OnThe Life Tank©️ Different for the first quarter of 2022Return on Alternative Investment Strategies of Insurance CompaniesIn , we pointed out that policyholders who chose S&P 500 strategy accounts in the last year generally received better returns on interest.

As the market began to pull back sharply, some outperforming insurers, by offering the lowestGuaranteed rate of return, CombinedS&P 500 IndexSync15.00% +one-year growth rate,Effectively achieved in Q1 "No loss of money, no loss of money, steady appreciation of assets” capital hedging target.

What is the annual cash value rate of return for holders of such insured assets?How is the annual rate of return on cash value calculated?

U.S. Life Insurance Guide Community Member Institutions, with Policyholder ConsentHummingLife, which provides an annual settlement in February 2022Insurance statement.Through the explanation of the interest calculation of the insurance annual statement income, we will help the policyholder to further understand these two common problems about the insurance wealth management account.

1. What strategy account did the insurance product choose?

Insurance products issued by different insurance brands provide different investment strategy accounts for policyholders to choose from.

In the column of the American Life Insurance Guide©️, we have explained in detail the most common among the main asset-based insurance products., an investment and wealth management strategy account composed of four major global market indices.

What accounts are provided in this insurance product?

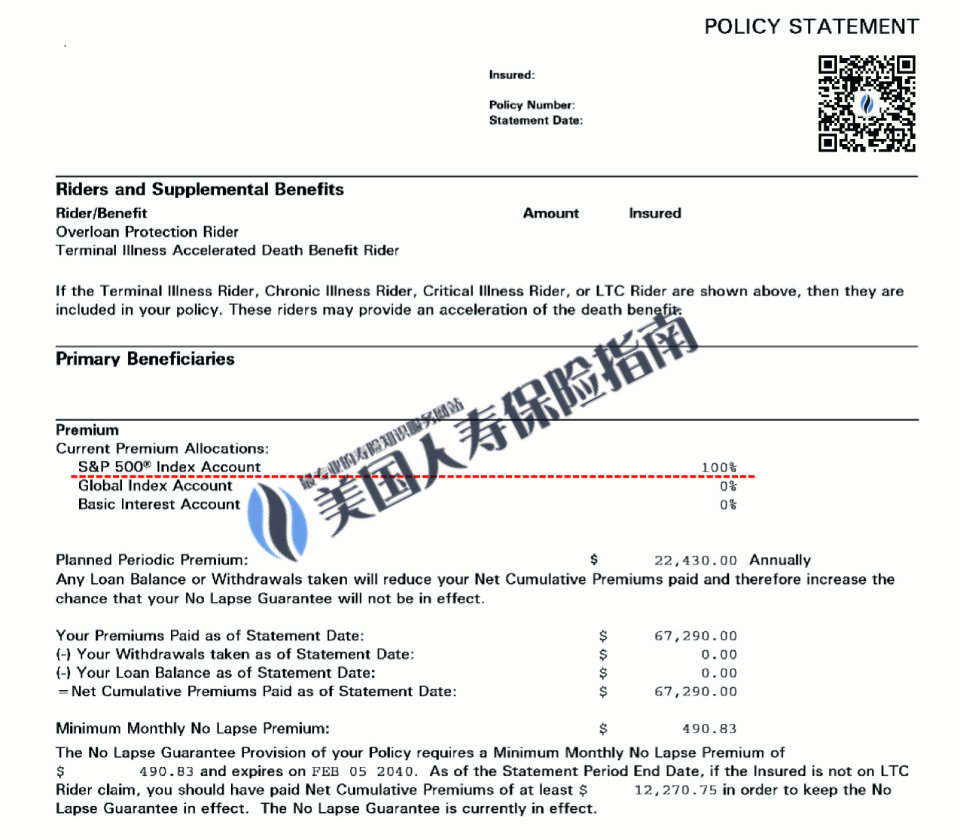

From the red line area in the above figure, we can see that this one held by the policyholder provides the following 3 financial strategy accounts:

- S&P500®️ Index Account

- Global Global Index Account

- Fixed Rate Account

The premiums we invest can be freely distributed among the three wealth management accounts according to different proportions.

In the screenshot of this annual statement for 2021/2022, the red line part indicates that the policyholder's premium funds are currently100%都stored inS&P500®️ Index Accountin.

(>>>Related reading:Evaluation|2022 Q1 Index Strategy Return and Insurance Brand Ranking )

(>>>Related reading:Popular science posts | What are the 4 most common investment and financial index accounts in US dollar insurance?)

2. What is the cap rate of return on the insurance?how to work?

The cap rate of return is called Cap Rate in English.It is the promise of the insurance company to give the highest rate of return to a financial sub-account.

In the past two years, due to the drastic fluctuations in the options market, most insurance companies have chosen to lower the cap rate of the S&P 500 index strategy account in the policy account to reduce costs.

Some life insurance brands that are common in the Chinese community have adjusted the annual cap rate in the past two or three years-through actual feedback from different policyholders, such asNational Life Insurance, and gradually lowered the cap rate of return on the S&P500 account from 12% to 9%;AIG InsuranceIt was reduced from 13% to 10%. (As of February 2022)

Policyholders will need to review your annual insurance bill, or contact your insurance company,Insurance broker.Life Insurance Financial Advisor, to learn about the changes in the cap interest rate of your policy benefit cap.

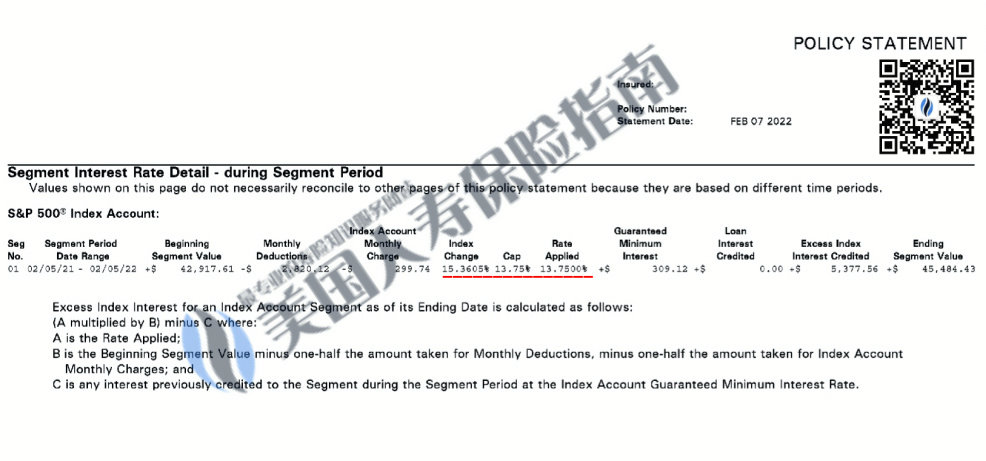

To illustrate how the capped rate of return on a dollar-insured account works,American Life Insurance Guide©️Used this copy of the policyholderannual statementThe account yield and interest rate section will be explained.

在投保人的這份年度保險賬戶對賬單中,我們可以看到,在2021年02月5日到2022年02月5日這一年期間,S&P500指數上漲了+ 15.3605 %.

在投保人的這份年度保險賬戶對賬單中,我們可以看到,在2021年02月5日到2022年02月5日這一年期間,S&P500指數上漲了+ 15.3605 %.

The cap rate (Cap) index of this insurance product is 13.75%. Therefore, the actual annual interest rate of the policy account is+13.75%.

The annual performance of this effective yield rate, exceedingPrediction Demonstration Scenario(Illustration), and comprehensively analyze the premium situation, the policy leverage is currently in a healthy state of operation.

Insurance Bill Evaluation Summary

through the pairStatement of Insurance Yearinstruction of,American Life Insurance Guide©️ explained to the public "Insurance Index Strategy Sub-Account"with"Insurance cap yield” concept and working principle.

USD Whole Life Insurance is a flexible and powerful financial leverage tool with a wide range of applications.But getting the best out of this tool and achieving our family's financial goals isn't a one-size-fits-all deal.It is inseparable from the long-term and continuous market control and data analysis of professional life insurance financial personnel.

American Life Insurance Guide©️ Since its inception, the LBYB principle has been proposed – "Learn Before You Buy".Study before you buycommon sense concept.

Also available on the American Life Insurance Guide community site ©️(TheLifeTank.com)Insurance College.Insurance Product Center.Insurance product evaluation.Insurance strategy guideA large number of special topics are available for investors and policyholders to refer to.American Life Insurance Guide©️ Will be appointed by the community in the futureHummingLifeCollaborate, review and share more policy account data.

Combined with various professional experience sharing, plus excellentLife Insurance Financial AdvisorWith professional assistance, we can rationally choose and make judgments based on the advantages and disadvantages and the actual situation of the family when applying for a US dollar insurance policy, so as to realize the use of US dollar life insurance, a powerful financial leverage, to achieve the ultimate financial goal of the family. (End of full text)

(>>>Recommended reading:Insurance Strategy|How to take the first step?4 common topics that insurance advisors must discuss)

(>>>Recommended reading:(Picture) What is the annual statement for dollar life insurance?What is the interest calculation of the annual policy income?)

(>>>Recommended reading:Buying a house 3 steps vs buying insurance 3 steps?What should I do if I suspect my insurance account will be terminated?)

About LifeTank©️ – LBYB

LBYB – Learn Before You Buy, is TheLifeTank.com – American Life Insurance Guide©️Proposed a guiding concept for individuals and families to configure financial insurance.In view of the extremely diversified financial instrument properties of American life insurance and annuity insurance, the application of these products in the field of wealth accumulation and inheritance has surpassed consumer insurance products that consumers can understand in the traditional sense.The lack of corresponding basic knowledge education and the impact of one-sided education may cause harm to your interests many years later.Before applying for an insurance policy, the American Life Insurance Guide©️ encourages consumers and investors to learn and understand the basic operating principles and functions of such financial products in advance, so as to obtain solutions that can truly protect their families and wealth.

*Cap Rate, the cap rate is not guaranteed, and the insurance company has the right to adjust the cap rate at any time.

*This article uses US dollar life policy year statements to educate the public about basic concepts and knowledge of life insurance and does not represent our endorsement of that particular insurance product.