(美國人壽保險指南網 2020年3月9日訊) 美國東部時間3月9日股市開盤後,標普500指數立刻下跌7%,觸發了美國股指第一層熔斷機制。

What is the US stock index circuit breaker mechanism?

In 1987, after the US stock market experienced the bloodbath of "Black Monday", the exchange launched a stock index circuit breaker mechanism.Among them, 7%, 13%, and 20% of the three gears fall fusing.

In the U.S. stock market for the past 30 years, only on October 1997, 10, did the fuse mechanism really trigger-on that day, the Dow Jones Industrial Index fell by 27%, the largest stock index decline since 7.18.

On March 2020, 3, the U.S. stock market once again triggered a circuit breaker, which was the second time that a circuit breaker in the U.S. stock index occurred in nearly 9 years, allowing participants to witness history.

U.S. President Trump tweeted that "rumors" and Saudi Arabia's strategy on Russian oil were responsible for the stock market decline.

"Stop Loss" and "Bottom Guarantee" are pragmatic choices

With the outbreak of the Saudi oil crisis, the long-term zero-negative interest rate policy in Europe and the United States, and the continued decline of US stocks, has the global economy really entered a conservative period?In this environment,"Stop loss" and "bottom guarantee" have become our most urgent risk management needs.

Demand for insurance products and annuity insurance products may soar

In the current U.S. dollar financial product market,There are still some products that provide "floor guarantee" and current "fixed income" interest rate options, such as some bonds, bank CDs, insurance products and their derivatives, and so on.

美元Bank time deposit interest rates have been sluggish. Following the emergency rate cut by the Federal Reserve a few days ago, the interest rates of various CDs and bonds have fallen again and again.For ordinary families and individuals, directly entering the hedge trading securities market is tantamount to going to a casino without equipment and experience.

From the perspective of sound family wealth planning, what we are going to introduce today isIndex insurance.Participating Insurance, And a lifelong stable fixed incomeAnnuity InsuranceThe content of this part of the product.

Index insurance

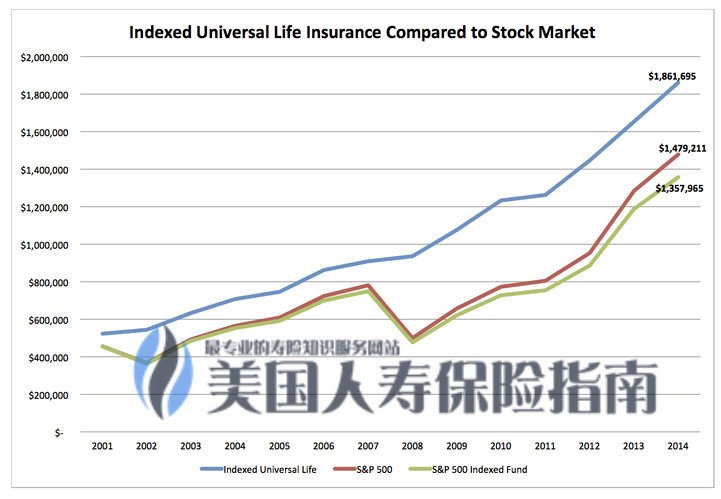

We introduceIndex insuranceThe reason is that this type of insurance product provides the technical advantages of both "index" and "insurance."

On the one hand, our cash value account has been guaranteed upside potential, and given the index's capped interest rate, participation rate and spread guarantee.On the other hand, this part of insurance can provide a guaranteed minimum return value, such as 0%, 1%, to cope with the sharp decline in the market brought about by the bear market.

Therefore, in essence, by using the "index strategy" of the US insurance policy, we can share the fruits of rising stock market yields until the capped interest rate is reached, and at the same time avoiding market down losses caused by the bear market.

Therefore, in essence, by using the "index strategy" of the US insurance policy, we can share the fruits of rising stock market yields until the capped interest rate is reached, and at the same time avoiding market down losses caused by the bear market.

in"2020 U.S. Insurance Company Ranking Top3 Review"In the article, the American Life Insurance Guide website pointed out that some powerful insurance companies currently offer 3% to 4% fixed income options for cash value accounts in their index policy accounts for policyholders to choose from.

Savings Participating Insurance

Savings dividend typeThe meaning is that this type of product provides a savings function, just like you set up a savings account in a bank, except that the savings function in the policy has a special name, called "Cash value"section.After paying the fixed insurance cost, the remaining part of the premium you paid is automatically converted into cash value.

Insurance companies will regularly pay dividends based on the company's profitability.Over time, the cash value in insurance will increase.The insurance company promises a given rate of return, such as the annual rate of return of the promised cash valueGuaranteed to be 2.5%-%4.Customers can use the cash value in the insurance policy in a certain way, which is one of the benefits of this type of insurance.

On the American Life Insurance Guide, "How to protect against losing money in a bear marketThe column of the article pointed out that "the above two main types of cash value insurance products are a means for long-term investors to hedge against bear market risks.

Annuity Insurance

An annuity is made up ofInsurance companyThe long-term investment products issued are used to manage the risk of "people are alive, but money is gone."

The process of buying annuity insurance is similar to opening a deposit account at a bank: we open an annuity insurance account with a financial insurance company, deposit money (premium), and the insurance company conducts professional investment and financial management according to the selected type of account income.When we are ready to receive money for life (this behavior is called "annuitization"), insurance companies begin to provide life-long income cash flow.

due toAnnuity insurance can be used to provide stable lifetime income, Governments all over the worldUse annuity insurance to solve the problem of national pension.Therefore, our life and annuity insurance are closely integrated, but in different countries and regions, annuity insurance usually appears under different names.

U.S. governmentSocial Security Pension Plan, Is a kind of annuity insurance operated by the government and participated by all residents, providing all residents with a basic source of life-long retirement income.The social security tax that is forcibly deducted in everyone's tax bill is the dollar annuity insurance premium we paid to the financial institution of the "US government".

Japan'sSocial pension systemIt is also based on three types of annuity insurance: national pension insurance, welfare annuity insurance and mutual aid annuity insurance.

In addition to annuity insurance issued by governments of various countries, commercial insurance institutions in various countries also issue annuity insurance products for consumers to purchase.

For American residents, annuity insurance is an important channel to protect retirement income.For residents of the global high-net-worth world, in addition to the allocation of local currency fixed income sources, choosing to match American annuity insurance products is an excellent way to build a cross-currency fixed lifetime income allocation.