Is the US financial insurance account conservative or aggressive?

Traditionally, insurance and policy products usually exist as a basic safety net for family finances.Therefore, in the eyes of most people, insurance products are relatively "conservative" financial products.In the current laws and regulations in the United States, insurance companies are also strictly required to explain to the public the difference between "insurance" and other "investment products" and their financial attributes.

Look carefully at the last page of the instruction manual of your lifetime warranty product,for sureYou will see instructions similar to the following:

however,Insurance companies usually have stronger financial ratings and comprehensive strengths than commercial banks.The credit value of this type of insurance policy account with strong financial attributes far exceeds that of ordinary financial products.

(>>> Recommended reading:What are credit and financial ratings?How to read the rating?What is the use of ratings for us?)

If you want to experience this for yourself, you can find a nearby private bank and compare it with your stock account, real estate as collateral, and life insurance policy cash account as collateral, and see how much the bank will loan according to the book value. It will be clear at a glance.

With the development of the times, especially after 2000, someAsset management financial insurance group, It is the "Risk Management", and the "Cash value growth potential"Combined with each other, it has brought into play the extreme under the existing institutional framework, and is far ahead of industry norms.

Even in the entire field of policy financing, a purely "investment product" type of life insurance policy contract has been developed.

This article will share and introduce thisClass-specific American life insurance policies.Point out the advantages and disadvantages of this type of life insurance policy account, and which specific groups of policyholders may be suitable for this type of policy application.

What is a pure investment product type insurance policy contract?

To explain this type of life insurance policy, you need to first compare the "normal" life insurance with cash value.

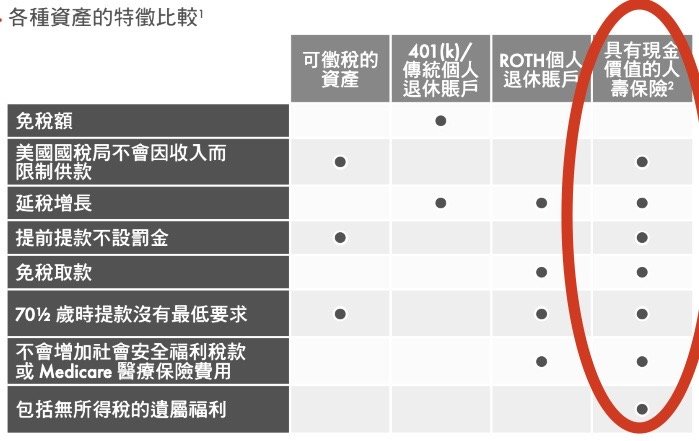

Under normal circumstances, life insurance with cash value hasNo penalty for early withdrawal.Tax deferred growth.Tax-free withdrawal.There is no minimum requirement for withdrawals at the age of 70.5.Will not increase social security benefits taxes or Medicare health insurance costsAnd other advantages, we provide a public asset feature comparison table to illustrate, as shown in the figure below.

Due to the long-term evolution and development of the American insurance market, some financial giants have gradually incorporated their expertise into products such as life insurance policies, and certain types of American life insurance policy accounts have gradually shown the "Low risk, high yield potentialWith these achievements, it quickly gained the recognition of the market and policyholders.

However, the IRS is not a fuel-efficient lamp, in order to prevent the rich from hiding all their money in the life insurance policy account (Related historical stories column), on June 1988, 6, the TAMRA Act came into effect.Simply put,Every standard life insurance policy, Will be based on each of our policyholdersActual age, sum assured, health conditionAnd other factors,TailoredThe upper limit of a deposit amount.

An "investment product" life insurance policy account is a product beyond this red line.

Is the investment-type policy contract still life insurance? Can claims be settled normally?

It is still a life insurance policy contract, and claims are settled in accordance with the conditions of a normal policy.

What are the advantages and disadvantages of investment product insurance policy contracts?

Compared with ordinary life insurance policies, the biggest disadvantage of investment product insurance policy contracts is that,Lost the tax advantage.

The normal claims of this kind of policy account, such as death compensation claims, for the beneficiary,Still exempt from income tax.However, if money is taken from the investment product insurance policy contract-no matter what method is used to take the money-All need to pay taxes.

Most policyholders would think that usingThe way of "borrowing", You can avoid paying taxes by borrowing money from yourself.However, for investment product-type insurance policy contract accounts, this methodNot applicable.

Withdrawal before the age of 59.5, there will be a 10% federal tax on account income.

This shortcoming is also the advantage of investment product insurance policy contracts-if our return on investment is far greater than the portion of the tax to be paid, and the risk of investment is also extremely low, then our first reaction is that we want to invest as much as possible. More funds.

On this topic, the Life Insurance Guide©️ past column has made a detailed interpretation, which can be accessed by clicking the link below.

(>>>Recommended reading:How much money can be loaded into an American life insurance policy account?)

Which groups may be suitable for pure investment-type insurance policy contracts?

- Groups over 45 years old

- Groups who need life insurance claims

- Too many assets, need to deal with the group of idle assets

- Those who believe that the tax rate will be higher in the future

- I hope to establish a group that has strong long-term cash value accumulation potential and can efficiently invest in this asset group in the credit market

- Understand the operating rules of financial insurance policies, and do not consider the groups who withdraw money from the insurance policy accounts

Article summary

Through the introduction of this article, we point out that life insurance is not just a "protection-type" product for death compensation in the traditional concept.The life insurance group may not be a company that simply provides "protection and claims" services in the traditional impression.

With the development and progress of society, life insurance policy accounts have derived diversified functions. The life insurance market has also undergone tremendous changes in the past XNUMX years. Different American life insurance brands have chosen different functional areas and products. In the field, actively looking for and serving groups with specific needs-the situation of relying on "brands" to take all of one family has long been a history.

What's more, some asset-management financial and insurance companies have directly abandoned the market for pure consumer and pure protection products such as traditional "term life insurance."More focused on providing refined professional asset management services for specific groups of policyholders.

However, for every policyholder, although there are so many choices in the market, due to the long-term monopoly of information, we policyholders do not have enough reference.Facing this circumstances,American Life Insurance Guide©️Compiled and released the "Trilogy of American Life Insurance Must-Read Strategies"(Preparation).(Misunderstanding articles).(Requirements)"And providedAutomatic price comparison system for consumer insurance productsIt is free for policyholders to inquire. I hope that these columns and gadgets can help some policyholders to clarify their ideas and have more efficient communication when facing brokers or financial advisors.

American Life Insurance Guide©️Finally hope that in the professionalLife insurance brokerWith the assistance of, every insured person can fully understand and master the pros and cons of different company's product solutions, and finally find a company and product solution that matches our financial plan, and truly realize the protection of assets and the inheritance of wealth.