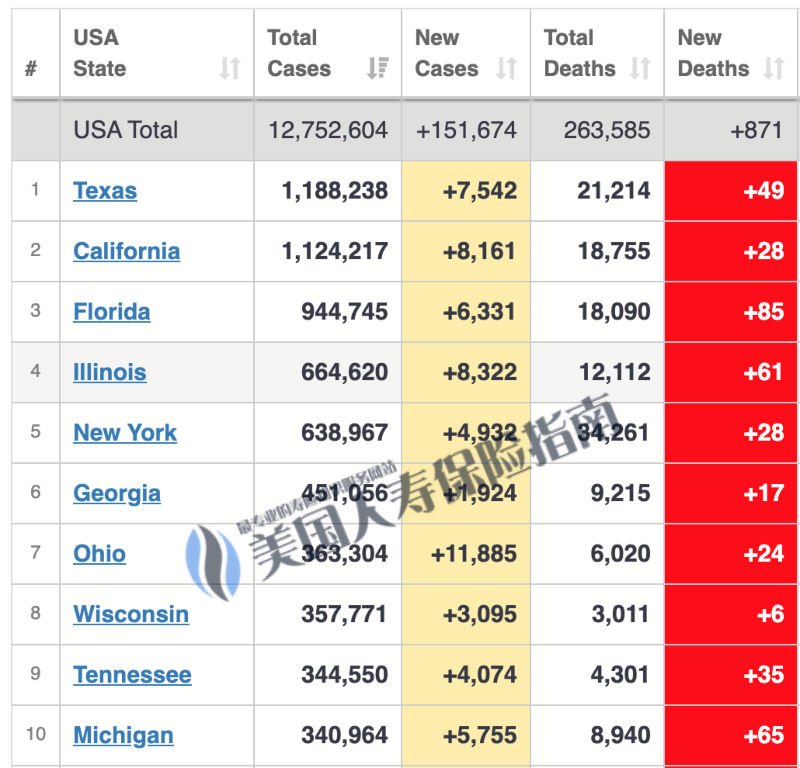

According to data from the World Health Organization, since November,New Crown OutbreakThe winter rebound triggered the second round of epidemics in the United States. The number of newly confirmed Covid-19 cases in a single day has broken records many times.

Ohio, the United States, reported 11,885 new diagnoses on Monday, breaking the record for the highest number of diagnoses in a single day.The total number of confirmed diagnoses in New York, New Jersey, and Connecticut exceeds 100 million.From the model predictions from the University of Washington School of Medicine,到2021年2月1日,將有約40萬美國人死於Covid-19。

New cases on the day as of press time ©️WorldMeters

New cases on the day as of press time ©️WorldMeters

Although it is unpleasant to talk about "death", as the second round of the new crown epidemic returns, more and more middle-aged and elderly people are beginning to face the problem of "mortality" and begin to accept and evaluate the family's demand for life insurance.

American Life Insurance Guide CommunityWill be the most common aboutTerm life insuranceQuestions and answers were made out of the 4 questions, and in conjunction with agencies of the Chinese-speaking community, at the end of the article, multipleLife insurance companyThe quotation and price comparison tools provided by the Chinese community help readers in the Chinese community to obtain the protection they need without leaving home.

1. Why do we need life insurance more during the epidemic?

Life insurance is different from health insurance.The latter is a means of protecting personal life, And life insurance,It is a means of providing protection to "family" and "family".

2. Will life insurance cover claims due to the death of Covid 19?

The answer is:Settlement of claims.

The basic basis for the existence of life insurance policies is to make claims for death.For deaths due to Covid 19, life insurance will make claims.

In the early days of the epidemic, there were some "remarks" on social media for a short while, saying that "after the insurance was purchased, the claim could not be settled due to the death of Covid 19", which caused "panic" to policyholders.

afterAmerican Life Insurance GuideThe editor verified that news reports clearly pointed out that the insured purchasedOccupational insurance, Not life insurance.At the same time, at the end of the section, the editor also conducted an extended reading on the legal issues of life insurance claims.

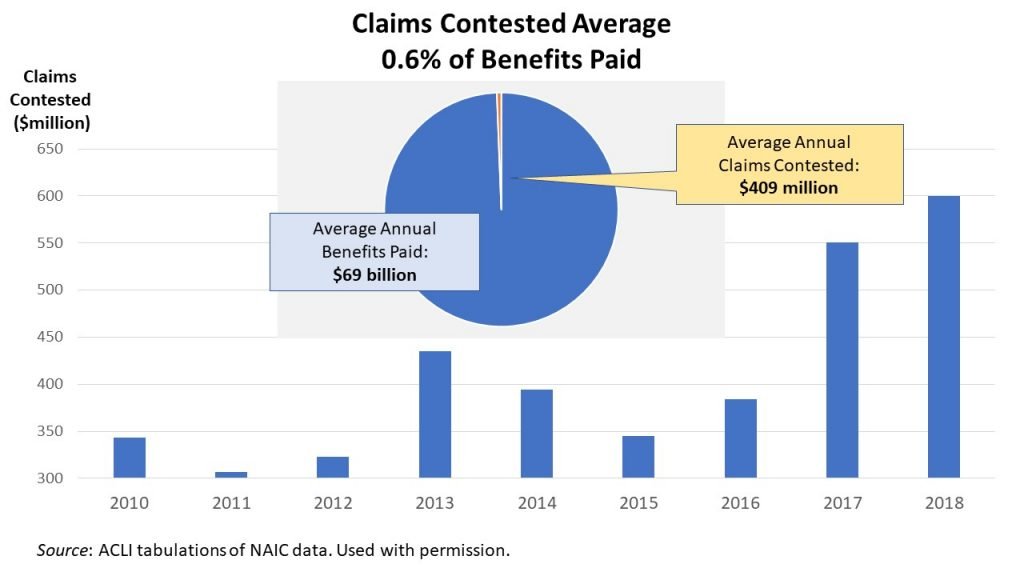

"It's very rare for life insurance claims to be rejected," said Dr. Stephen Weisbart, chief economist of the American Institute of Insurance Information. When it happens, it is usually because the insured has applied for life insurance.But didn't pay the premium, The policy has lapsed.Or policyholderProvided "inaccurate" or "misleading" informationI have applied for life insurance.

As long as you have a life insurance policy and die due to the new crown virus,Life insurance companyYou cannot unilaterally change the content of the policy contract suddenly, and you cannot refuse to pay a death benefit to the beneficiary.

Life insurance companies do not make profits by refusing to settle claims, but through accurate investigations and underwriting, to provide the market with high-quality products and benefits to grow and develop.

(>>>Recommended reading:Popular Science|What should I do if some of the information provided when applying for an insurance policy is not accurate?What does the law say?)

3. During the second round of COVID-XNUMX, can we still apply for life insurance?

The answer is: yes.Although life insurance companies continued to dynamically adjust the application conditions during Covid 19, the vast majority of people can still apply for life insurance now.

BankRate pointed out in a column on "Covid 19 and Life Insurance" that life insurance companies are still issuing underwriting life insurance as they face the severe challenge of the new crown virus.In fact, many life insurance companies even adjusted their application conditions to allow policyholders to accept"Exemption from medical examination"Insured.

Due to the social distancing regulations issued by the CDC, medical staff cannot conduct face-to-face physical examinations with insured persons to collect blood and urine.

In order to allow more families to get life insurance protection more quickly, since the new crown epidemic, nearly a quarter of life insurance companies have begun to use big data for automatic underwriting.And encourage policyholders to stay at home and apply for insurance through the Internet.

During the entire insurance process, the applicant needs to fill in a personal medical and health information questionnaire and related authorization documents. Based on this information, the life insurance company will assess whether the applicant needs to accept a new medical examination, and whether it is necessaryTelephone interview.

Finally, after the applicant's application is approved, the life insurance policy documents can also be delivered by traditional courier or electronic delivery. This is confirmed at the time of application.

(>>>Recommended reading:Insured|A list of life insurance companies insured on the Internet that are "exempt from medical examination" during the Covid-19 pandemic )

4. How to make life insurance claims during the new crown period?

If our loved ones pass away because of the new crown,Beneficiary of the policyIt is necessary to take the initiative to make a claim to the insurance company. The process of this claim is usually divided into the following steps:

- contact directlyLife insurance company, Or throughLife insurance brokerContact the life insurance company and inform you that you need to make a claim, so you can get the forms and documents related to the claim.

- The life insurance company will send the required documents and a list of required documents for the claim, and will also provide a detailed description of the claim process in text.BeneficiaryYou need to prepare these documents and attach a copy of the death certificate issued by the government agency.

After submitting the relevant documents of the claim,BeneficiaryLater, you can decide how to accept the claim, whether to receive it in a lump sum, or to receive it in installments. (End of full text)

–Free price comparison tool for term life insurance –

first step:

Enter the amount of insurance you want, and the length of insurance time you need, and click the button to start.

The second step:

Enter your age, whether you smoke or not, self-health evaluation, and basic personal information.

third step:

Get premium quotes from multiple American life insurance companies.

the fourth step:

Choose the life insurance product you need to know more about.