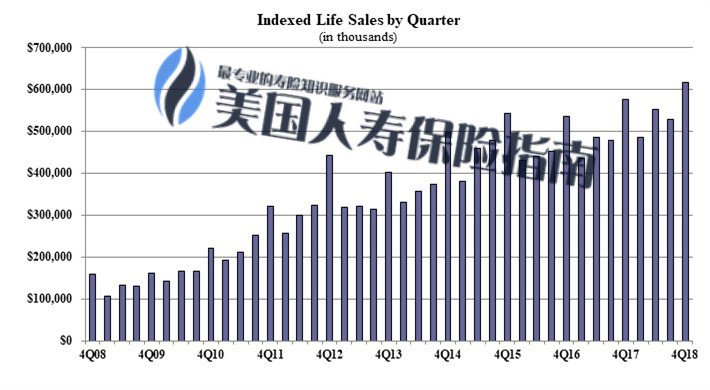

(American Life Insurance GuideNet News/CA) Wink®️ released the "U.S. Life Insurance Market Sales Report" in March 2019,Index insuranceSales reached a record high in 2018.

The report stated thatExponential life insurance在2018年第4季度的銷售額達到$6.174億美元,環比增長了16.8%,同比增長了7.2%。2018年指數型人壽保險險種的總體銷售額超過了$21億美元。

"In terms of the recent trends in the development of index life products, it is not surprising that the sales of index life policies ushered in a new quarterly history and a new year history." Wink, Inc CEO Sheryl J. Moore commented.

Wink®️, the industry leader in American insurance data analysis, has been included in its sales statistics report since the emergence of index insurance in 1997.The following is the report brief.

NON-VARIABLE UNIVERSAL LIFE, In 2018, Q4's overall sales exceeded $96.54 billion, an increase of 10.3% from the previous quarter and a decrease of 7.9% from the same period last year.

The sales of non-variable universal insurance for the full year of 2018 were $36 billion.Non-variable universal insurance, including index universal insurance IUL and fixed universal insurance UL.

Among all non-variable universal life insurance policy sales, Pacific Life Insurance Company (Pacific Life) Continued to maintain its No. 1 position, with a market share of 10.7%.

Index insurance INDEXED LIFE,在2018年第4季度的銷售額達到$6.174億美元,環比增長了16.8%,同比增長了7.2%。2018年指數型人壽保險險種的總體銷售額超過了$21億美元。

Index insurance INDEXED LIFE,在2018年第4季度的銷售額達到$6.174億美元,環比增長了16.8%,同比增長了7.2%。2018年指數型人壽保險險種的總體銷售額超過了$21億美元。

U.S. Insurance Company RankingSituation: In the index insurance market, Pacific Life (Pacific Life) Occupies 16.4% of the market share, occupying the first position.National Life(National Life Group)withPan American Life(Transamerica) Ranked 2nd and 3rd respectively.The No. 4 insurance company asked Wink to remain anonymous. Nationwide followed closely behind, ranking fifth.

Pacific Life Insurance Company's Pacific Discovery Xelerator IUL index insurance, among all non-variable universal life insurance policy products, maintained the No. 6 sales in six quarters.

Index insuranceThe primary positioning goal in 2018Q4 is: cash value accumulation, which contributes 75.9% of sales in total under this goal.

In Q2018 of 4, the average target premium for index insurance was $9,781, an increase of 9.0% from the previous quarter.

Universal Insurance FIXED UL Universal insurance在2018年Q4的銷售額是$3.491億美元,同比下降了26.5%,但環比增長了0.5%。

Universal Insurance FIXED UL Universal insurance在2018年Q4的銷售額是$3.491億美元,同比下降了26.5%,但環比增長了0.5%。

Fixed universal insurance’s primary positioning goal in the fourth quarter is to "guarantee continuous insurance (No Lapse Guarantee)”, contributing 66.8% of sales under this target.

Universal Insurance UL’s average target premium for this quarter was $5,443, a decrease of 5.0% from the previous quarter.

The annual sales of fixed universal insurance in 2018 were $14 billion.

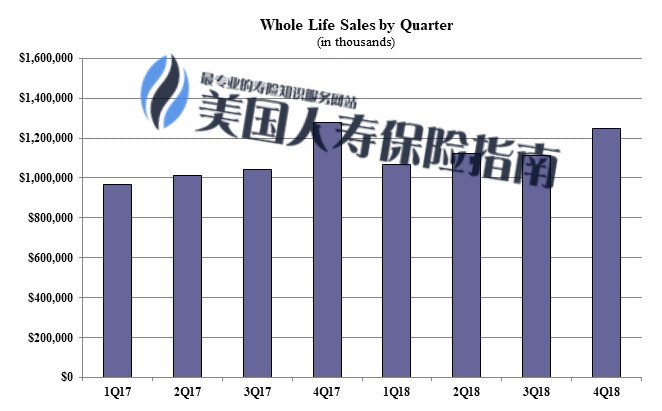

Participating Whole Life Insurance WHOLE LIFE Sales in the fourth quarter were $4 billion, an increase of 12% from the previous quarter and a decrease of 12% from the same period last year.Participating whole life insurance typesThe annual sales volume is $45 billion.For the participating whole life life insurance market, the primary pricing target is: cash value accumulation, which accounts for 72.8% of sales.

Participating Whole Life Insurance WHOLE LIFE Sales in the fourth quarter were $4 billion, an increase of 12% from the previous quarter and a decrease of 12% from the same period last year.Participating whole life insurance typesThe annual sales volume is $45 billion.For the participating whole life life insurance market, the primary pricing target is: cash value accumulation, which accounts for 72.8% of sales.

Participating Whole Life Insurance WHOLE LIFE In the fourth quarter of 2018, the average annual premium was $4, a decrease of 3,714% from the previous quarter.

Term Life Insurance Term The market performance for the whole year of 2018 will be announced in the next quarterly report, and reporters from American Life Insurance Guide will continue to follow up the report.At the same time, American Life Insurance Guide will update insurGuru©️ based on recent market reports.2019 insurance company ranking.

(American Life Insurance Guide Los Angeles group report)

Recommended reading:Introduction and comparison of advantages and disadvantages of American life insurance