(#2020 new crown virus epidemic topic) Due to the pandemic of the new crown virus, the record of plunge in the US stock market has been continuously broken. On March 3, U.S. stocks plunged again after rebounding in intraday trading.At the close, the Dow Jones Index plummeted by nearly 16 points, setting the largest single-day drop in history. This was the worst day the American people have faced since the "Black Monday" in 3000.On March 1987, the U.S. stock market fell 3% after the opening, triggering a 18-minute trading suspension again.

In the face of market volatility, there is no so-called "correct" response standard.Before selling because of fear or entering the market because of greed, it is very necessary to carefully consider whether such an approach can be handled by our experience, and whether such an approach is in our current best interests.

For those who want to keep their pensions,When the stock index slumped 3000 points, how we should protect our retirement accounts has become a very urgent matter.

There are risks in the market, and you need to be cautious when you retire

Before making a financial decision, we must first assess our "risk tolerance" ability.

We often hear the above sentence, but to what extent is "risk" too high?Is there a simple way to judge?

American Life Insurance Guide©️ provides a "insomnia judgment method"-if we invest in the loss of the wealth management portfolio,If we started to sleep in the middle of the night during the recent period, then such a financial management combination may be too risky.

Risk tolerance depends on many factors, including age, occupation and financial experience. For those young people, taking risks may mean opportunities.The recent 3000-point plunge in the US market may provide an opportunity for this group of people because they can buy more securities at lower prices when the market is falling.In the long-term fixed investment index market, such as 401K, 403B, personal IRA, such patience may be effective, because we are still young and have enough time to deal with the ups and downs of the market.

The dilemma faced by retired people

When the market fell by 3,000 points as it did recently, people over the age of 50 had completely different thoughts and perceptions of risk.

Because we are about to retire, when the market drops sharply like this recently, our pension accounts will suffer a lot of losses, and there will be less time to recover from this loss.Our thinking is completely different when we retire, and our risk tolerance will also change.

We don't know how long we will live, and we are worried about the stock market plummeting. What should we do if we have no money to spend?

Risk Management for Retired People

The stock market is a high-risk market area. The violent turbulence of the market may cause drastic changes to our retirement accounts, causing the wealth we accumulated in the first half of our life to shrink rapidly.Therefore, as you approach retirement, look forThe principal will not lose money as the market falls, and at the same time there is a wealth management channel that has room for gains and appreciation, which is a must to seek a safe retirement.

With cash value account "revenue guarantee" functionIndex insurance和Participating InsuranceIs a choice, andAnother way to "guarantee life-long retirement income" is to use annuity insurance products. inFortune Academy©️In the lecture hall, we introduceWhat exactly is annuity insurance.

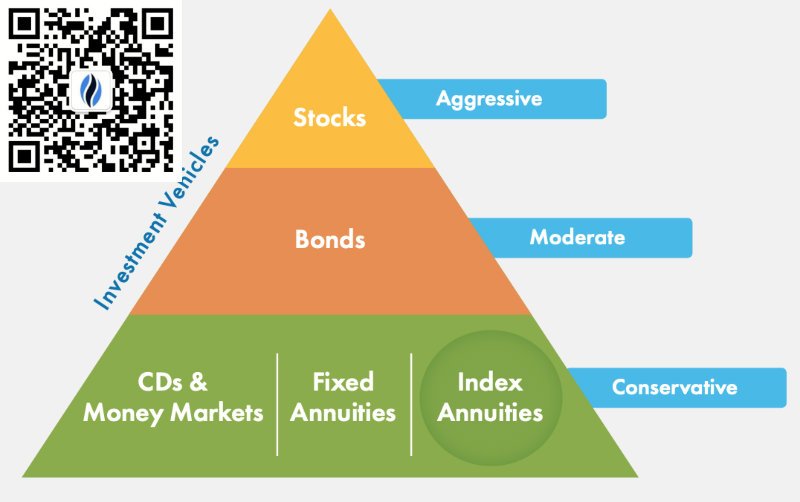

In the investment channel risk pyramid icon, we can see that time deposits, money market, fixed annuities, and index annuities are the most stable and conservative financial management channels.These types of accounts are usuallyProvide a guarantee for the return of the principal, and will not lose the principal due to the violent market turbulenceTherefore, it has the lowest market risk among the general wealth management channels.

The US stock market is a high-risk investment and wealth management channel, and participants are mainly institutions with strong risk tolerance.

According to data in mid-2018, US institutional investors accounted for 93.2% of the market value, and individual investors accounted for less than 6% of the market value.

In this high-risk market, individual retail investors not only need a lot of personal time, money and energy investment, but also face the natural advantages of competitive institutional investors in terms of technical support, information acquisition, and professionalism. Therefore, individual investors Often in the volatility of the stock market, there is a greater risk of loss.

(>>>Recommended reading: gadgets|The American Personal Pension Smart Calculator, how much do I need to save every month?)

Article summary

Annuity InsuranceIn today's severe market turmoil, it can help protect the retirement savings of the retired people, and protect groups who want to avoid risks, from the impact of market uncertainty, and provide guaranteed lifetime income, thereby reducing our violent market turmoil Anxious emotions, and at the same time bring peace of mind.

(>>>Recommended reading:2020 U.S. retirement annuity insurance company ranking top 8 )