(American Life Insurance GuideNetwork 07/23/2019 News) LIMRA recently released a report that after three consecutive years of growth, hybrid personal life insurance products (commonly known as "life insurance that you can use while you are alive") have increased premiums by $2018 in 43 Billion US dollars, an overall decrease of 2%.But in terms of the number of policies, 2018 policies were sold in 404,000, an increase of 2017% over 2.

Life insurance data you can use while you're alive

In the life insurance that only provided the function of "death compensation" in the past, the "Long-term care"or"Chronic disease"ofadditional terms, So that policyholders can receive compensation while they are alive. This type of hybrid life insurance (Hybrid Policy) has played the role of a "breaker" in the market in the past few years.

In the Chinese community, we are accustomed to calling this kind of "Benefits paid before death"The insurance is "life insurance that you can use while you are alive."

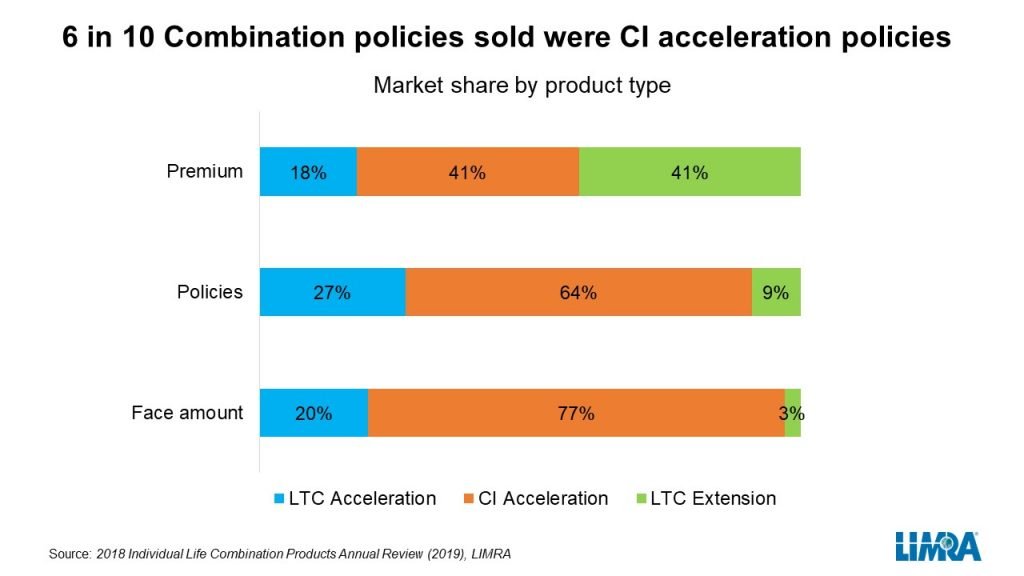

Among the insurance policies that participated in the survey, 64% of the insurance policies providedChronic diseaseTime of "Withdrawal before death"Terms.

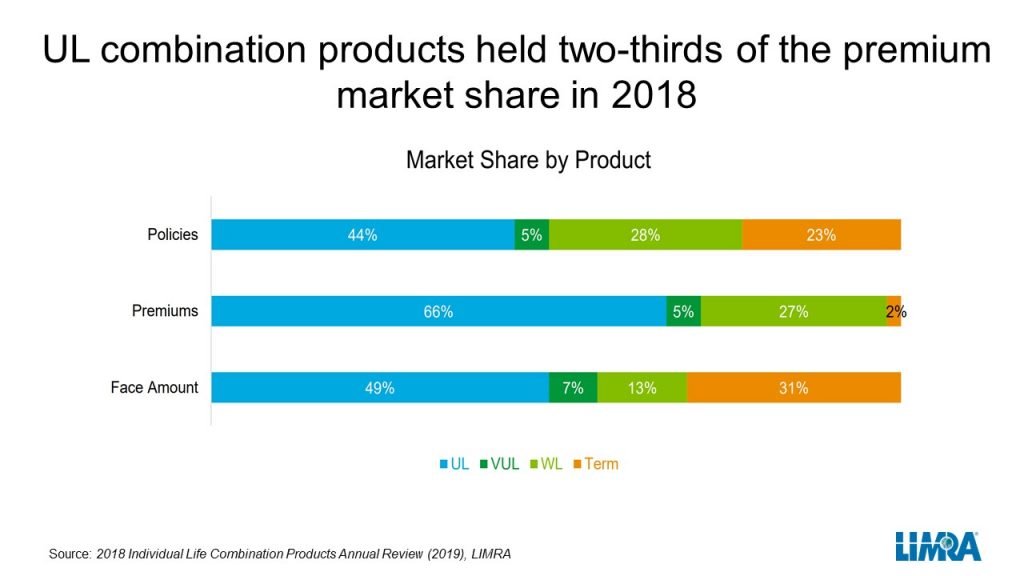

The fastest growth in 2018 is the hybridSavings insurance(Whole Life) insurance, premiums increased by 34% year-on-year, and this insurance product occupies 27% of the hybrid life insurance market share.

Investment insuranceIn 2018, its premiums rose by 5%, and its market share remained stable at around 5%.

In 2018, hybrid universal insurance (UL) and hybridTerm life insuranceAll insurance premiums fell by 11%.The premium share of hybrid universal insurance reached 66%, continuing to dominate the entire market.The premiums of hybrid term life insurance accounted for 2% of the hybrid life insurance market.

60% of hybrid policies provide early benefits for "chronic diseases"

Price includesChronic disease (CI) and extensionLong-term care(LTC)Early payment of benefitsOf life insurance policy products, each accounted for 41% of the premium share.simpleLong-term carePay in advanceadditional termsProducts accounted for the remaining 18% of the premium market share,

Price includesChronic diseaseThe hybrid insurance policies with additional clauses paid in advance account for 64% of the number of insurance policies and 77% of the total insured amount, which has an overwhelming advantage.

(End of the article)

(End of the article)

appendix:

01. "Individual Life Insurance Combination Product Premium Falls 2% in 2018", LIMRA, 07/22/2019, https://bit.ly/2YbLXth