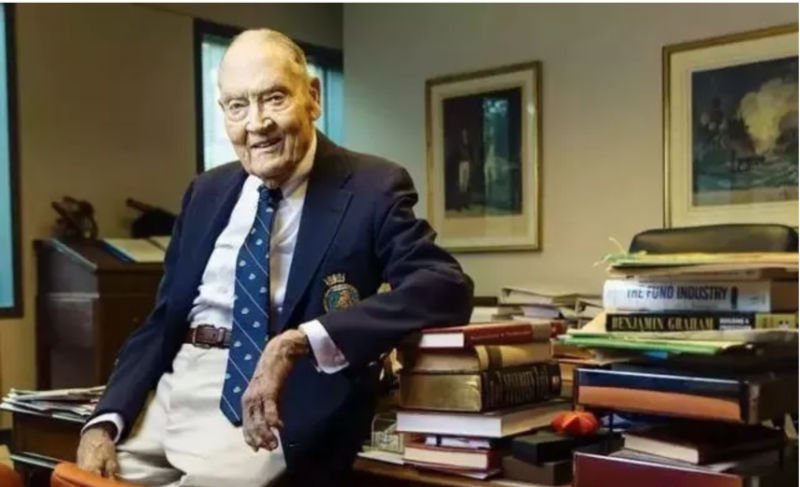

John C. Bogle, founder of Vanguard and godfather of index funds, passed away on January 2019, 1 at the age of 16.

John C. Bogle, founder of Vanguard and godfather of index funds, passed away on January 2019, 1 at the age of 16.

Berg is the founder of the world's first index mutual fund, and his Vanguard Group currently manages more than $5.1 trillion in assets.He is considered one of the greatest investors in the world.His index mutual funds enable investors to obtain high returns at a lower cost than actively managed funds.

In 1975, he founded the world's largest mutual fund Pioneer Group, and later served as chairman and CEO until 1996.Vanguard now manages assets for more than 170 million investors in approximately 2000 countries.

He has written 13 books on investing, the most recent one is "Keep It Up: The Story of Pioneers and the Exponential Revolution" in 2018 (Stay the Course: The Story of Vanguard and the Index Revolution).

American billionaire investor Warren Buffett, known as the "stock god", wrote in his annual letter to shareholders in March 2017: "If you want to erect a statue to commemorate the person who made the greatest contribution to American investors, then Jack Berg should undoubtedly be chosen.Jack was often ridiculed by the investment management industry in his early years.However, today, he is satisfied to know that he has helped millions of investors and their savings have received far better returns than they could have earned.He is their hero and my hero."

"For decades, Jack has been urging investors to invest in ultra-low-cost index funds. During his investment career, a lot of wealth has flowed into the pockets of managers, and his accumulated wealth only accounts for a small part of it."

Jack Berg’s personal worth is estimated to be only US$8000 million. He has a history of heart disease. He suffered from a heart attack at the age of 31. He suffered a total of six attacks. At the age of 65, he received a heart transplant.

Bogle's main philosophy is "common sense" investing.In fact, he has two books that use this word in their titles.

He said in an interview with Reuters in 2012: "Invest as efficiently as possible, using low-cost funds that can be purchased and held for a lifetime.Don’t chase past performance. Instead, buy broad stock indexes and bond index funds. Your bond ratio is roughly equivalent to your age.Most importantly, you must abide by discipline and save, even if you hate our current financial system.Because if you don't save money, you will definitely have nothing."

Today, let us review the godfather of index funds John Bogle and his great life.

Today, let us review the godfather of index funds John Bogle and his great life.

Early life and education

John Bogle was born on May 1929, 5 in New Jersey, USA.

His family was affected by the Great Depression.Without money, he had to sell their house. His father fell into alcoholism, which caused his parents to divorce.

Bogle attends Manasquan High School on the coast of New Jersey.His academic performance enabled him to transfer to Blair College for a scholarship.

At Blair College, Bogle showed a special talent for mathematics, numbers and calculations fascinated him. In 1947, Bogle graduated with honors from Blair College and was admitted to Princeton University, where he studied economics and investment.

In 1949, at Princeton University, Bogle accidentally read an article about the mutual fund industry-"Big Money in Boston", which aroused his interest in the fund industry and decided to study the mutual fund industry that had not been analyzed before.Bogle spent his junior and senior years writing his thesis "The Economic Role of Investment Companies."

He received his undergraduate degree in 1951 and attended evening and weekend courses at the University of Pennsylvania.

Bogle and its index funds

After graduating from Princeton University in 1951, Bogle began his career in banking and investment.He was employed by the company's founder, Walter L. Morgan, to manage the Wellington Fund.Morgan said, "Bogle knows more about the fund business than we do."

In 1965, Morgan transferred the company's management to Bogle and appointed him as executive vice president.After a successful promotion, he was appointed chairman of Wellington, but was later dismissed due to a corporate dispute on January 1974, 1.

On May 1975, 5, Bogle founded Vanguard, which is now one of the most respected and successful companies in the investment field.Bogle successfully turned Vanguard into a huge company.

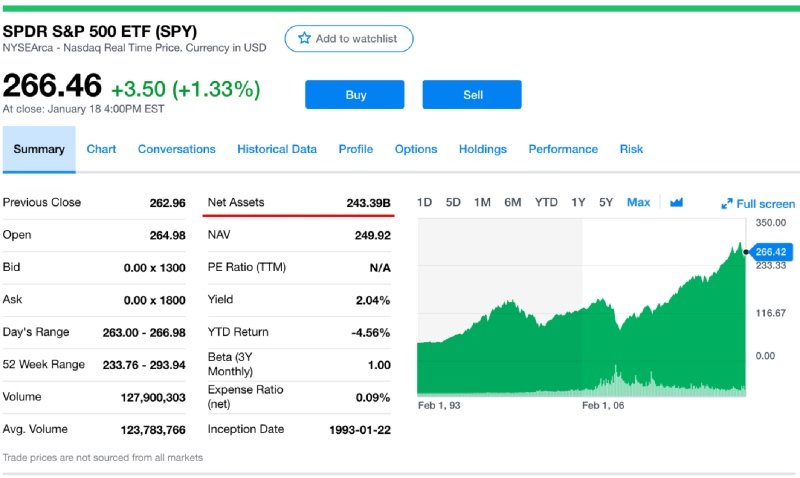

In August 1976, Bogle launched the Standard & Poor's 8 Index Fund, the world's first index fund launched to individual investors. The current scale exceeds $500 billion and is one of the world's largest public funds.

From 1976 to 1995, after 20 years of development, the US market index funds accounted for only 3% of the public fund market share;

In the 1995 years from 2018 to 20, the market share of index funds in the U.S. public fund market has increased significantly to 38%. If Vanguard did not have the loneliness of the first two decades, it would not have succeeded in the next two decades.

In the 90s, Bogle suffered from a heart attack. In 1996, he stepped down as the CEO of Pioneer.

A heart transplant was successfully performed in 1996.He then returned to Vanguard as the senior chairman.

In 2012, Linghang Group's total assets under management reached US$2 trillion.

In 2000, he stepped down as the senior president of the Vanguard Group. Nowadays, he still supports many organizations, such as the National Constitution Center in Philadelphia, and the establishment of the "Bogle Brothers Scholarships" at his alma mater Princeton University.

At present, the group has become one of the largest investment management companies in the world. The scale of assets under management has grown from USD 20 billion at the time of establishment to over USD 5.3 trillion at present.

At the same time, it is the world's largest public fund and the second largest institutional investor in asset management.At the same time, through RQFII and Shanghai-Shenzhen-Hong Kong Stock Connect investment channels, Vanguard Group has a capital quota of about RMB 300 billion to invest in China A shares, holding more than 1900 companies, and is also one of the large foreign institutions investing in the Chinese market.

The founder, Bogle, is not as rich as other mutual fund giants. He gave up group ownership and chose to let investors become shareholders of Vanguard Fund.If John Bogle had not given up his ownership, he should now be the top three rich men in the world.He has stated that his own wealth is mainly wages in the mutual funds of Vanguard and Wellington.

John Bogle Investment Rules and Experience

1. You must have realistic investment expectations, such as a dull bagel, and speculation like a sweet doughnut.

2. Don't look for needles in the haystack, you should buy the entire haystack. (Instead of picking stocks, it is better to invest in index funds)

3. The theory that investors should enter or exit the market when a certain signal is sent is not credible.For nearly 50 years in the investment industry, I have never seen anyone who can achieve consistent and precise timing.

4. Time is your friend, impulse is your enemy.

5. Carefully consider suggestions for increasing costs.

6. Don't overestimate the past performance of the fund.

7. Time is your friend, impulse is your enemy.

8. Study every day, especially from the experiences of others.This is cheaper!

9. Index funds are a wise and usable method that can effortlessly obtain market rates of return at the lowest cost.Index funds eliminate the risks of individual stocks, markets, and manager selection, leaving only stock market risks.

10. Speculation that short-term market timing is a loser's game, we don't know what will happen tomorrow, Bogle doesn't know, no one knows.So I only make reasonable forecasts for 10 years, and do not make other forecasts.

Four investment principles: goal-balance-cost-discipline

XNUMX. Goal:Set clear and appropriate investment goals. The appropriate investment goals should be measurable and achievable.Success should not depend on large investment returns or unrealistic savings or spending requirements.Clearly defining goals and ways to achieve them can help protect investors.

XNUMX. Balance:Using a wide range of diversified funds to develop appropriate asset allocation and reasonable investment strategies begins with asset allocation that suits the objectives of the investment portfolio.Allocation should be based on reasonable expectations of risks and returns, and diversified investments should be used to avoid unnecessary risks.Asset allocation and diversification are derived from the concept of balance.Since all investments involve risks, investors must manage the balance between risk and potential returns by choosing an investment portfolio.

XNUMX. Cost:Minimizing costs is unpredictable in the market.Cost is eternal, the lower the cost, the greater the share of return on investment.Research shows that low-cost investments are often better than high-cost alternatives.In order to maintain more returns, manage tax efficiency.You cannot control the market, but you can control costs and taxes.

XNUMX. Discipline:Maintaining a perspective and investing in long-term discipline can trigger strong emotions.In the face of market turmoil, some investors may find themselves making impulsive decisions, or unable to implement investment strategies or rebalance their portfolios as needed.Discipline and perspective can help them stay committed to long-term investment plans in times of market uncertainty.

Buffett: What Bogle did for American investorsMore than anyone

Bogle is the hero of Buffett's letter.Buffett has repeatedly recommended Borg's books and recommended investors to buy the S&P 500 index fund of Vanguard Pioneer.In 2008 Buffett and Ted Seides (Ted Seides) of Protege Partners entered into a "500-year bet", Buffett bet on Vanguard's S&P XNUMX index fund, which ultimately won a big win.

At Berkshire’s 2017nd Annual Meeting in Omaha, Nebraska on May 5, 6, Pioneer founder John Bogle “may do more for American investors than anyone in the country. There are many.” (Bogle has probably done more for the American investor than any man in the country.)

Buffett said, “The development of index funds is not in the interest of Wall Street because it drastically reduces fees. When Jack started, very few people, of course Wall Street did not applaud him. He is the subject of some ridicule. Now, when we enter When index funds, we are talking about trillions of dollars."

Buffett said, “The development of index funds is not in the interest of Wall Street because it drastically reduces fees. When Jack started, very few people, of course Wall Street did not applaud him. He is the subject of some ridicule. Now, when we enter When index funds, we are talking about trillions of dollars."

"Jack has at least saved it. In the pockets of investors, he has put tens, tens and tens of billions of money in their pockets!"

(End of the article)