What does the beneficiary of life insurance mean?How can we use this feature?How does the beneficiary get the compensation?Will the insurance company not compensate?This article will answer one by one.

American Life Insurance Guide > Life Insurance Academy > What is the "beneficiary" in life insurance?

in"What is life insurance"In the article, we mentioned the beneficiaries (beneficiary)the concept of.

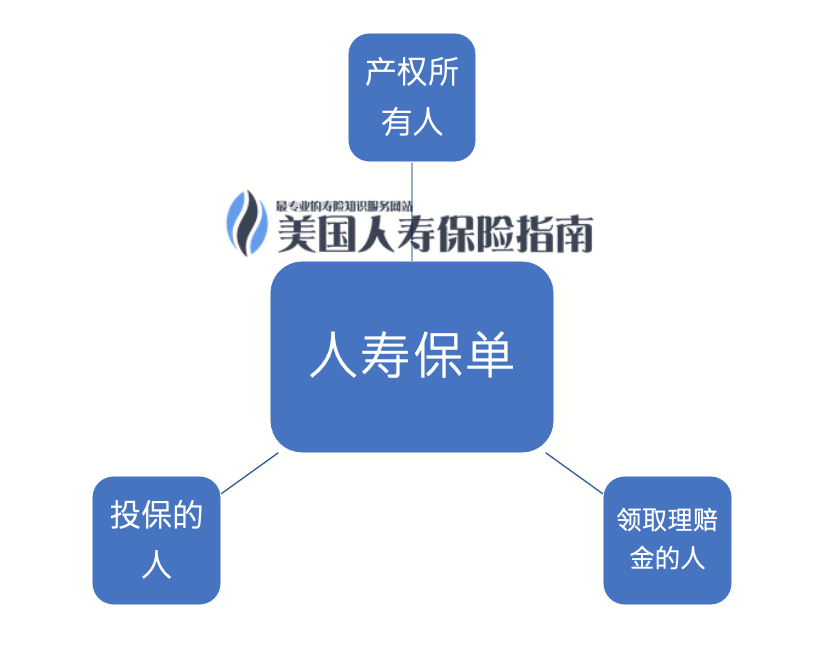

If you have a life insurance policy and pay the premiums on time, there will be two situations:

If you have a life insurance policy and pay the premiums on time, there will be two situations:

- If you have term life insurance, the insurance company will pay a death benefit after your accidental death.

- If you have whole life insurance, the insurance company will eventually pay a death benefit.

Then, the individual or organization that receives the compensation is called the "beneficiary".

Your beneficiaries can be relatives, friends, business partners, or institutions or legal entities, such as a trust fund.Although you can usually appoint the beneficiary yourself, some states will appoint your beneficiary.

2019/09 update Death compensation Can be specifiedForeign beneficiary?The answer is yes.American Life Insurance has realized global joint insurance and compensation, and the beneficiary can be designated as a foreign natural person.

You can choose multiple people or organizations as your beneficiaries/individuals and decide what percentage to allocate this claim.Read on and you will learn about the differences between different beneficiaries/individuals, who can be the beneficiaries, and the roles and responsibilities of the beneficiaries:

- Primary beneficiaries and secondary beneficiaries

- Who can be the beneficiary

- Modify and update your beneficiary

- How does the beneficiary settle the claim?

- How does the beneficiary get the money?

- Will the insurance company not pay compensation to the beneficiaries?

Primary beneficiaries & secondary beneficiaries

- InsuredMain beneficiaryIt is an individual or organization designated by the insurance company to the insurance company.For most people, this main beneficiary is generally each other's spouse.If you do not appoint a beneficiary, the insurance company will treat the money as your inheritance, leaving the procedures for future generations more cumbersome.You can also appoint multiple beneficiaries and allocate different proportions of funds.We recommend designating a beneficiary.

- Second beneficiaryIt is also designated by the policyholder.It is used when the main beneficiary has died suddenly or parted ways from a common business and does not meet the conditions for receiving compensation.Although the second-ranking beneficiary is one of the beneficiaries, as long as the main beneficiary is still alive, the second-ranking beneficiary does not have the conditions to receive the compensation.The first and second beneficiary is calledSecondary beneficiary, The third beneficiary of this rank is calledThird beneficiary, And so on.

Who may be the beneficiary of the policy?

spouse

The original intention of life insurance is to protect the family from financial difficulties in the event of misfortune.So most policyholders have chosen their spouse as the main beneficiary.In this way, in the event of an unfortunate death, the insurance company will pay a large sum of money to keep relatives from worrying about living bills and children’s education and tuition.

There are "Community Property Laws" in nine states in the United States.The law stipulates that after marriage insurance, without the consent of the spouse, the beneficiary cannot be designated as a person other than the spouse.The states that enforce this law are: Arizona, California, Louisiana, Idaho, Nevada, New Mexico, Texas, Washington, DC, and Wisconsin.

child

Due to legal procedures, it is not recommended to designate your minor children as the beneficiaries of the policy.Because paying a large sum of money to minors may fall into more complicated legal procedures.

If you appoint your minor children as the beneficiaries and let the insurance company pay the children, the compensation will go to a trust account supervised by the court-appointed guardian, and the guardian will guard the money until the child grows up to 21 -Year-old adult.Before that, the children cannot receive the money, and your other family members, such as your spouse, have to face expenses such as lawyers' fees.

The UTMA (Uniform Transfers to Minors Act) bill provides a solution: you can specify a guardian or trustee.Or, set up a trust in the name of the child, and use this trust as the beneficiary of the policy.The executor who performs the fiduciary duty pays welfare to the children.

People other than relatives

As long as you are not married and do not live in the above 9 areas with community property laws, you can designate your business partners, or even friends, as your beneficiaries.

organization

The beneficiary does not have to be an individual, but can also be an organization.You can assign your compensation to a company, such as a family business, to prevent losses caused by the death of key members.

You can also choose a charity or non-profit organization as the beneficiary.Such organizations usually have tight budgets. Such a large injection of funds can help them better achieve their social mission.

Trust

If you have some unusual beneficiary demands, or have more in-depth plans and plans, you can set up a trust as your beneficiary, and at the same time, let the trustee receive and dispose of the funds according to your requirements.

The most common reason is to skip the legal red tape of the insurance company and get the compensation for the children's convenience.There are other situations, for example, some people want to leave compensation to surviving pets.In this way, you need to appoint a trustee of the person who inherits the pet in front of you, and set up a trust in this person's name, and then use this trust to receive money from the insurance company and pay for the pet's living expenses.

Modify and update your beneficiary

If you have 20, 30 years, or even life insurance for life, you may designate your spouse as the beneficiary when you buy it. 10 years have passed, your quota unfortunately passed away, or your marriage ended. At this time, you want to renew your main beneficiary of the policy and designate it as your good friend or other relative.In this case, you need to update your beneficiaries.

We recommend renewing your beneficiary if your beneficiary dies.Because when a claim occurs, your claim will be the legacy of the deceased beneficiary and will be received by the court or his/her relatives.Maybe you don’t know or even like these recipients?

To update the beneficiary, just contact the insurance company and fill in the "change beneficiary" application form.Some leading companies have allowed customers to submit applications directly through mobile apps or the Internet.You need to fill in the basic information of the beneficiary.

Other occasions when you need to update your beneficiary information include: marriage (need to add spouse as beneficiary), divorce (remove spouse beneficiary), when buying a car and buying a house (check to confirm that the spouse is the beneficiary to hedge the family loan risk), and just When there are children (check to confirm that the spouse is the beneficiary to hedge the children's education funds expenditure).

How does the beneficiary settle the claim?

When the policyholder dies, the beneficiary will receive a large sum of money, but what is the process?

Apply for death compensation

Before the insurance company pays, the beneficiary needs to do the following:

- First of all, the beneficiary needs to hold a copy of the insured’s death certificate to prove that the claim is legal.

- Second, the beneficiary needs to find insurance documents.If you can't find it, please contact the insurance company.

- Finally, the beneficiary directly initiates a "claim" to the insurance company, usually by filling out a form and submitting it.

How does the beneficiary get the money?

If the beneficiary has completed the above three steps and submitted the claim form, now is the time to take money from the insurance company.The beneficiary will receive a sum of money the size of the insured amount, and then there are two alternative ways to receive the money:

- One-time withdrawal: The beneficiary can choose one-time withdrawal to pay for various expenses, such as funerals or mortgages.This money isduty freeof.

- Installment payment or annuity method: The beneficiary can choose to pay on a monthly or annual basis.This is a good choice if the beneficiary wants to manage the money well and avoid his own lavish expenses.You can usually choose to pay off within 5 to 40 years.

A question that everyone is concerned about: Will the insurance company not pay compensation to the beneficiaries?

meeting.If your beneficiary murders you for this compensation, the insurance company will reject her/his claim.

If you had a disease that was not disclosed to the insurance company when you applied for the insurance, and you died of the disease, then the insurance companyMay refuseClaim application of the beneficiary.For example, if you die of esophageal cancer or lung cancer, but you did not say that you have a habit of smoking when you apply for the insurance, in this case, the insurance company can withhold the death compensation.

Similarly, you should make sure that you have stated all your risky hobbies or habits when you apply.If your beneficiary applies for death compensation, the insurance company discovers that the cause of death was due to some high-risk hobbies that have not been disclosed previously, the insurance company can recalculate the amount to be paid and deduct this part from the overall compensation .

The last case in which an insurance company refuses to settle claims is: if youSuicide within two years, The insurance company may not pay death compensation.Basically, most insurance companies have instructions on suicide clauses that define how to make claims for this suicide situation.Usually, the insurance company simply refunds the premium.

In general,American Life InsuranceThe experience of applying for a US visa is similar to the experience of applying for a U.S. visa, so please followHonest applicationthe rules.American insurance companies have a "strict entry and wide exit" operating process.The purpose of our life insurance policy is to reduce risks, protect our needs, and give ourselves, family members or the next generation a peace of mind, not to increase the risk of the policy in the process.

American Life Insurance GuideI wish everyone can apply for an American insurance plan that can truly protect themselves and their families. (End of full text)

//Unclaimed Life Insurance Claims Inquiry System (what is this?)

(>>>Extended reading:Column Q&A|Can the beneficiary of American life insurance be oneself? 11 Frequently Asked Questions and Answers Live Record)