"Deposit 25, interest rate 1.x%, and an account opening bonus of $1000"Is this kind of bank reserve advertisements, do you often see them, and they are very exciting? No matter whether your heart is moving or not, I am thinking about it every day.

It was not until later that after taking 0.01% of bank interest for many years, I learned that the interest rate of annuity accounts issued by life insurance companies is usually higher, and it is unambiguous to send out account opening incentives.

However, there are many types of annuity accounts in the U.S. market, and there are many more products. Before we start, we have to get a general idea.What do the different types of annuities in the United States mean by their respective "interest rates"?Do interest rates refer to yields?And how to find the best "interest rate" annuity insurance product.

1. The “interest rate” of fixed-rate annuities

Fixed rate annuitiesGive a "fixed" interest rate. "X-year annuity account base interest rate is 2.0%, bonus bonus 1%*", this is a common promotional advertisement for life insurance companies to attract depositors.

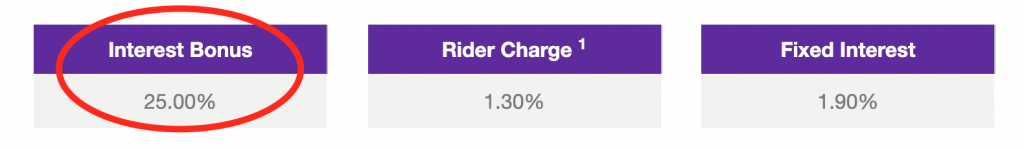

eg A certain annuity product provides 25% income reward (2020/12/14)

eg A certain annuity product provides 25% income reward (2020/12/14)

Fixed rate annuities are very similar to bank term deposits,Interest rate becomes the main contrast factor.

If we openedFixed rate annuity account, the funds in the account will be compounded according to the agreed "annual interest rate".

in"What is Fixed Annuity?"In this article, we explain in detail.

2. The "interest rate" of index annuities

The promotional advertisement for opening an annuity account of this type is usually, "Deposit $10,000, guaranteed to increase to $20,000*","10% of the principal for opening an account*"and so on.

Index annuityThe value-added "interest rate" is divided into a guaranteed interest rate andCapped interest rate, the annual income is not fixed.The actual rate of return in the annuity account will not be lower than the guaranteed minimum rate, nor will it be higher than the ceiling rate.

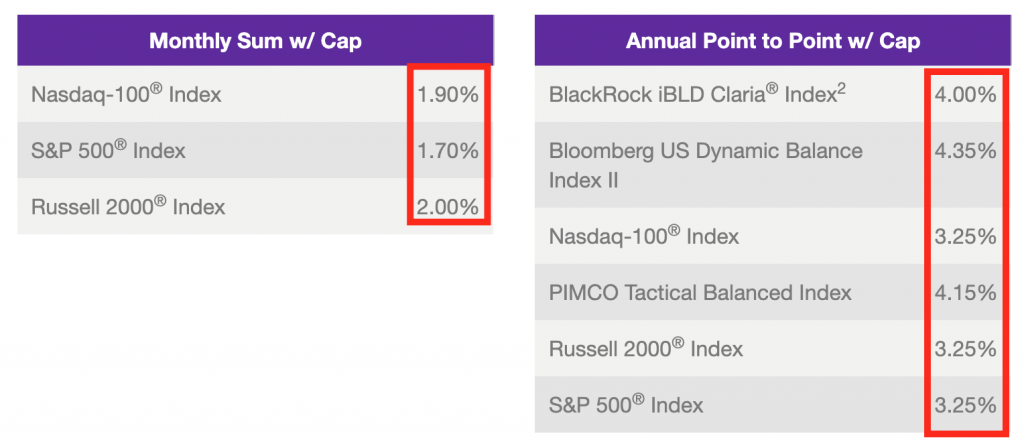

eg Different capped yields in an index annuity product (2020/12/14)

eg Different capped yields in an index annuity product (2020/12/14)

To put it simply, we have traded part of the income potential in exchange for insurance companies to bear all the risks of the stock market decline.

According to different insurance companies and insurance products, the spread between the guaranteed interest rate and the capped interest rate is usually between2% to 5%between.As of January 2022, the index-based annuity accounts linked to SP1, the market averageThe capped yield is 3.5%.

Some insurers allow us to pay for this higher yield potential if we want a better interest rate range.

3. Interest rates of securities investment annuities

Such annuity accounts are securities derivatives and are subject to dual supervision by the Financial Supervisory Authority and the Insurance Authority.

Since our premium goes directly into the stock market,Securities Investment AnnuityGuaranteed yields are not available.The annual rate of return of this type of annuity account is directly determined by the trend of the underlying securities market and the actual annual return.

This type of annuity account usually buys mutual funds, which is why securities investment annuities are also called "fund insurance" and "fund annuity"..The account income rises and falls with the current market fluctuations, and the actual rate of return in the account each year is directly related to the investment object we choose in the annuity account.

Because of this feature, when we receive a copySecurities Investment AnnuityIn the account opening quotation and proposal, the value on the document will review the past "annual" income, and based on the historical market performance, predict the possible return for the policyholder's reference.

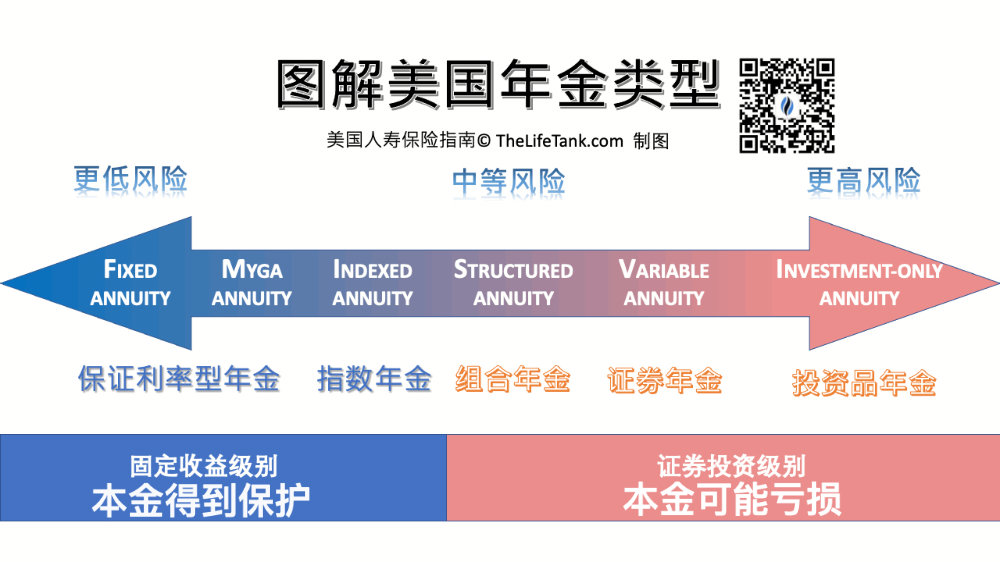

(>>>Recommended reading:American Annuity Insurance Product Type Comparison, Price and Advantages and Disadvantages Comparison (2021 version))

4. Interest rate of spot annuity (income annuity)

For those who start withdrawing money immediatelyImmediate income annuity, Its interest rate is determined according to the age, gender, and payment cycle selected by the policyholder at that time.Although we start to receive the money immediately, we will also receive a portion of the interest income.

selectImmediate income annuityIf , the implied interest rate behind it is not the core factor we consider,The key is to see how much money you can get each year.

It is generally believed that in a higher interest rate environment, immediate annuities provide higher income.

(>>>RecommendedGadget|Which specific fixed income annuity insurance is suitable for me?What is the latest interest rate indicator?)

Article summary

These four categoriesAnnuity products, Corresponding to the different investment risk tolerance of the insured and different usage scenarios, "High risk, high return expected"The same principle applies to annuity insurance.

"Fixed Rate" AnnuitiesThe risk is the lowest, but the rate of return is also the lowest. Its rate of return means that the money we deposit in the annuity will continue to compound with a fixed "interest".So it is often usedAsset hedging.

"Index" annuityThe risk is moderate, and the yield is generally considered to be higher than that of a "fixed-rate" annuity.Its interest rate means that our account funds will calculate the rate of appreciation according to the increase of the market index. The interest rate is not fixed, but the rate of return is guaranteed to be more than 0%.usuallyThe actual annual rate of return is as low as 0% and the highest is determined based on the functions of different products, and the income is uncertain.

"Securities Investment" AnnuityThe risk is higher and is generally considered to have the highest return potential.Its interest-bearing interest rate refers to the rate of return when our funds directly enter the selected securities fund and follow the rise and fall of market fluctuations. Therefore, there is a possibility of loss of principal.The benefits are uncertain.

According to our age, asset portfolio, and risk tolerance, we can determineWhich type of annuityMore suitable for yourself.Subsequently,Through comparison and understandingDifferent credit levelsInsurance company, the interest rate of this type of annuity account,It will eventually help us find annuity products suitable for ourselves and our family members. (End of full text)

(>>>Recommended reading:Column|A must-read for purchasing American annuity insurance!8 common problems and misunderstandings that you are most concerned about )

(>>>Recommended reading:Knowledge Sticker|How to buy American annuity insurance?How much does it cost to receive 2 per year?)

(>>>Recommended reading:Comparison|Index annuity and fund annuity, which annuity insurance is better? (Version 2022))

*Marketing advertisements are colloquial descriptions, not actual promises. For the specific annuity deposit reward system, please refer to the specific English descriptions of the insurance company's products.