American Life InsuranceThe most basic function is to provide comprehensive protection for individuals or families.When we moved to buylife insuranceAfter his thoughts,There is bound to be the question of whom to buy the insurance first.

Many young friends first think of applying for their children or parentsAmerican Life Insurance, Instead of thinking about applying for yourself first, because I always feel that I am in a strong body now, and people are also good. Accidents, illnesses, and deaths will not actively come to the door, and they are more taboo when it comes to these things.Is this kind of thinking right?United Stateslife insuranceThis column on the guide network will give a detailed explanation.

Who should we buy insurance first?

American Life Insurance GuideAmong the readers of Net, there are many friends who are married and have children. They are in love and responsibility for their children’s lifelong major illness protection, education funds for schooling, home purchases when they grow up, and even entrepreneurial funds. , Began planning to configure for young children, even newbornsAmerican Insurance.Some single friends are busy with their careers, do not have time to take care of their families, and worry about the health of their parents, so they start to consider buying insurance for their elderly parents.

Most people's intention to buy insurance is to protect and protect their families.American Life Insurance GuideThe editors at this point empathize with this.

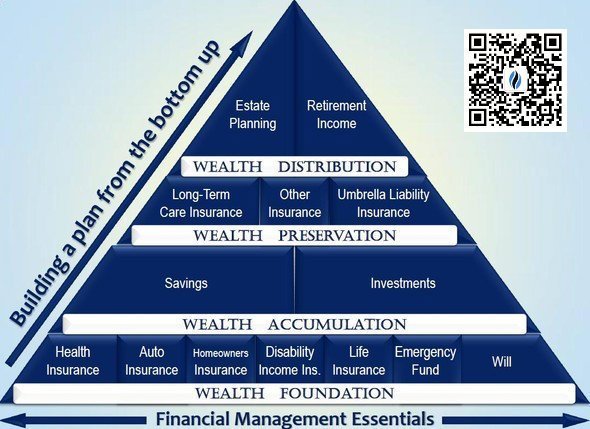

Insurance is the transfer of objectively existing risks in the future.As shown in the figure below, in a healthy family financial management pyramid display table, insurance is the basic part of a family’s wealth accumulation and is at the bottom of the pyramid. It can be said that insurance is the foundation of each family’s wealth accumulation. .

Therefore, in the process of wealth accumulation in a small family,The first thing to do is to buy insurance for the family pillar to build this foundation.

Family pillar first

Who is the breadwinner of the family, buy insurance first.If your husband earns more than his wife, buy it first. If your wife earns more than your husband, buy it first.

On the surface, the life of middle-class American families looks very beautiful.However, if there is a major change, such as illness, accident, unemployment, etc., the family loses its source of income. At this time, there are parents and the elderly who need to take care of them, and children who need to pay for education and support, family housing loans and vehicle loans. It has not been paid off, and the whole family will fall into the financial abyss at once.

For both the elderly and children in the family,American Life Insurance GuideThe editing of will also be explained in the next section.

For both the elderly and children in the family,American Life Insurance GuideThe editing of will also be explained in the next section.

First of all, these two groups of family members usually cannot generate economic income, especially children, so they are usually not the first to consider insured objects.

At the same time, as far as the family is concerned, the safety of adults is the only prerequisite for the healthy growth of children. Before the adults have configured insurance, they should be careful to insure their children.Even in the unfortunate event of an accident, due to a major illness or death, the family loses its source of income. The children can live on through the insurance claims, continue to receive a good education, and the elderly can also receive support and care.

When buying insurance for a child

From a professional point of view, because children basically do not have the ability to provide a source of income for the family, from the perspective of financial risks, the unfortunate death of a child, family members bear more spiritual losses rather than financial losses loss.

At the same time, from the data point of view, the probability of a personal accident before a child reaches adulthood is generally less than that of an adult.Therefore, in the U.S. life insurance industry, not all insurance companies are willing to insure children. At the same time, it is also required that parents need insurance before they can insure children.

In real life, parents buy American life insurance for their children, usually for the following three reasons:

- Used for "Lifetime comprehensive protection": The child has the lowest insurance cost.

- Used for "Savings and financial management"Purpose: such as supplement529 Education Plan, Provide down payment for house purchase, venture fund, etc.

- Ensure that the child will not be unable to insure or increase the amount of insurance due to any health changes during the growth process.

The situation of buying insurance for the elderly

Because the elderly are older, they have more health problems, high insurance costs, and relatively low insurance coverage.At this stage, children buy insurance for them, usually to solve the economic pressure brought by long-term care, medical treatment, and Final Expense that they will face when they are old.

But from the perspective of wealth inheritance, if parents and elderly people accumulate a large amount of wealth in their lives, they can take the initiative to use "American Life Insurance"This financial tool carries on the inheritance of wealth.

In real life, elderly people buy American life insurance, usually for the following two reasons:

- Cooperate with irrevocable trusts for wealth inheritance

- Pay high inheritance taxes

Article summary

After we have laid a solid foundation for family support, we can consider purchasing insurance for the other spouse, and then insuring the children.If these foundations have been laid, we can consider buying insurance for our parents.

The ultimate goal of purchasing insurance for children and parents is to help reduce the financial burden we face as children in the event of some accidents.

Therefore, we conclude that the priority of purchasing insurance in a family is:The main source of family income> children> the elderly.