"I'm almost 60 years old this year, can I still apply for IUL index insurance in the United States? How much premium do I need each year? Is it safe and secure?"

HummingLife is a company located in California that specializes in life insurance asset allocation and policy asset management. After communicating with insured family members and obtaining consent and authorization,American Life Insurance Guide©️provided this56 years oldInsured near retirementInsurance policy design plan and annual billing statement.

We hope that through this article, help the insured readers understand,The insurance policy account configuration requirements and risk management points of the retirement group over the age of 55, and the comparison of bill numbers will help you find your own answer.In order to comply with relevant regulations, the specific names of the underwriting life insurance companies and policy products will not be mentioned in this article.

Insurance background

Mr. X (pseudonym) is 58 years old this year, Chinese nationality, and his children live in the United States. Mr. X belongs to a very conservative industrialist. In his own words, "No financial management at all, no investment property, no stocks".According to family members, Hong Kong banks recommended Hong Kong Life Insurance to him every year, but Mr. X refused.

During a visit to the United States in 2018, Mr. Wang, accompanied by his family, applied to open the first American life insurance policy account.Currently, Mr. X's policy account is managed by HummingLife.

Why decide to insure?

If Mr. X moves to the United States after the age of 65, because Mr. XHave not worked in the U.S. for 10 years and paid taxes, and met the 40-point pension benefit access requirement of the Social Security Bureau(Retirement points description), then the life insurance account can be used to pay the cost of MA commercial medical insurance for foreign retired immigrants orLong-term care insuranceThe cost to solve the family’s worries.

If Mr. X is pensioned in other countries or regions, the life insurance account can help provideLifetime foreign exchange cash flow, Used to pay part of the pension living expenses.

Finally, due toAge factor, 6 US dollars per year, 8 years of deposit, corresponding to only $ 5 million insured amount (Death Benefit), to say that this leverage is not high.But in the end, Mr. X's family realized that if they were not insured right now, as they grew older, it would definitely become more and more expensive.

List of plan values at the time of policy account opening

*This Chart is not an offer, contract, or promise of future policy performance. Actual policy values may be more or less favorable than the nonguaranteed values shown.

*This Chart is not an offer, contract, or promise of future policy performance. Actual policy values may be more or less favorable than the nonguaranteed values shown.

Taking into account Mr. X’s risk tolerance and preferences, the account uses"Conservative"The initial design of the floating interest rate is shown in the figure above: the annual premium $67,788 plan,Monthly deposit of $5,650, payment period of 5 years, The expected rate of return for the first 5 years from4.6% to 6.5%. Payment of premiums will cease after 5 years.

In the 7th year, at the age of 62 in the scarlet part of the picture above, the policy account will be able to get all the invested principal and at the same time there is a million-dollar insured amount (death claim).

Is the leverage of $100 million insured too low?

First, the leverage of the $100 million insured amount (death claim) is not high. The objective reason is that due to the older age, the customer's risk appetite is conservative.For Mr. X's age, the annual premium of nearly $7 can actually buy nearly $200 million in insurance coverage and get a higher death claim leverage.

However, this approach, in addition to the fact that the distribution brokerage agency can get more commissions, not only increases the risk exposure of the policy account, but also reduces the probability of achieving Mr. X's family's financial goals. It is not beneficial to Mr. X's family.

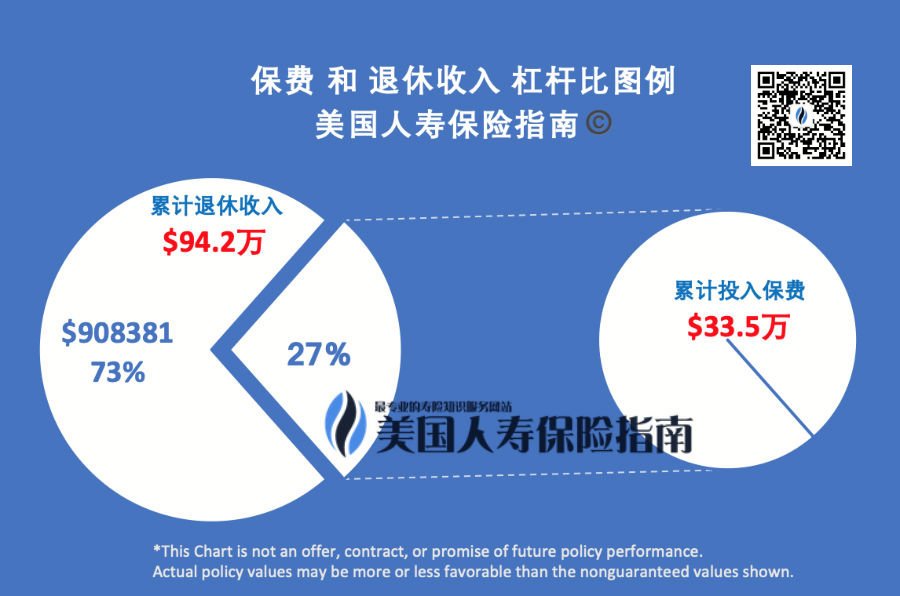

Second, 5 years of accumulated premiums of $33, and its output leverage has been improved.The plan is about7rd year(The red part of the above picture) recover all the principal of the premium, and after the age of 69, can be the family of Mr. X,Provides retirement income of approximately $4 per year,Provide 21 consecutive years of capacity.As shown below.

Finally, to improve the leverage ratio and display the number, and to design a targeted insurance policy plan. This is a purely use of "information asymmetry" to conduct a sales behavior, rather than a professional insurance advisory service with "trust" responsibility .

How much money can be put into this policy account each year?

If you follow the way of thinking of buying a purely "consumer product", such as buying health insurance, term life insurance, car insurance,"How much is the annual premium?" It is the most normal question.

However, when it comes to the "financial products" field of American cash value insurance, the problem becomes, "How much can I put in this policy account?'

OnAmerican Life Insurance Guide©️'s original column "How much can a U.S. life insurance account hold?This is actually a historical drama of "Gong Dou""In the article, we pointed out that every policy account is subject to the regulations of the IRS. According toThe age and health of the insured和The size of the insured (Death Benefit)These three factors set the maximum premium limit that can be put in.

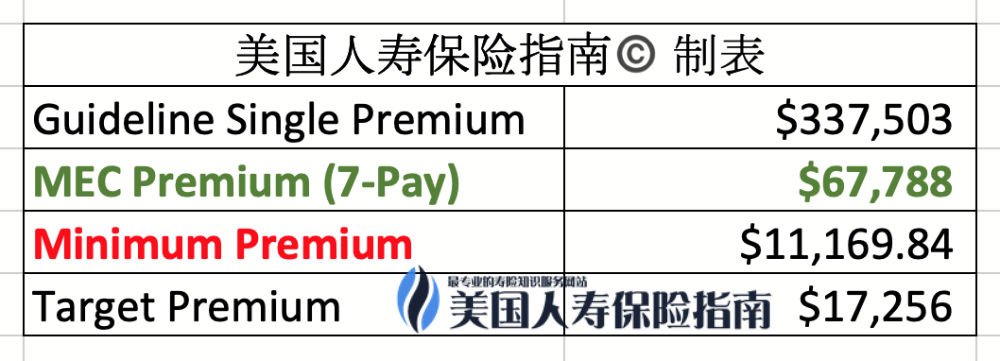

For this policy account of Mr. X, we have marked the premium payment instructions with the form below.

Take the above picture as an example, if it’s just to achieve the highest "leverage ratio"-the 56-year-old policyholder only needs to deposit the red part$ 11,169 USDYou can hold this million-dollar insurance policy.

At this time the leverage ratio reaches its maximum value,1 bars 100 million.However, this "consumer goods" purchase idea of pursuing the "leverage ratio" of premiums and insurance amounts completely deviates from the operating logic of this type of policy account, and it is easy to fall into it.Common Sales Traps and Misunderstandings in American Insurance Financial Management, The specific consequences can be点击 这里Get to know.

Back to the main text, under the premise of not violating the rules of the IRS, the policy account has the mostAllow a lump-sum deposit of $337,503 USD premium, The annual maximum allowable deposit is $67,788.

In other words, a 56-year-old policyholder who applies for an index policy account with an insured amount of US$100 million can deposit a little more than 1 a year, or about 6 a year.The large floating space of premiums ranging from 1 to 6.7 is not only related to whether the insured has a clear demand and goal, but also whether the life insurance broker accurately delivers the professionalism, as well as individual values and professional ethics.

Policy account billing after one year

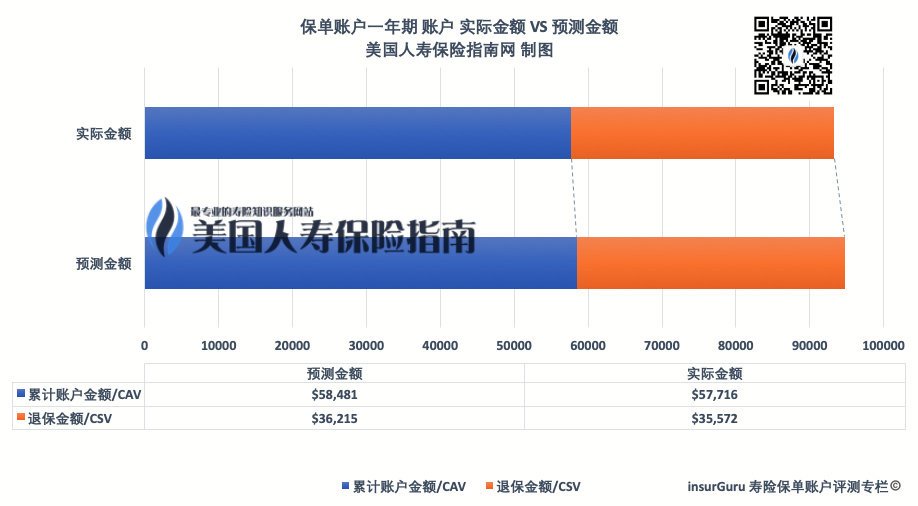

One year later, the policyholder will receive the first annual account bill from the insurance company.After deducting all costs, the actual performance of the policy account is very close to the expected deduction when the account is opened.The offset value is within the safe controllable range of 1.7%, Which is less than the average offset rate FOR Benchmark for the first year of the U.S. cash value life insurance account.

One year later, the policyholder will receive the first annual account bill from the insurance company.After deducting all costs, the actual performance of the policy account is very close to the expected deduction when the account is opened.The offset value is within the safe controllable range of 1.7%, Which is less than the average offset rate FOR Benchmark for the first year of the U.S. cash value life insurance account.

It’s worth mentioning that the first year of a cash value life insurance policy account is often the most expensive.Surrender penaltyThe highest, the year with the most complicated growth and settlement process, and the policyholder’s payment model also slightly reduced the rate of return. The results of this operation show thatThe policy account is in a "healthy" operating state, No need to initiate additional actions.

Evaluation summary and postscript

For groups over 55 years of age who are about to retire—especially “world-resident” families—family members need to fully understand their own risk tolerance and the needs that families will face in the future.

It may be difficult to do this alone, but through and professionalInsurance Advisor BrokerThe communication and cooperation can help each of us to clarify our thinking and grasp the key points to achieve our goals.

No matter which one you chooseAmerican Life Insurance Company——The configuration of these cash value life insurance policy accounts is just a means to achieve goals.In the end, they all serve the purpose of our family life.

In the process of achieving this goal together, the risk prevention and control design and management of cash value life insurance policy accounts are above all else.

The insurGuru©️ evaluation team is also very much looking forward to the annual performance of this policy in 2020-2021. If we obtain follow-up permits and data, we will also update this article from time to time. (End of full text)

>>>Recommended reading:(Picture) What is the annual bill of American life insurance?How do you look at the annualized rate of return?