Looking at the living habits and daily expenses of Americans, you will find that in addition to the poor are easy to "moonlight people", the rich people in the United States pay attention to pension and financial management, and invest a lot of money in pensions and insurance.

Americans like to buy insurance so much, what kind of insurance do they usually buy?

In addition to ordinaryConsumer insurance: auto insurance, housing insurance, medical insuranceIn addition, accounting for U.S. household expenditureThe largest proportion is life insurance.In the United States, life insurance is mainly divided into five types, according to the order of product launch:Term (term life insurance), Whole Life (life insurance), Universal Life (universal insurance), Variable Universal Life (investment universal insurance), Indexed Universal Life (indexed universal insurance).

1. Term Life

1. Term Life

The earliest and simplest type of insurance.As the name suggests, this type of insurance only covers a certain period of time, such as 10 years, 15 years, 20 years, and 30 years.If the insured passes away within the validity period, the insurance company pays the amount of insurance.If there is no death, the premiums paid before will be "failed."This is just a pure insurance,There is no cash value, just for peace of mind and peace of mind.

Advantage:cheap price.

Disadvantage:There is no cash value, no savings and investment functions.Moreover, after the insurance contract expires, as the insured ages, it will become very expensive to buy insurance anymore.

Suitable for the crowd:This type of product is most suitable for people who need short-term protection and a relatively limited budget.

2. Whole Life

This is the most traditional insurance in the United States.Obviously, that is the validity period of the insurance until the death of the insured.After you pay the fixed insurance cost, the remaining part of the premium you paid is converted into a cash value.Insurance companies will regularly distribute dividends based on the company's profitability, but the payment and amount of dividends are not guaranteed.The cash value of this type of insurance is in the policyHas tax deferment functionAs time goes by, the cash value in the insurance will increase.If the insured wants to cancel the insurance in advance, he will only get back a part of the cash value.

Advantage:Dividends are distributed regularly.

Disadvantage:The dividend payment standard is not transparent. Judging from historical data,The dividend return rate will not be very high;Cash value is difficult to use before death,The loan interest rate for the cash value of the policy is 4%-6% per year; the premium is the highest among all insurance products.

Suitable for the crowd:People who are unwilling to take any risks and will not use the money out of insurance.

3. Universal Life

Universal insurance, similar to whole life insurance, is guaranteed for life.After paying the insurance cost, the premium will be invested in a separate account.The difference between the two is that the universal insurance regulations are more flexible, and the policy owner can pay at any time, the cost can be more or less, but the minimum payment level must be reached.It also has a cash value, that is, fees and profits paid minus insurance fees and charges.The income of universal insurance is generally linked to the interest rate market. In the current low interest rate environment, the return on investment of universal life insurance is generally too low. This also makes policyholders need to invest higher premiums to pay for insurance costs in order to maintain insurance. Effectiveness.It belongs to the same as whole life insuranceConservative products, The rate of return is not particularly high.

Advantage:Flexible payment methods.

Disadvantage:The rate of return was mediocre.

Suitable for the crowd:Conservative investors who want to pay flexibly.

4. Investment universal insurance (Variable Universal Life)

Investment-oriented universal insurance evolved from universal life insurance. The key difference is that customers can choose to invest in different funds within the scope of funds provided by insurance companies to obtain corresponding investment returns. There is no cap, and the income does not need to be taxed. .

But at the same time, there is no guarantee. If the cash account loses too much in the financial market, then the insured may need to add more cash to maintain the effectiveness of the insurance.Therefore, the product here requires a relatively high level of investment from the client/broker.

Advantage:Have the above advantages of universal insurance; potential high rate of return.

Disadvantage:It is possible that the fund will suffer a serious loss; failure to guarantee the bottom may lead to the loss of principal and the need to pay premiums.

Suitable for the crowd:Investors who are familiar with financial markets, seek tax avoidance investment tools, and can bear market risks

5. Index Universal Life

This type of insurance is also covered byUniversal life insurance evolved, Average returnLinked to the trend of the US Standard & Poor's 500 Index (S&P500).There are also two other major US indexes: Dow Jones and Nasdaq, global indexes: Hong Kong Hang Seng Index or Europe 50 Index.

Compared with investment universal insurance, there is a risk of loss of principal. This type of insuranceEven if the index drops, the cash value of the policy will not suffer any loss.According to data, the average annualized income of S&P in the past 20 years is 8%-9%.Simultaneous Index Universal InsuranceThe annual rate of return is capped, Depending on the product design of different companies, usuallyProbably capped at about 11%.Relatively speaking, this level of return is better than the 3% to 4% return of only investing in bond market insurance products.

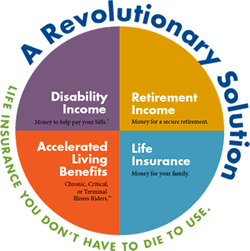

In addition to the same function of avoiding capital gains tax and inheritance tax, customers can also borrow money from the cash value at any time, up to 90% of the cash value, almost zero interest rate, and no tax is also required.Therefore, it can not only provide protection to the family in the event of an accident, but also can be used as an investment account, which can be withdrawn when the children go to college, retire or even make large purchases in peacetime.

Advantage:It has the above advantages of universal insurance; global indexes are all public information, so index returns are based and transparent; a special design with lower guarantees and upper caps, annual guarantees, lock-in profits, tax-free, tax-free and compound interest increases.

Disadvantage:The rate of return has a capped limit.

Suitable for the crowd: People who want to use the cash value in insurance while alive

In fact, the above 5 types of insuranceThere is no absolute good or bad, Each type of insurance has its own characteristics, you canChoose according to your own situation and needsSuitable products.

This article is from the Internet, edited and published by this site.