(American Life Insurance Guide 06/06/2023 News)In the first quarter of 2023,Index Annuity Insurance和Multi-Year Guaranteed Rate Annuity Insurance (MYGA)Sales hit an all-time high.

Financial annuity insurance sales hit $847 billion, up 6.8 percent from the previous quarter and a staggering 41.9 percent from the same period last year, according to Wink's sales and marketing report.

Financial annuities include security annuities, combined annuities, index annuities, traditional fixed-rate annuities and multi-year guaranteed-rate annuities.

In financial annuity sales, Athene USA became the leader in overall sales with a 10.2% market share, followed closely by Corebridge Financial (formerly AIG), while MassMutual, New York Life and Allianz Life were among the top five in the market .

Annuity Insurance Brand Ranking Top 5

- 🏆Athene USA / Athena Annuity Insurance (News)

- Corebridge Financial / Formerly AIG Life Insurance (Evaluation)

- MassMutual/ MassMutual Life Insurance (Evaluation)

- New York Life/ New York Life Insurance (Evaluation)

- Allianz Life / Allianz Life Insurance (Evaluation)

Athene's MYG 5 became the best-selling financial annuity insurance in terms of total sales across all channels.

| 🏆Quarterly Champion: Athene MYG 5-Year Guaranteed Rate Annuity Insurance |

|

2023Q1 Athene multi-year annuity latest interest rate

🏆Athene – Athene MYG (product evaluation)

| 3-year interest | 5-year interest | 7-year interest |

| 4.70% | 5.05% | 5.10% |

*MYG (with MVA) Current rates with $100,000+ as of: 06/06/2023 except New York State

(>>>Related reading:Ranking|Account premium increased by 138%, 2022Q3 US best-selling annuity insurance brand list )

However, sales of security annuity products were flat in the first quarter of 2023, down more than 34% from a year ago.

Industry Commentary

"Sales of security annuities have probably never been lower," said Wink CEO Sheryl Moore. "Until the market picks up, sales declines will continue."

LIMRA's Individual Annuity Sales Survey showed total annuity sales of $929 billion in the first quarter, up 47% from a year earlier.It was the highest quarterly sales on record.

LIMRA expects total annuity sales in 2023 to exceed $3000 billion for the second year in a row.

Stock, bond market turmoil boosts annuity insurance

Volatility in stocks and bonds, along with fears of recession, inflation and rising interest rates, has investors flocking to what they perceive as safer annuity insurance that can provide a guaranteed stream of income.

"People are concerned about security," said Lee Baker, founder of Apex Financial.

The sales of annuity products are mainly concentrated in two categories of investment or quasi-pension plan products.Issued by insurance companies, these products can protect against wild swings in the market, or the possibility of "living but losing money" after retirement.

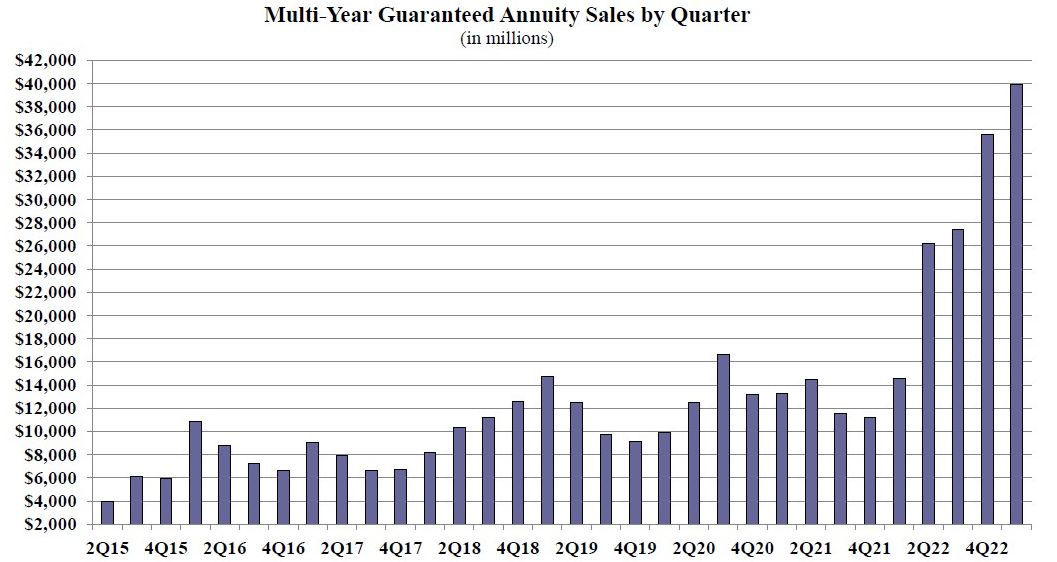

In the first quarter of 2023,Multi-Year Guaranteed Annuity (MYGA) TypesSales of annuity products were the highest at nearly $400 billion, up 12% from the previous quarter and 173% from the same period last year.This is the highest MYGA sales since Wink tracked in 2015.

*2015-2023 MYG annuity quarterly new premium historical trend chart

*2015-2023 MYG annuity quarterly new premium historical trend chart

"As long as the bank's fixed deposit CD interest rate is lower than the annuity interest rate, then it is foreseeable that the sales of index annuity and MYG annuity will rise." Wink CEO Moore said.

Indexed annuity sales in the first quarter were $226 billion, up 4.4% from the previous quarter and up 35.5% from a year ago.An indexed annuity is characterized by a guaranteed annual rate of return of no less than zero and the potential for upside determined by an external index such asStandard & Poor's 500) performance to determine.

HummingLife Insurance Financial Advisor Heather xiong Said, "The current high interest rates make this type of annuity insurance like high-interest fixed deposits a good choice. Market data also proves this."

In general, the sales data of Q2023 annuity products in 1 reflects that investors are increasingly inclined to look for investments that can provide guaranteed returns or guarantee stable income streams when faced with market turmoil and economic environment uncertainties Financial management.

However, despite the strong sales growth of annuity products, annuities are not suitable for everyone. Buyers need to consider some potential limitations of annuity insurance and their own circumstances, and purchase with the assistance of professional financial personnel. (full text)