The current bull market in U.S. stocks turned "nine years old" on March 3. If it continues for another six months, it will refresh the record for the longest bull market in U.S. stock history.Most market participants believe that this record can be broken, but it seems difficult to say whether the bull market can survive until the tenth year.

The current bull market in U.S. stocks turned "nine years old" on March 3. If it continues for another six months, it will refresh the record for the longest bull market in U.S. stock history.Most market participants believe that this record can be broken, but it seems difficult to say whether the bull market can survive until the tenth year.

Recently, well-known investor Jim Rogers predicts that he is about to usher in the worst stock bear market in his life, which will be more catastrophic than any market downturn he has experienced, and this prediction has not taken the trade war into account.

羅傑斯經歷過幾輪嚴峻的熊市。就在本世紀,羅傑斯經歷了道瓊斯指數在金融危機期間跌幅超過50%的一輪大熊市——自2007年10月的高點跌至2009年3月的低點。還有在2000年至2002年的互聯網泡沫時期的熊市,當時道瓊斯指數自高點下跌了38%。

"Because of debt, the next bear market will be the worst in my life, but if we still encounter a trade war, the situation will be worse than disaster," the 75-year-old chairman of Rogers Holdings Inc. Rogers said in an interview in Moscow. "I am extremely worried. I have read enough history and experienced enough market changes, so I know that trade wars are usually disastrous."

He believes that the end of this year is likely to be the moment when the correlation between U.S. stocks and U.S. bond yields begins to reverse, that is, when the real bear market comes.

Of course, you can choose short positions to watch from the sidelines, but there is also an opportunity cost if you don’t enter the market. As early as 2017, someone called the bull market over, but the result?How do you know that 2018 will not continue?

At this time, what you need is actually a product that can support the bottom, so that you can participate in the market, keep up with the index, and have a bottom line, without worrying about losing money.So is there such a product on the market?Anyone who knows American insurance knows that this is index life insurance.

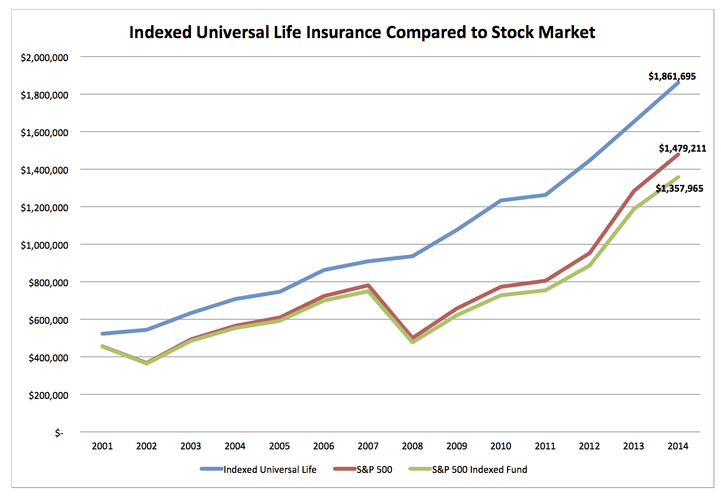

Index-type life insurance was introduced to the market by American insurance companies in 1997. It is for customers who want to obtain stock market returns but do not want to bear the risk of stock market collapse.At first, it was not attractive, because the stock market was soaring year after year at that time, and everyone had long forgotten what the risk was.After 2001 and 2008, the U.S. stock market and even the global stock market plummeted. Many people went bankrupt and their pensions were cut in half. However, exponential life insurance kept the principal and became more and more popular.

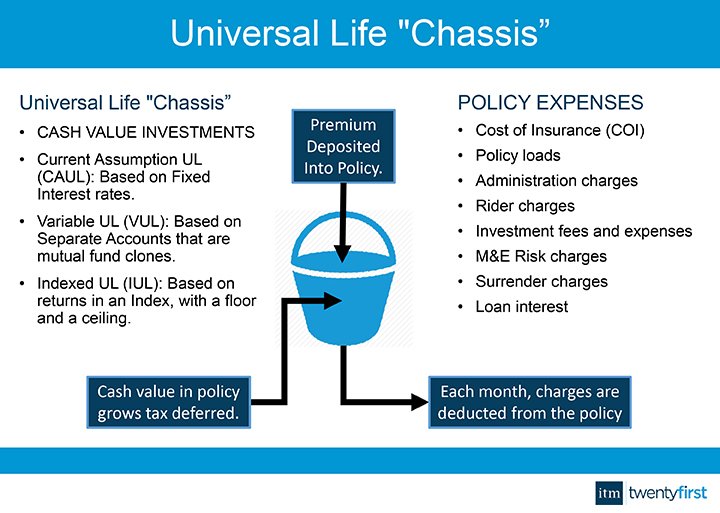

Index Universal Life (IUL), the cash value of the insurance is linked to the performance of one or more indexes in the external stock market, such as the S&P500 (S&P500).The income of index-type life insurance is completely calculated according to the designated index. When the index rises, the income rises (but generally there is an annual income cap of 10%); when the index falls, the income falls but the capital is guaranteed (ie 0%).In addition, it has these advantages:

As mentioned earlier, the cash value income of index-type life insurance is linked to the index.In addition to tracking a single index, some insurance company's products can also track the US S&P 500, Hong Kong Hang Seng Index, Germany 30DAX Index, Emerging Market Index, etc., and automatically select the best performing index to calculate income according to the annual performance.

In addition to diversifying risks on the index, index-type life insurance can also diversify over time.Anyone who invests knows that timing is almost impossible, and you never know when is the best time to buy.The safest way is to buy by fixed investment.Index life insurance customers can choose when to enter the market every month, so that there are 12 time points each year to compare with the index on the same day next year to calculate the return. This risk is far less than putting a large sum of money into the stock market at once.

Some investment professionals want to say that if I make a portfolio myself and buy Call options, I can also achieve the same bottom-guarantee effect.But as a life insurance, IUL has a tax avoidance function that other financial products cannot match.

In the United States, the accounts that can save taxes are nothing more than 401K, IRA, each of which must meet the conditions to contribute and the amount is very small.Life insurance is one of the few products that can put a lot of money into it for tax-free and value-added products. Therefore, the US tax law has very strict regulations on insurance.Only insurance products that meet the requirements of Regulation 7702 in the tax law can enjoy the tax exemption policy. Simply put, clause 7702 is that it limits the maximum amount of money that a life insurance policyholder can put in for tax-free investment.In contrast, from the perspective of the U.S. tax law, Hong Kong's savings and dividend insurance does not meet the requirements at all and is not regarded as an insurance product, so naturally it cannot enjoy the insurance tax exemption policy.

We talked about so many benefits of IUL,But its essence is insurance first, that is, if the insured person dies, the insurance company has to compensate, so there are insurance costs..So comparing IUL with self-investment, the difference isIUL uses a portion of the income to buy protection for itself, while making investment by itself cuts down the income to pay taxes to the government.

If your child is underage or the mortgage has not been paid in full, buying insurance is a guarantee for the family, which is a must.If your children are adults and your own retirement plans are doing well, the main purpose of buying insurance for yourself may be to maximize the assets left to your children.If you do nothing, the assets left to your children are assumed to be 100 million, of which 50 are current assets, such as bank deposits, stocks or mutual funds.If you use a part of 50 current assets and assume 30 to buy life insurance, for a 50-year-old person, this 30 may buy 100 million or 180 million life insurance (depending on your age, gender and health status). ), insurance companies will lose money 2-3 weeks after death, and there is no tax.I can't imagine any other investment that has such a tax-free and guaranteed return.

If you don't want life insurance claims to be included in your estate, you can set up an irrevocable life insurance trust (ILIT) as the owner and beneficiary of your own insurance.A hundred years later, this claim will enter this trust account, and your children will take money from this account as the beneficiary of the trust.

Four. Conclusion

Four. Conclusion

Index-type life insurance is a good product that can achieve higher returns under the premise of controllable risks. It is especially attractive when the investment environment is uncertain, but it is not a panacea for everyone.Everyone's situation is different, and exponential universal insurance, due to its unique and flexible characteristics, can meet the different needs of customers through the planning of the broker.Whether it's protection, pre-mortem benefits, tax-free retirement planning, or children's education funds, all can be met with exponential universal insurance.