insurGuru©️Insurance Class: Cash Surrender Value,Chinese isSurrender amount.itis when the policyholder choosesSurrenderWhen the insurance company pays a certain amount of compensation.

Surrender , that is, surrendering the policy, giving up the policy, which means ending the partnership with the insurance company.

If your policy can no longer meet your needs, you may choose to surrender the policy and abandon the policy.

Two years before enrolling is a common surrender period

In reality, most surrenders usually occur in the first two years after enrollment.

The policyholders receive and learn more comprehensive insurance education, and discover the "wrong" or "unreasonable" insurance products or plans that they originally subscribed for.

Therefore, choosing to cooperate with professional life insurance financial advisors and receiving comprehensive insurance education when applying for insurance will effectively avoid financial losses.

Cash value policy only has surrender amount

If the policy with cash value has accumulated over many years and matures, abandoning the policy may cause you a greater loss.

There are many reasons for choosing to abandon the policy. For example, the insured is facing a financial shortage and it is difficult to pay the premiums; or, you have learned that there are similar services but more attractive insurance products.At this time, policyholders began to pay extra attentionSurrender amountThis indicator.

Surrender Amount: How Much Can I Take?

Surrender amountThe amount varies depending on the type of policy.General insurance such as health insurance, medical insurance, disease risk, motor vehicle insurance, travel insurance, etc. has no surrender amount.

In the case of life insurance products, theType of insuranceDepends.For example, term insurance, which is purely life insurance, has no surrender amount.

usually,A lifetime insurance policy with Cash Value may have a certain amount of surrender.

per servingWhole life insurance policies with cash value have a penalty period, usually 10 years.

Surrender within 10 years, we don't have to pay additional penalties to the insurance company, but we can't get back the premiums we paid "in full".

What does Cash Surrender Value mean?

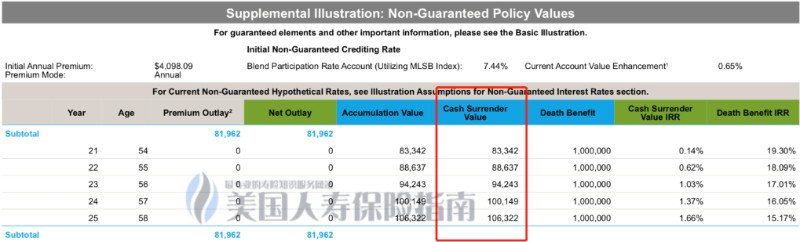

Cash Surrender Value, Chinese isSurrender amount.It is a certain amount of compensation paid by the insurance company when the insured chooses to abandon the insurance.It will be reflected in your insurance policy design plan, as shown in the figure below:

From the red box, we can see that the annual surrender amount ranges from $83,342 to $106,322

From the red box, we can see that the annual surrender amount ranges from $83,342 to $106,322

Under certain circumstances, the insured may choose to apply for surrender money, but when can I apply for surrender to get Cash Surrender Value? Is there any way to maximize the use value of the policy?Let us learn further.

When can I get the surrender after paying the premiumCash Surrender Value

The time to withdraw Cash Value varies depending on the type of insurance policy, and the design plan (Illustration) Different but different.

Take a situation as an example: If your insurance policy is designed for a ten-year payment period, usually after three consecutive years of premium payment, you may get a surrender if you give up the policy.

We recommend that when applying for various insurance products, you should learn more about the surrender policy in advance.

Why it is not wise to give up the policy at the final stage

Because of the surrender amount, it seems that there will be no loss if you give up the policy.However, if an insurance policy with cash value has been accumulated for many years and becomes mature, abandoning the insurance policy may cause you greater losses.

From an economic perspective, it is the best choice to wait for the accumulation of insurance policies to be relatively mature before accepting the surrender money, and then put it into more inclined products.

When movedSurrenderWhen the idea of surrendering the insurance, often the insured has already faced various situations or problems, or is in urgent need of cash.At this time, please learn from the insurance company the amount of surrender that you can get in that year, and then learn from professionals how to directly get it from your insurance policyLoan cashpolicy.Both of these methods may help policyholders solve the dilemma of sudden cash flow shortages. (End of full text)

(>>>Related reading:What does Lapse in life insurance mean?What are the actual situation and consequences of insurance breakage?)