The United States is a country with extremely complete tax payments.According to the regulations of the U.S. Internal Revenue Service (IRS), since 1993,

- Foreign students holding F, J, M visas

- Foreign scholars holding J and Q visas

Regardless of whether you have a job or income, as long as you are staying in the United States temporarily, you must declare your tax situation to the IRS.

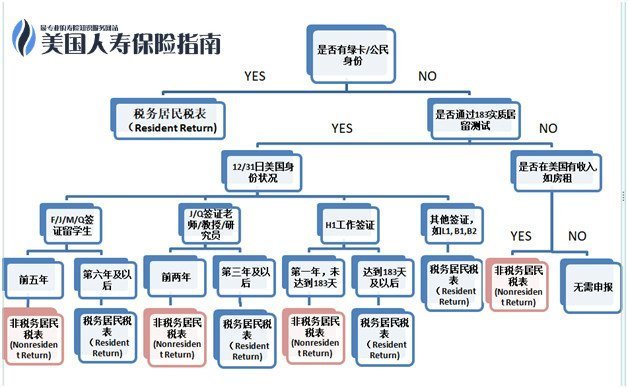

So tax filing is not just a matter of US green cards and citizens.If you are in the U.S. and have not yet obtained a U.S. green card or become a citizen, whether you need to declare U.S. taxes is a headache every year.

Below, I use a quick-check chart to answer your doubts.

Why do I need to file a tax return?

For the average person, tax filing is a must, an obligation, and a responsibility.

If according to the regulations, you need to file a tax return, but you do not take the initiative to file it on time, you may be fined up to 25% and even criminally liable.

In addition, if you can get the money back from the Internal Revenue Service, you can only get the tax refund if you file a tax return.

In addition, filing taxes on time can also provide you with a good tax filing record and reduce the chance of social security number being stolen.

Finally, tax filing can earn points for social security benefits, meet the point requirements and actively file taxes, and receive social security pensions, health protection and other corresponding government benefits from the government when you retire.

Therefore, if there is a need to file a tax return, you must report the tax.