In the case shared by insurGuru™️ Insurance Academy today, we will use two different solutions for 45-year-old Mr. Wang to plan to supplement retirement pension income, and show how much their expected income will differ.

At last,American Life Insurance GuideNet©️ will point out that comparing these twoRetirement planningOne point that the public often overlooks when making plans:When it comes to retirement, the differences and advantages and disadvantages of withdrawing money from the policy account and the securities account respectively.

15-year retirement planning: savings insurance account VS securities account

Mr. Wang, 45 years old this year, does not smoke or drink, and is in good health.Starting from the age of 45, Mr. Wang plans to save a sum of money every year to manage his finances and use it as an old-age retirement income.In the highly developed American financial market, Mr. Wang has many choices, such as buyingIndex annuity, Invest in stocks and securities, open an IRA account, configure a life insurance account, and so on.

In this article of American Life Insurance Guide Network©️, we will compare and use personal securities accounts to doSupplementary retirement income planningCircumstance, and use a 15-year paymentSavings and Dividend InsuranceTo do supplementary retirement income planning.

- Securities account, lifetime annual income 6.00%, tax rate 39%.

- Savings Participating Life Insurance Account

Personal retirement wealth management account

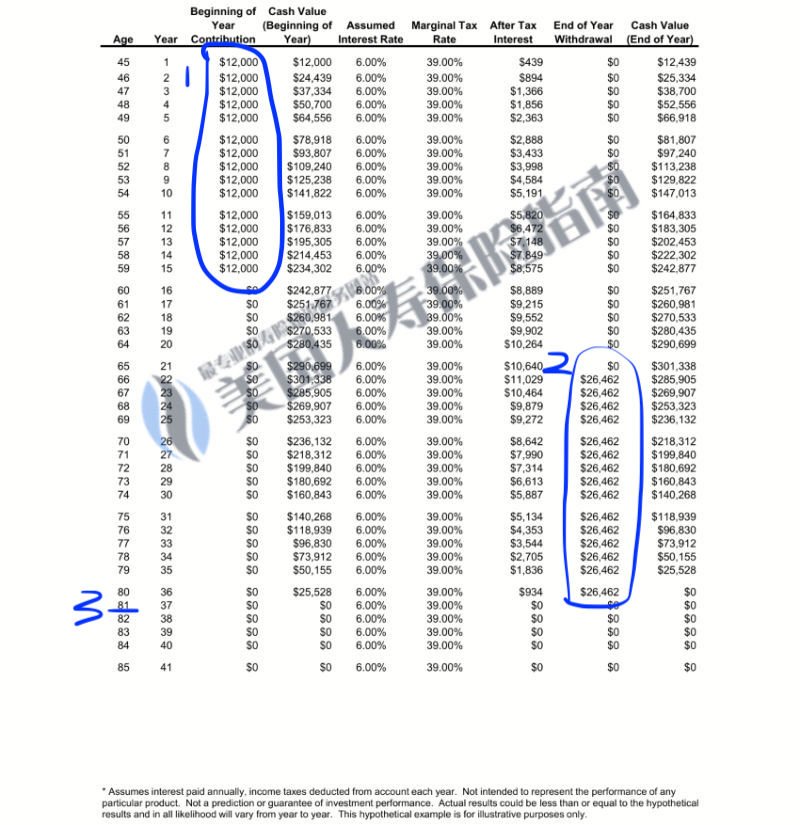

The picture above shows the operation of Mr. Wang's investment and wealth management account.In District 1, Mr. Wang spends $12,000 in investment and financial management every year, calculated based on 6% of the annual income, compound interest rolling.

The second area shows that when 2 years old meets the official retirement age, Mr. Wang starts to withdraw money from this investment account. If he has withdrawn continuously for 65 years, he can withdraw $15 per year.

After the age of 81, the funds in the financial account were exhausted.

Savings policy account to supplement retirement income

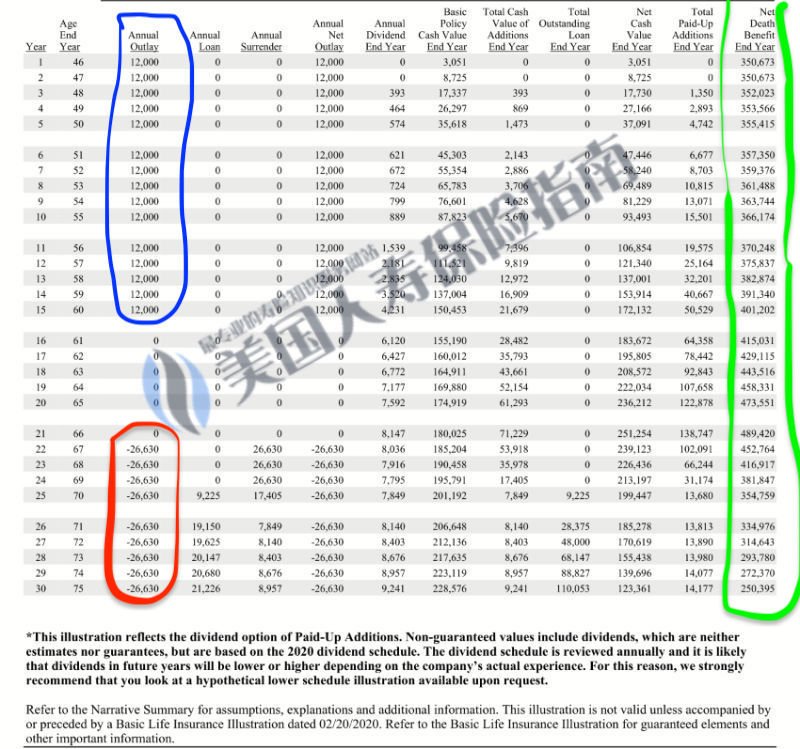

The picture above shows what Mr. Wang uses to supplement his retirement incomeSavings dividend typeThe operation of the policy account.

The picture above shows what Mr. Wang uses to supplement his retirement incomeSavings dividend typeThe operation of the policy account.In the blue area, Mr. Wang also puts $12,000 as a "premium" every year and deposits it into this policy account to accumulate and increase cash value by compound interest.

The green area shows the amount of insurance claims that will be received for each year after the policy account takes effect.We can see that the claim amount for the first year of the policy is $350,673, and by the age of 65, it has grown to $473,551.

The red area shows that when he was 65 years old, Mr. WangWithdrawal of retirement pensionIf you withdraw the money for 15 consecutive years, you will be able to withdraw $26,630 per year.

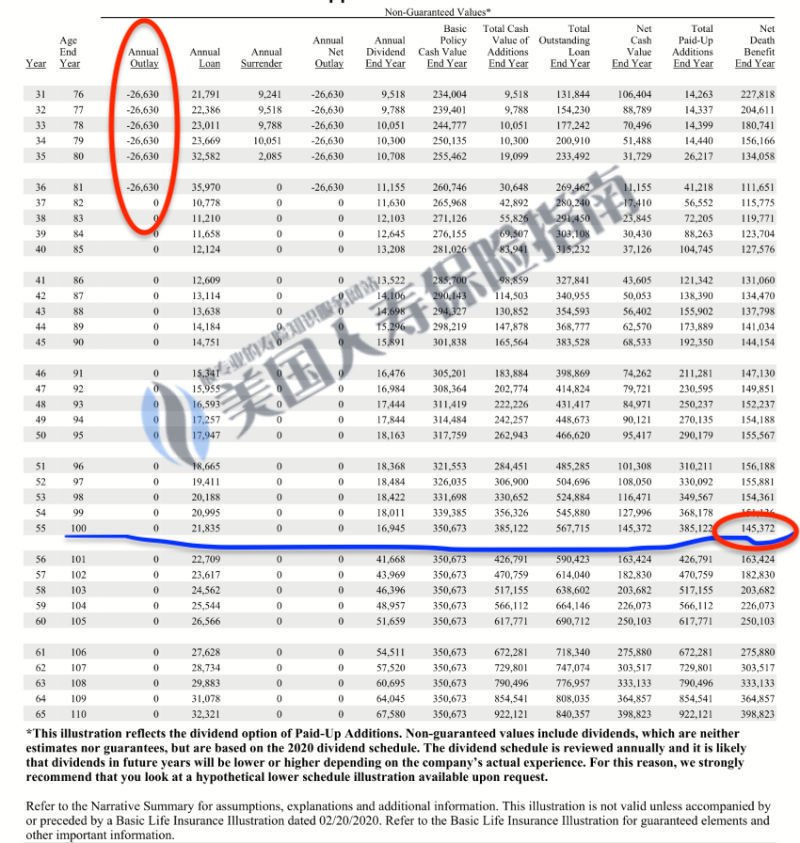

In this picture, it shows the savings and dividend policy accounts from 76 to 110 years old.

The large red area shows that Mr. Wang continues to withdraw $26,630 in retirement income from the policy account.Such withdrawals ceased until the age of 81.At this time, at the age of 81, the policy is still valid, and the amount of the claim at the age of 85 is still US$111,651.

The blue horizontal line shows that at the age of 100, if Mr. Wang passed away unfortunately, he would still receive a claim of $145,372 from the insurance company.

Comparison of two retirement income plans

At first glance, the annual withdrawal indicator for securities and stock accounts is $26,462, and the annual withdrawal indicator for savings policy accounts is $26,630, twoTheoretical dataIt looks almost the same.But arrivedreal lifeWhen facing various unknowns in life, the gap between the advantages and disadvantages of the two is quite huge.

1. Comparison of additional leverage and benefits

When we deposit money into the investment and wealth management account for retirement, the funds will fluctuate with the selected investment products and future market trends, and no other benefits or leverage will be generated.

After depositing money into the life insurance account for retirement, from the first day the account becomes effective, you will receive a death compensation of $350,000, which is a comparative leverage.1: 29.

2. Comparison of protection in case of accidental death

During the 10 years of the accumulation and growth period of funds, if we pass away unfortunately, our family will get back the money we invested in the stock investment account that we originally planned to use for retirement.

If life insurance is used, our family will getAround $35OfTax-free death compensation, Used to make up for family expenses, such as mortgages, children’s tuition, family living expenses, etc.

There is a huge gap in the amount of withdrawal between the two methods.Take the eighth year as an example, the family can get back $8 from the investment account and $108,649 from the insurance company.The latter is more than three times that of the former,The difference is more than $20.

3. Comparison of benefits in the case of disability

In the event of accidental disability, the “premium exemption” attached to the life insurance policyadditional termsThe policyholder’s fee will be exempted, and the insurance company will help the policyholder continue to deposit premiums into the policy account, and the accumulation of cash value in the policy account will not be interrupted.

After we accidentally become disabled, we may lose our job and cannot guarantee our original income. At the same time, we need to maintain living expenses. The family's income is a net outflow.At this time, we may not be able to spend $12,000 per year and continue to invest in the stock investment account forRetirement incomePlanning will be interrupted.

Article summary

"Save money for retirement, buy stocks, or buy insurance" is a problem, but not a problem.

Saying it is a problem because we always want to find the best storage channel for our money; saying it is not a problem, is based on two points, one is the unpredictability of the future, we are probably for the unknown. Add troubles; the second is that the two do not conflict with each other.Securities investment and insurance financial management are two of the many financial management methods at different stages of life and different risk tolerance. Both of these need to be combined with our own actual situation to comprehensively use.

AndAmerican Life Insurance Guide©️ believes that in the case of our ability, a reasonable allocation of enough tools and means in hand can better protect the accumulation of family wealth in the face of the unknown in the future. (Finish)

>>>Recommended reading:Ace to Ace Evaluation!Savings dividend policy VS index policy

>>>Recommended reading:[Case Studies] How to plan and realize the annual tax rebate income of 13 yuan?

Your rating?Please click the star to rate

[Total votes: 4 The average score: 5]