(American Life Insurance Guide 05/15/2024) Are you like other Americans who feel uneasy about preparing for retirement in 2024?

The latest research report* released by Northwestern Mutual in 2024 states that,On the one hand, Americans’ “ideal numbers” for retirement are growing much faster than inflation, rising by 15% in just one year and an astonishing 2020% since 53; on the other hand, with the general trend of rising prices, The cost of living continues to increase, and per capita retirement savings have dropped to $8.8.

Between now and 2027, 11,000 Americans will turn 65 every day,But only half feel they are in a financial position to retire comfortably.

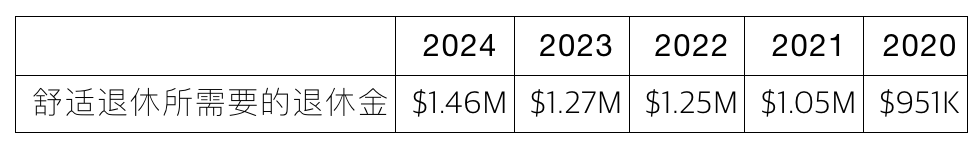

New target for 2024: 146 million pension

This new 2024 research report shows that Americans believe that,In order to enjoy a comfortable and decent retirement life, it is necessary to prepare a pension of about US$146 million today, and this figure will still be US$2023 million in 127.

As you can see from the chart above, over a 5-year period, the target pension figure has increased from$951,000 , soared to $1,460,000, an astonishing 53% increase.

Although US$146 million seems like a high figure, it is based on a rational assessment of the current price increase trend and future market expectations. In the long term, this number is likely to continue to rise as the cost of living continues to increase.

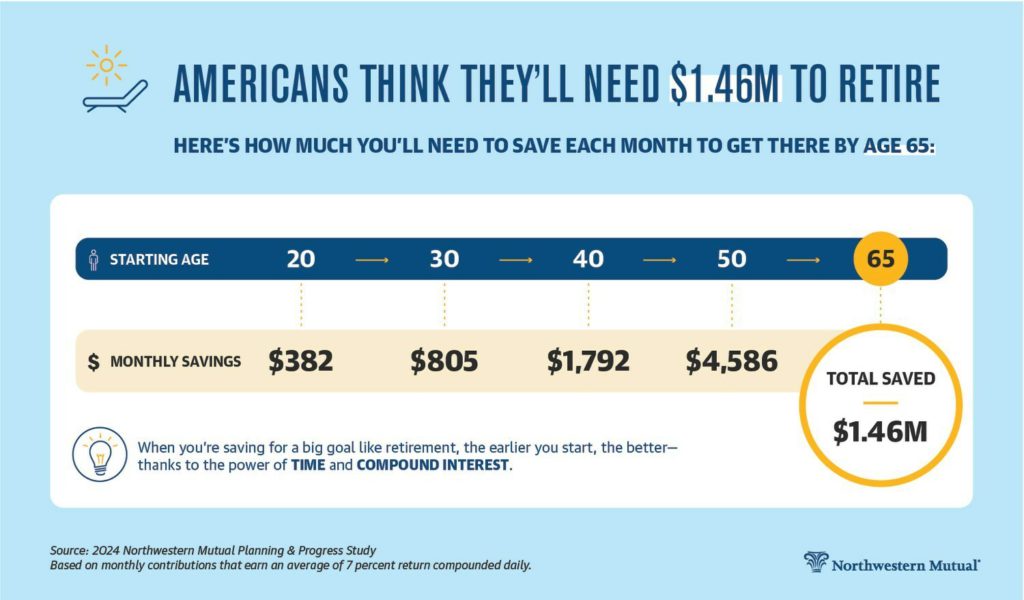

How much pension do you need to save every month?

No matter you are 20 years old, 30 years old, or 50 years old, how much money do you need to save every month to achieve your retirement goal of $146 million? The figure below gives a reference answer.

The report data points out that20-year-old saves $382 a month for retirement, it is expected that a pension of $65 million will be accumulated by the age of 146.

A family of about 40 years old,You need to save $1,792 every month.After 25 years, a pension of $146 million will be accumulated.

50 year old family,You need to save $4,586 every month.

Therefore, plan and start saving for retirement as early as possible. "Time" and "compound interest" will help us achieve our retirement goals effectively.

The dilemma facing retirement savings

On an individual level, retirement funding needs will vary based on a variety of factors including an individual's lifestyle, health, and life expectancy. For example, those who wish to continue to enjoy a higher quality of life after retirement may need more savings to support their retirement. Meanwhile, uncertainty about health care costs is also a big factor driving up retirement savings goals.

Although many Americans feel insecure about their retirement preparations and recognize the importance of saving for retirement, in reality, not many people can actually commit to setting aside a portion of their income to accumulate funds for retirement.

This phenomenon is partly due to the lack of effective financial planning and investment strategies, but also related to personal consumption habits and financial responsibility.

Article summary

In summary, when formulating a retirement plan, individuals should carefully consider potential market risks and economic fluctuations and choose retirement financial products that meet their own risk tolerance.

Particularly in the face of inflation and market uncertainty, it is critical to understand which instruments can achieve healthy growth while protecting principal from loss.

Annuity retirement accounts are a common and ideal option for those approaching or already in retirement because they provide the ability to protect retirement assets and weather market fluctuations. You can passClick Here , understand the performance of different annuity products. (Full text ends)

* "Northwestern Mutual's 2024 Planning & Progress Study," Northwestern Mutual, 2024, https://news.northwesternmutual.com/2024-04-02-Americans-Believe-They-Will-Need-1-46-Million-to- Retire-Comfortably-According-to-Northwestern-Mutual-2024-Planning-Progress-Study/

This material is not intended to serve as legal or tax advice. Financial representatives do not provide legal or tax advice.