For policyholders entering the retirement age, the first thing that needs to be solved is not the question of how much money to leave for their children, but how to take care of themselves so that they can be treated for their old age and illnesses.It will not add more "burden" to family members and children because of chronic illness and the need for long-term care.

First solve the problems that you are about to face, take care of your own needs, and then consider the problem of leaving money for your children.This is a more pragmatic and responsible performance.

therefore,Long-term care insuranceIt is the focus of consideration for the retired family.

How to pay for long-term care insurance?

Long-term care insurance, Also calledLong-term care insurance, English name: Long Term Care, abbreviated as LTC.

Various diseases and accidents may damage our physical skills, thenHow does long-term care insurance settle claims?

In order to regulate claims, the U.S. insurance industry regulates 6 basic human physiological functions:

- eat

- dressing

- Bathing

- Go to the toilet

- action

- Urine Control

If two of these six basic functions cannot be completed independently, you may claim against the insurance company.

For most commercial life insurance companies, If the doctor diagnoses itAt least 2 functions are impaired——To put it simply, you can’t take care of yourself, you need to ask someone to take care of you at home, or live in a nursing center, including the private nursing homes, retirement communities, and adult daycares mentioned below — then the insurance company will Perform verification and claim settlement.

When comparing claims conditions, inAmerican Life Insurance GuideIn previous reports,Mandatory long-term care insurance operated by the Washington state government, Need to meetAt least 3 functions are impaired,In order to settle claims to the government.

In general,Look at the result, not the reason.It is the biggest advantage of long-term care insurance claims in the United States.

(>>>Recommended reading:Effective in 2022, Washington State has introduced universal long-term care insurance. Is it a benefit or a tax increase in disguise?)

Long-term care insurance case

56 years old, Ms. Li, green card, because considering the gradual increase in age, she did not want to cause trouble for her children in the future, so she decided to insure her long-term care insurance and use a premium of $10 to solve her old-age care and medical problems.

Need to return or exchange premiums at any time

Buy traditionLong-term care insuranceOf policyholders, one of the concerns is,If we are safe and secure for the rest of our lives and no claims have been settled, will the long-term care insurance premiums be paid in vain?

In order to solve this problem, some life insurance companies have introduced Hybrid long-term care insurance with "premium refund at any time".

For Ms. Li, although she paid a one-time payment of $10 to the insurance company, if this long-term care insurance is provided, "Immediately refund the premium”Function, then she can get back the $10 at any time.

Death compensation required

Another issue that long-term care insurance policyholders are concerned about is:What if you unfortunately died unexpectedly (such as a car accident, Covid-19, etc.) soon after purchasing the insurance and did not use long-term care insurance?

In this case, the policyholder can buyWith death compensationLong-term care insurance.If unfortunately dies during the coverage period, the insurance company will also need to pay a large amount of death compensation.

How much will Ms. Li's insurance amount?

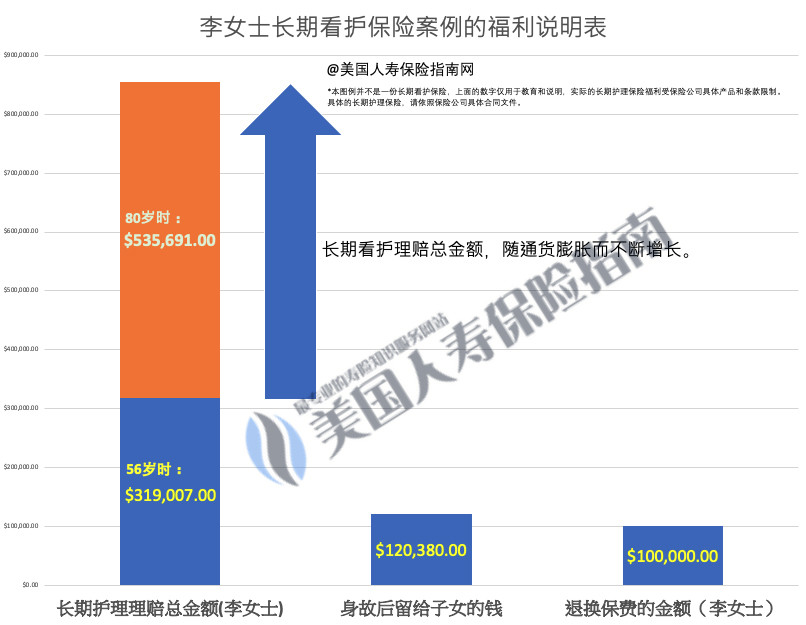

According to Ms. Li's situation, after considering the above two factors, we can roughly calculate the benefits that Ms. Li can get by comparing different insurance companies, different long-term care insurance products, and selecting the inflation index. ,As shown below:

When Ms. Li was insured at the age of 56, if she had two living functions and was unable to take care of herself, the insurance company would need to pay Ms. Li a claim of about $5,000 each month, up to a maximum of 5 consecutive years.The total amount of accumulated long-term care claims is approximately $32.

For example, Ms. Li is very healthy. When she was 80 years old,The total claim amount will rise to around $53, If you start claims after the 80s, the monthly claims for long-term care will be between $8 and $9.

During Ms. Li’s insured period, if there is no claim settlement and she continues to spend money suddenly, it’s okay.Surrender at any time.Get back the premium of 10 U.S. dollars.

As for the expenses in the following situations, claims can be made immediately:

- Family health and community health services

- Coordinated care

- Nursing training

- Home renovation nursing facility

- Purchase nursing medical equipment

- Adult Day Care Center

- Short-term care center

To insureLong-term care insuranceFor more understanding, please move to:

https://thelifetank.com/howto-buy-ltc-1