At work, I often come into contact with new immigrants.When it comes to insurance, they usually understand the American insurance industry in their own way.ThisIt is the instinct and mental inertia of environmental training, but it may cause certain obstacles to applying for US insurance.In order to facilitate everyone’s better understanding,Today, I will use the method of comparison to briefly talk about some basic differences between domestic life insurance and American life insurance.

Domestic life insurance can be basically divided into "consumption type", "saving type" and "universal insurance" and "participating insurance"

Life insurance in the United States, no matter how the insurance company promotes it, is essentially of five types.“Term”, “Whole Life” “Universal Life(UL)” “Index Universal Life(IUL)” and “Variable Universal Life(VUL)”.

Term can be regarded as the corresponding domestic "consumer insurance".Generally, Term is guaranteed for ten years, twenty, or at most thirty years.During this period, if something happens, the insurance company loses money, it's okay, even if the premium is contributed.

Whole Life is more like domestic savings insurance.The premium is expensive, but your cash value is guaranteed.Basically when you are 120 years old, if you are still alive, the money you paid yourself plus the interest accumulated over the years is exactly what the insurance company should pay.Therefore, Whole Life, the longer you live, the less risky the insurance formula will be, until the risk is 0-because in the end all the money is your own investment.

Universal Life (UL) corresponds to "universal insurance".The characteristic is that the premium payment method is flexible, you want to pay more and pay less, and you are free to pay within a certain limit.For UL in the United States, the rate of return is based on the current interest rate.The United States in the XNUMXs was an era of high interest rates. At that time, UL was very strong, but with the subsequent decline in interest rates, the profitability of this insurance policy was naturally too poor.

"Index Universal Life (IUL)" "Variable Universal Life (VUL)" This can be regarded as a typical "investment insurance"."Variable Universal Life (VUL)", to put it bluntly, is to speculate mutual funds in insurance.However, this type of product has high risks and benefits. Whoever scrambles will know.

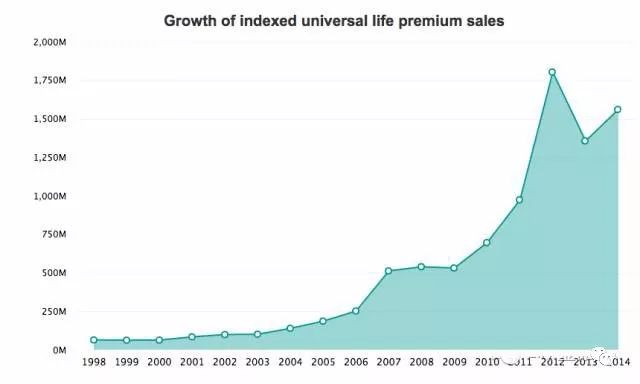

IUL can be regarded as the "popular fried chicken" product of the American insurance industry in the past decade.There is no similar product linked to the stock index in domestic insurance.After experiencing the ups and downs of VUL, people favored this kind of low-risk products.However, no matter how small the risk is, there is still risk. If an insurance broker tells you that IUL is XNUMX% risk-free, then his/her professionalism is questionable.

IUL can obtain higher benefits than Whole life and UL when the risks are affordable to most people. This is the reason why it is really popular.

In short, to buy life insurance in the United States, first understand this basic classification, and then choose the next step according to personal needs.Don't be fascinated by those hyped advertisements.No matter how beautiful it is, it still can't get out of this box.

Speaking of the difference between American insurance and domestic insurance, we must first talk about the difference in handling tax issues.

In the United States, any economic activity must take into account the issue of "tax".Life insurance is no exception.This must be very different from domestic life insurance and Hong Kong life insurance.

Taxes in life insurance in the United States are mainly reflected in the following aspects:

Life insurance's death benefit (Death Benefit) exempt from income tax (income tax).Please note that this is income tax, not inheritance tax.This means that the total amount of life insurance death compensation in the United States will be included in the amount of inheritance tax. In 2018, the inheritance tax allowance for one person is 1100 million U.S. dollars.Therefore, ordinary people probably don't have to worry about the inheritance tax on life insurance money left to their sons in the future.What are the benefits of exempting income tax?In the United States, you have to pay taxes on everything you make to make money, and the average tax rate is more than 20%, which is really distressing.However, the money raised in the whole life insurance will be borrowed when the "loan" is used, and there is no need to pay a penny of tax.

In addition, the U.S. Internal Revenue Service is also very sophisticated. The money you invest in life insurance has a cap, and the part that exceeds the limit is "MEC" (Modified Endowment Contract), which means that you can't enjoy the benefits of taxation. .

If you are a U.S. green card or citizen, and you have income tax declaration worldwide, then you can buy Hong Kong insurance, domestic insurance,Without this "MEC" restriction,All income is to be counted as income tax.

If you are a foreigner, you will basically have an inheritance tax when buying a house in the United States, because the inheritance tax allowance is only $6, and you will have to pay taxes if you exceed it.But if you buy insurance, because it is an intangible asset, there will be no inheritance tax.and soForeigners who buy American insurance are exempt from income tax and inheritance tax, There are very few subjects similar to tax preferential treatment.

The second point is about the differences in some types of insurance.

Domestic insurance includes major illness insurance and accident insurance.These similar "insurance types" in the United States are basically supplemented in life insurance in the form of "Rider" (additional clauses).Compared with domestic specialized insurance types, it has the first advantage of lower cost, and second, it covers a wide range.

Have friends many years agodomesticI bought a critical illness insurance. At that time, the insurance broker proudly said that we can cover more than 40 kinds of diseases.But now if you look at the relevant insurance clauses in the United States, you will know who is better.Because there is no specific disease name, it is OK if the doctor says it is an incurable disease or a serious disease.So there is no specific limit to cover the largest.

This additional clause also varies from insurance company to insurance company.It depends on the products of each company.

There is also a very "special" insurance in the United States called "long-term care".I have never heard of it in China.But it is very important in the United States.

First of all, no matter where you live, statistics show that one in three people needs long-term care.

The cost of long-term care in the United States is also really expensive. Now the cost of living in an ordinary Nursing home is $300 a day!What is even more sad is that this cost of medical insurance is not yet covered, only a white card can be used.Therefore, long-term care insurance is almost necessary if you plan to endure in the United States in the future.This insurance can be bought separately or as a Rider with life insurance.This varies from company to company.As for buying it separately, it is better to buy life insurance and add this function. This depends on your specific situation.