(American Life Insurance Guide 12/02/2020 News) Wink, Inc., an American life insurance and annuity market analysis groupNon-securities "Cash Value Life Insurance"Sales report in the third quarter of 2020.From this report, we can learn thatWhich life insurance Americans are applying for and what are the main reasons for applying?.

Whole Life for end-of-life expense planning

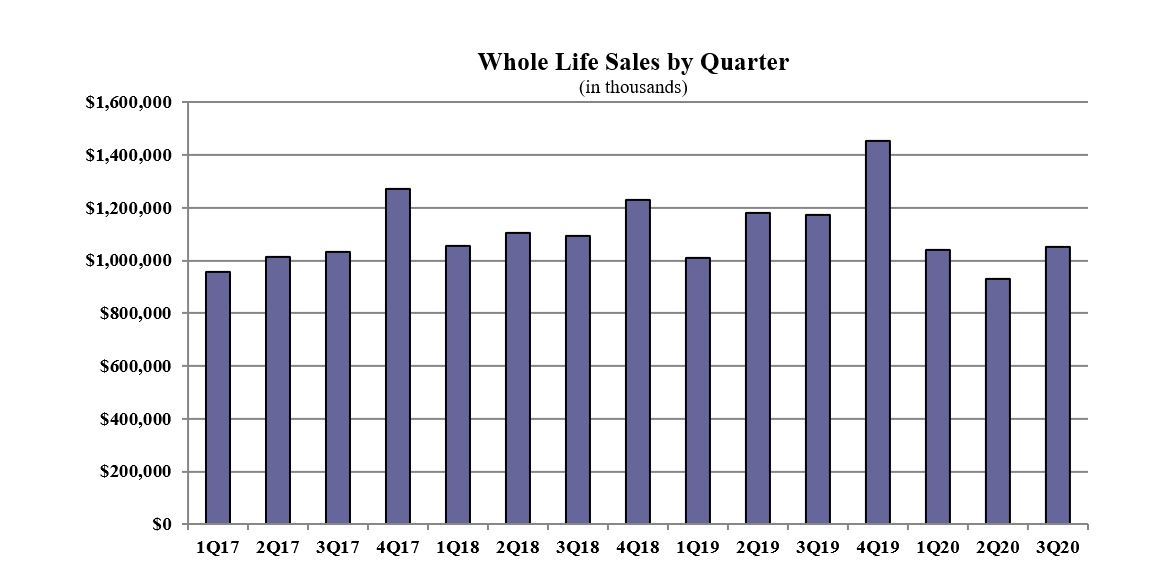

Savings Participating Life Insurance (WHOLE LIFE) In the 3rd quarterSales reached 10.5 billion U.S. dollars, An increase of 2% relative to the second quarter.

57.7% of policyholders purchase savings dividend products for the purpose of"End-of-Life Expenses / Estate Planning".In the third quarter of 2020,The average premium for savings and dividend insurance is $3,700.

Fixed UL, whose main force is to ensure continuous maintenance

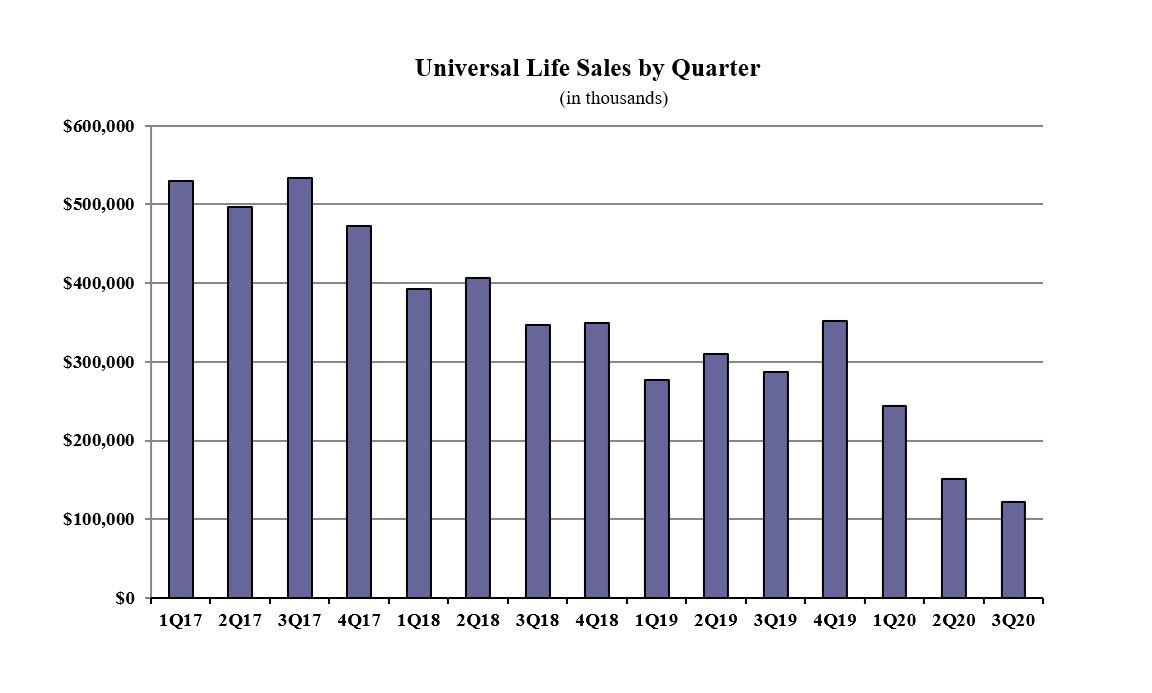

Fixed income comprehensive life insurance ( Fixed UL ) Sales in the third quarter were $1.2 million, a decrease of 19.4% from the previous quarter.

The main market demand for Fixed UL insurance types is Guaranteed continuous coverage/guaranteed claims type (GUL)Products, this type of products accounted for 54.3% of sales.

In the third quarter of 2020, each fixed-income insuranceThe average target premium is $5,066.

Indexed Life for cash value accumulation

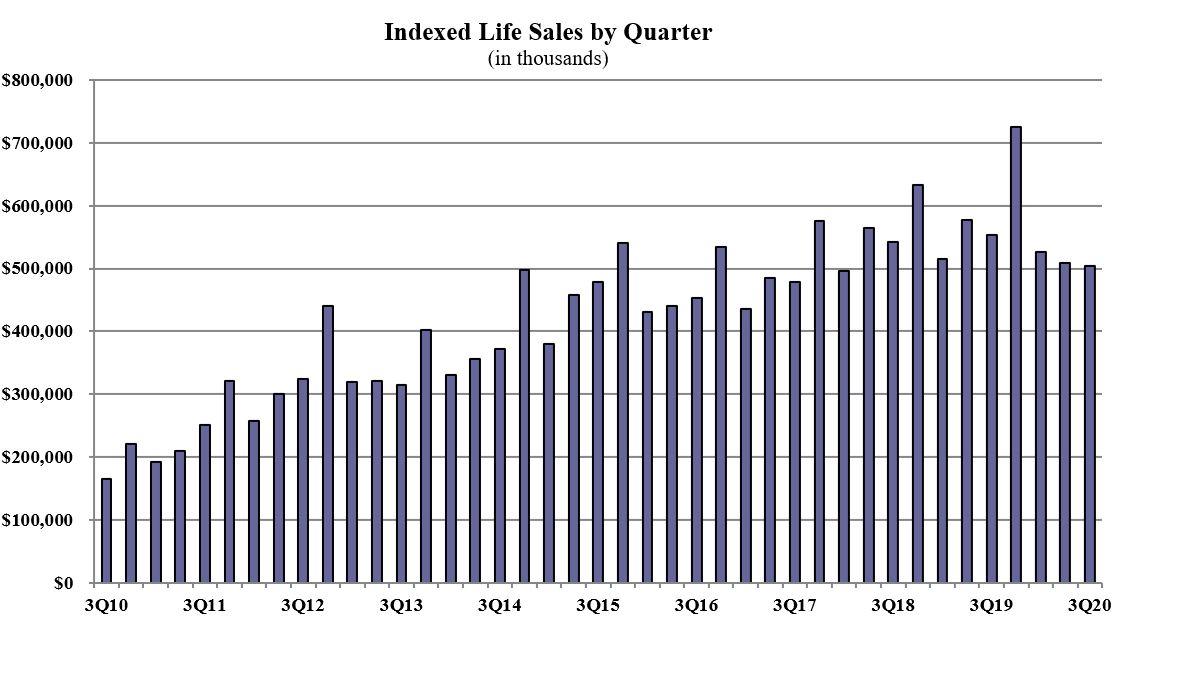

Sales of index insurance dropped by 1% from the previous month, and premium sales were approximately $5 million.The sales statistics includeIndex Universal Insurance(IUL) and Index Dividend Insurance (IWL).

In the index insurance market,National Life Insurance GroupOccupies a market share of 13.4%, ranking first.Pacific Life Insurance Company.American Life.Hengkang Life,as well asNational LifeRank 2 to 5 respectively.

- #1 National Life Group / National Life Review

- #2 Pacific Life Group / Pacific Life Review

- #3 Transamerica / American Life Review

- #4 John Hancock / Hengkang Life Review

- #5 Nationwide / National Life Review

Transamerica Transamerica LifePremier Financial Foundation IUL (FFIUL for short) is on the marketSales ranking #1 Of exponential products.

66.7% of policyholdersThe purpose of buying index products is to "Accumulation of cash value".In the third quarter of 2020, each exponential insuranceThe average target premium is $10,920.

(End of the article)

(End of the article)

20210528 update:

>>>Data|2020Q4 U.S. Index Life Insurance Company and Product Market Ranking Top 5

>>>Data| Wink®️ released the 2019Q4 American life insurance market ranking top 5

appendix

Wink, Inc. is the company behind the most comprehensive life insurance and annuity due-diligence tools, AnnuitySpecs and LifeSpecs at www.WinkIntel.com. Wink, Inc. is the distributor of the quarterly Wink’s Sales & Market Report. Serving as the insurance industry』s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. Wink’s Sales & Market Report expanded to cover all deferred annuity products in 2015, all deferred variable annuity products in 2019, and all non-variable cash value life insurance products in 2017.