More and more middle-class and above families are beginning to use life insurance as the basic configuration of asset planning. Let's take a look at the specific answers to some common questions.

How much coverage do I need?

This of course varies from person to person. The insurance industry has different algorithms, some are calculated based on the value of a person (how much money you can earn in your life), some are based on family needs, some are based on multiples of income, and so on.

Under normal circumstances, it is calculated according to the needs of the family.If you have a mortgage, you must cover the total amount of the mortgage; if you have minor children, the alimony of 1 thousand per child per year is counted until the age of 5, plus four years of university education.If there is a wife who does not go to work, the spouse will have to leave several years of living expenses and so on.Adding these items together is the total amount of insurance you need.Generally speaking, if you have a child and a mortgage, you need at least 18 insurance; if you have 4 children, you should add at least 50.

When making estate planning, calculate how much your total assets will be now and in the future, remove the allowances, and how much estate taxes will there be. In most cases, your total insurance coverage should be enough to pay the estate tax.We have helped our clients with 1,000 million life insurance, which is calculated based on the inheritance tax.

There is also a certain limit on how much insurance an insurance company can sell to you, usually 20 times your income as the upper limit.The person planning the estate may not have much cash income, and the insurance company depends on how large your assets are to decide how much insurance to grant you.

Click here to learn more about how to calculate life insurance coverage

How is the premium determined?

Various insurances, such as car and house insurance, determine premiums based on the probability of accidents, while life insurance is based on

According to the probability of death of the insured, the insurance company will take the risk and decide whether to insure you and what kind of rating it will give you according to the magnitude of the risk.

The insurance company's assessment of the applicant's probability of death is mainly based on the applicant's current and past physical health, lifestyle, such as whether he is engaged in dangerous activities, whether he often eats a ticket for driving, and family genetic factors.The basic rule is that the older the age, the more expensive the premiums. Men's premiums are more expensive than women. Smokers are much more expensive than non-smokers. People who are not healthy are more expensive than those who are healthy.

From this we can also conclude that, first, you must buy insurance as early as possible, the younger the cheaper; second, you must go in when you are healthy now.Once the insurance is purchased, and if your health is not good in the future, the insurance company has no right to increase your premiums, let alone cancel your insurance.

Basic knowledge of insurance policy

Life insurance policies (policy) haveThe insured (insured), the beneficiary (beneficiary) and the owner (owner)Three items.The insured takes his own life as insurance, and the beneficiary gets a death claim after death.

The beneficiary is generally the spouse, child or relative of the insured person, or it can be a trust, organization or institution.The beneficiaries are divided into two categories: first and second. After the death of the insured, the compensation will be paid to the first beneficiary first, and only if the first beneficiary has died. The second beneficiary is also called the contingent beneficiary.

The policy owner is generally the insured, but it can also be a different person or even a non-natural person.The policy owner has the insurance, can change the beneficiary, can borrow money from the cash value of the insurance, and has the right to extend or cancel the insurance.

Once the insured person dies, the death claim will be the property of the policy owner, not the insured's estate. This is very important when making estate planning.If you are a high-valued person, if you have your own insurance, the millions of insurance you have in a hundred years will be counted as part of your inheritance and you must also pay inheritance tax. The purpose of paying inheritance tax by buying insurance is also very significant. Discounted.

Of course, you can change the owner of the insurance to your child, but minors cannot be the insurance owner. Even if an adult child is the insurance owner, there are many ills. If he/she has a divorce or lawsuit, spouse and lawsuit Creditors can get a share of this death claim.

Therefore, life insurance for estate planning generally does not appoint children as the owner of the insurance. A better way is to set up an irrevocable trust, which will own the insurance.Life insurance owned by a trust can achieve two goals. First, the claim is not counted as the insured’s estate, so there is no estate tax; second, because the trust is the beneficiary of the claim, and the children are only the beneficiaries of the trust, not death The direct beneficiary of the claim, so it can avoid the lawsuit and the division of the divorced spouse.

Learn more about "What is life insurance?"

The company provides insurance, do I still need to buy it myself?

Many larger companies provide life insurance to their employees, usually 1-2 times their salary. Employees do not have to pay or pay a small fee. If you want to buy more, you have to pay for it yourself.

The company’s insurance is generally cheaper, because large companies have a large number of people and there are discounts, but large company insurance has three major characteristics. First, this is the company’s insurance is part of the company’s benefits. You can’t take it away once you leave. The company, whether it is being laid off, or resigning or leaving, will lose your insurance.Although the current unemployment rate in the United States has dropped to the lowest in four years, due to policy uncertainty and the deterioration of Sino-US relations, even Chinese working in large companies should not count on company life insurance.

Second, the life insurance provided by the company is generally term(Term life insurance), even if you stay in a company for a lifetime, once you retire, your insurance will be gone.

Third, the premiums of insurance provided by some companies increase every year, and even more expensive than those purchased outside. The reason is that the group insurance provided by the company does not require a physical examination. Some people are in poor health and risk a lot. You are young and healthy. It is necessary to share this part of the risk for the old and sick employees.Therefore, the conclusion is that the company must have insurance, but it must also have its own insurance purchased outside, which is more reliable.

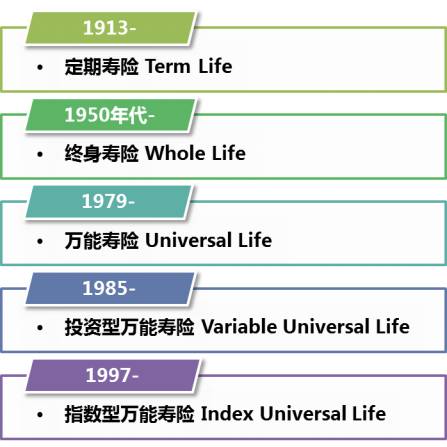

What types of insurance products are there?

life insuranceDivided into two categories: term and permanent.Term insurance only covers 10 years, 20 years, and 30 years. If a person passes away within the period, the insurance company loses money. After the period, the insurance will be lost.Term insurance generally has no cash value, but there is a newer term insurance calledRefundable premium insurance(Return of Premium Term) is different. It stipulates that the insurance company loses money if the person passes away within the time limit. After the time limit, the person is still alive, and the insurance company returns all the premiums paid by you in the past 20-30 years.

Of course, this kind of insurance is about 50% more expensive than pure term insurance, but you can get all the money back at that time, which is equivalent to exchanging interest for another insurance.

Perpetual insurance is much more complicated. Common ones include participating whole life, variable universal life (VUL) and index universal life.Let’s start with Whole Life (WL). WL is also known as life insurance. It is the oldest type of permanent insurance. Its premium is fixed and will never change. As long as you pay the premium on time, the insurance will always be valid.

WL will have cash value in one or two years and may have dividends. After more than ten years, the cash value may be equal to the premium you paid. There are three biggest problems with WL. One is that the premium of WL is the highest among various permanent insurances. The second is that the premium cannot be adjusted. The third is that there is no written guarantee for how many years the premium will be paid, such as that of an insurance company that is familiar to Chinese people. The product is called WL98, which means that in theory the insurance company can ask you to pay the premium until you are 98 years old.

This article does not say that WL is not good, but that WL is more suitable for work, has a relatively stable income, can persist for a long time, and regards WL as a way of saving money.The longer the time (more than 15 years), the more the benefits of WL can be revealed. WL is not suitable for estate planning because its premium is too high, there is too much cash value, and there is no guarantee of how many years it will be paid.

Let's talk about VUL, also known as investment insurance, which ties investment and insurance together.After deducting various expenses, the monthly premiums you pay are invested in mutual funds.When the stock market rises, your cash value rises; when the stock market falls, your cash value falls.When the cash value drops to a certain level and is insufficient to pay the premiums and various expenses, the insurance company will ask you to pay more.

If the stock market keeps going up, 10-12% every year, VUL is very good, because the cash value will rise quickly; but if the stock market falls sharply, the cash value will also fall quickly.The stock market plummeted twice in the past 10 years, and people who bought VUL may have lost a lot of money. Another problem with VUL is that the cost of insurance will increase every year, because its premium is equivalent to a one-year or one-year term insurance term. The older the age, the greater the probability of death, and the higher the premium will naturally be. , To share the rising risk of death.

40-50 years old may not be a big deal, but after 60-70 years old, the rate of increase in premiums will be greatly accelerated. If you do not accumulate enough cash value at that time, your insurance will be in jeopardy.At that time, you only had two options. One was to add additional premiums, ranging from thousands to tens of thousands a year, or simply to give up the insurance.But if the stock market continues to fall, additional premiums may become a bottomless pit.If you give up the insurance, it means that the premiums you have paid for many years have been lost, or you can only get back very little.

VUL is more suitable for young people who have great confidence in the stock market and are not afraid of the stock market. Middle-aged people over 40 generally do not recommend VUL, and estate planning is definitely not suitable for buying VUL.

Index UL (IUL) is a relatively new insurance launched in recent years. It is the same as VUL in that its cash value follows the stock market. The difference is that VUL follows individual mutual funds, while IUL follows the index. S&P500 go. When S&P rises, you also rise (there is a ceiling), but when S&P falls, the insurance company will give you the lowest interest rate of 1-2%, which means that your cash value will not fall due to the decline in the stock market.

If you are afraid that the stock market will be volatile and your cash value will fall sharply, but you don't want to miss the opportunity for the cash value to rise faster when the stock market rises, buying IUL is a good choice.

Learn more about the 5 classifications, advantages and disadvantages of life insurance products

How do different types of insurance compare?

WL和VUL最大的弊病是你永远不知道保费要付多少年,15年、20年还是一辈子?你不知道,保险公司也不知道。而近几年来推出的Guaranteed UL(GUL)就没有这种模糊不定。不同于以往的WL或VUL,GUL允许你自己选择保费付多少年(3年、5年、10年、15年等)、保险报到多少岁,保险公司书面保证你付了若干年的保费后,保险一定不会断掉(lapse), 一定会保到100岁、110岁甚至125岁, 而且每年的保费还比WL低20%-30%.

The reason is that this kind of insurance does not have much cash value, and later there is even no cash value, but your insurance guarantee is always valid.If you want to buy a guaranteed never lapsed insurance with the least amount of money, GUL is undoubtedly the best choice.If you want to leave a sum of money for your children after death, buying this GUL is also the most cost-effective plan.

Finally, I will introduce a kind of insurance called Guaranteed Survivorship UL (GSUL), which is specially prepared for those who do estate planning. It is also called second-to-die insurance. Lose money.Like GUL, you can also choose the number of years of premium payment and how old the insurance will last. GSUL is cheaper than GUL because it loses money only when the second person passes away.There is no income tax for death claims, and no estate tax on the trust. It is the most economical and effective tool for estate planning.

New trends in life insurance The industry has changed a lot in recent years. One of the outstanding features is that life insurance has begun to combine the functions of long-term care insurance and critical illness insurance.Some insurance products stipulate that if you have a chronic disease, a major disease or a fatal disease, you can take out part or most of the death claim before you die.It is used to treat diseases or do other things, which breaks through the traditional life insurance stalemate that only people can get money when they die.

In view of the longer and longer lifespan of modern people and the better and better medical conditions, life insurance companies have gradually proposed that "you can use the sum assured" to insure your life benefits after 2007.It includes claims for serious illness, terminal illness, major illness, and major injury. It can truly take care of the family and heal the sick.

How does the insurance company approve insurance?

After filling in the life insurance application form, a few days later, the medical examination company designated by the insurance company will send someone to do the physical examination for the client, mainly for blood sampling, urine test, height and weight measurement, and ask some simple questions, and some may even do a simple one. Electrocardiogram.At the same time, the insurance company will check your medical records to see if the customer has any medical history worthy of attention.

If the customer’s medical record is simple, the insurance company will give the customer an underwriting response based on the results of the medical examination and the medical record: whether to insure you, how much coverage is insured, and what level it will give you.This relatively smooth approval process only takes 3-4 weeks.

If the client has undergone surgery and has seen a specialist, they will adjust the client’s medical history from the specialist until all the information is available, and the insurance company will not give the final result.This process may take a long time, and it may take a few months or six months.

You don’t have to pay for all the medical examinations and medical records, but the insurance company will pay for it.If the customer needs it, he can request a medical report from the insurance company through the insurance broker, which is also free.

What is the procedure for insurance death claims?

When a person passes away, the family should contact the insurance company as soon as possible while dealing with the funeral. Of course, it is best to go through your insurance broker to handle the death claims.Generally, you are required to fill out a form and provide a death certificate. If there is nothing suspicious, the insurance company will issue death claims within 1-2 weeks in most cases.The insurance company will give you a checkbook, and you can write a check to get money, or deposit the money in your own bank.

Under what circumstances does the insurance company not compensate?

All life insurance in the United States has a two-year no suicide clause.Counting from the policy date, the suicide insurance company will not lose money for the first two years, but will return the premiums you paid in the past two years to your family, which is also a kind of humanitarian compensation.After the two-year non-contestable period, suicide also loses money.So if the person who bought the insurance passed away in the first two years, if the insurance company found it suspicious, it would conduct an investigation to understand the real cause of the death.

If you pass away 2 years later, you have provided a credible death certificate. Generally, insurance companies will not worry about the cause of death and lose money immediately. If he dies after 2 years, if the insurance company refuses to pay, the family can file a lawsuit.Once things become big, they will be known to everyone and affect the reputation of insurance companies.Therefore, if there is not a very good reason, the insurance company will not refuse to pay.

This article is not original and will be published after editing and collation on this site.