We have always heard that American insurance premiums are more cost-effective and cost-effective. In terms of similar insurance: American insurance premiums are 1/3 of Hong Kong, Taiwan, and South Korea, 1/5 of Japan, and 1/6 of the mainland.How is the pricing behind this?

table of Contents

- How to price life insurance

- Explanation of terms of insurance cost

- The meaning and cost impact of the life table

- Actual calculation cases of life insurance premiums in three places

- Who is suitable for buying American life insurance

- Frequently Asked Questions for Foreigners Buying U.S. Insurance

- Reference appendix

text

in"Why buy U.S. life insurance"In the article, the most common sentence is quoted:「同類保險上:美國的保費是香港、台灣、韓國的1/3,日本的1/5,內地的1/6」。Then, why are the premiums of American insurance products so low?How is this price comparison calculated?Next we will briefly explain.

1. How is life insurance priced?

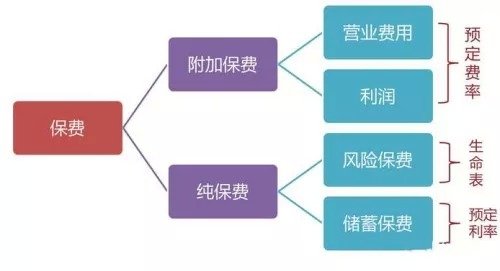

To calculate an account, you must first determine the cost and pricing, and the same is true for life insurance.There are three main factors that affect the pricing of life insurance: predetermined rate, death rate, and predetermined interest rate.

2. Explanation of terms of insurance cost

Reservation rate:It refers to the insurance company's forecast rate based on the company's cost and expenses, including sales expenses, administrative expenses, operating costs, etc. The rate of different companies may be much different.

Scheduled interest rate:It refers to the insurance company's forecast of the future capital utilization rate of return when the insurance company is pricing the product, and the annual rate of return assumed for the insurance policy is mainly set with reference to the bank deposit interest rate and the expected investment rate of return.In layman's terms, it is the rate of return that insurance companies provide to consumers.

mortality rate:Also called the life table, it is a table formed by analyzing and sorting out statistical data about survival and death of a specific population in a certain country or region during a certain period of time. It is the mathematical basis of life insurance actuarial calculations and the basic for determining the pure premiums of life insurance. in accordance with.

Mortality is public data. Today, the difference in premiums is mainly explained from the perspective of mortality.At the end of December 2016, the China Insurance Regulatory Commission issued a notice on the "China Life Insurance Industry Experience Life Table (12-2010)" and announced the latest life table.

3. What does this life table mean?

The mortality rate in the life table refers to the probability that a male (female) of a certain age will die within one year.For example, in China's new life table, the probability of a 40-year-old male dying within one year is 0.001651, while that of a female is 0.000692.

4. How to calculate the premium difference between the United States, Hong Kong and Mainland China from the life table?

Assuming that only the mortality rate is considered, a 40-year-old healthy man purchases term life insurance with an insured amount of 100 million and a predetermined interest rate of 3%. What is the premium (CL1) in the three places?

| Basic formula: premium = death rate X sum assured / (1+3%) | |||

| China Mainland | China Hong Kong | United States | |

| calculation process | 0.001651 X 100 million/103% | 0.0011655 X 100 million/103% | 0.000855 X 100 million/103% |

| Final premium | 1602.91 | 1131.55 |

830.10 |

| Premium comparison ratio | 1 | 0.71 |

0.52 |

1>1602.91>1131.55

2. Hong Kong is nearly 30% cheaper than the mainland, and the United States is nearly 30% cheaper than Hong Kong.

Attach the addresses of the life tables of the three countries or regions:

American life table: Https://www.irs.gov/pub/irs-drop/n-13-49.pdf

Life in Hong Kong: Http://www.statistics.gov.hk/pub/B1120016062015XXXXB0100.pdf

Life Table in Mainland China: Http://www.circ.gov.cn/web/site0/tab5216/info4054990.htm

Therefore, when the operating expenses of the insurance company and the rate of return are similar, the most important thing is that thisMortality Table, Also known as the "Death Probability Table", it is a survey statistics table that reflects the law of survival and death of the population in a country or region.The insurance company evaluates the risk and determines the premium based on the mortality and survival rate on the life table.The relationship between it and the rate, to put it simply, is,"The longer the person lives, the lower the rate".

Since the average life expectancy of Americans is the longest, it is an indisputable fact that the cost of American life insurance products is relatively the lowest in terms of rates.

Who is suitable for buying American insurance?

1. Those who intend to or have immigrated to the United States

2. People who bought real estate in the U.S.

3. People who want to allocate USD assets

4. Those seeking asset protection and risk isolation

5. People who want to buy the most cost-effective insurance

Take an actual customer as an example. For a 40-year-old male, the same annual premium payment of 8 US dollars, five years of payment, the insurance coverage of Hong Kong insurance is 5 US dollars, while the insurance coverage of American insurance is 80 million US dollars.

Because of the huge difference in insurance premiums, coupled with the repeated low prices of domestic flights to the United States, American insurance is more attractive to the most savvy insurance buyers.

Click to learn" (updated in September 2018)Ways for foreigners to buy U.S. insurance and the 4 advantages of buying U.S. insurance"

After talking about this topic, it is inevitable that you will face the next topic——

Frequently Asked Questions for Foreigners Buying U.S. Insurance

1. When choosing life insurance, which aspect should you consider most?

Each policy of American Life Insurance is customized, that is, the financial consultant will focus on the needs of the client and recommend the most suitable policy for the client.So before buying insurance, you must clearly understand your needs.Based on past experience, the policy options that customers care most about are:

- The premium is cheap, and some cash value of the policy is accumulated

- Maximize tax-free retirement income

- Living benefit contract, including long-term care claims for serious illnesses

- The cash value in the policy grows steadily without tax and compound interest

2. What materials do foreigners need to purchase insurance policies?

Information that foreigners need to submit when purchasing U.S. insurance:

- Personal related information and documents (passport, etc.)

- Application form

- Related medical records

- Financial certificate

3. What are the contents of the physical examination?

Problems with blood tests, urine tests, height and weight, past medical history and family medical history.

4. When will the premium be paid?

After the policy is approved, pay the premium.

5. When will the policy take effect?

The insurance company needs to receive the customer's receipt and the initial premium at the same time, and the policy will come into effect.

6. Once the insured person dies, how to settle the claim?

In general, large life insurance companies with high credit ratings in the United States settle claims fairly quickly, usually within a few weeks.

- When the insured person dies, the beneficiary should immediately notify the insurance broker

- The insurance broker will assist the beneficiary to fill in the death claim application form as soon as possible

- The insurance broker sends the signed death claim application form and the original death certificate issued by the government unit to the insurance company.

- The insurance company sends the claim settlement and cashier's check to the beneficiary (some insurance companies can accept the customer's request to remit to the customer's designated account)

But it should be noted that:

- If the insured person dies overseas, the death certificate issued by the local government must be translated into English and notarized by the local US consulate.

- If the death of the insured occurs within two years from the effective date of the insurance, the insurance company has the right to investigate and require related family members or beneficiaries to provide further supporting documents.

Reference appendix

01. "CRS transits, are your assets still safe? ``, Article, 12.16.2017, Jeff Zhang,

https://thelifetank.com/crs-why-go-to-usa-to-buy-life-insurance-after-common-reporting-standard-in-china-hongkong/