★Quickly learn about Tax Returns in the U.S.

ToU.S. Internal Revenue Service (IRS)Report personal income and pay personal income tax accordingly.

Taxpayers are required to declare "Federal Tax" and "State Tax".

- Federal taxes are the responsibility of the Internal Revenue Service (IRS).

- The state tax is the responsibility of the state government of the residence. (Some states do not levy state taxes, such as Texas, Florida, Alaska, etc.)

- Before the filing deadline, two different tax return forms need to be filled out and submitted to the IRS and the state taxation departments together with the tax payable.

The general tax filing steps are: (The steps will be described in detail below)

Step 1│Download or fill out tax forms online.

Step 2 │According to the instructions for filling in the form, fill in all the personal income of the previous year and the income deductions that meet the tax exemption clauses, and the amount of personal income tax payable will be automatically calculated in the form.

Step 3│Before the tax filing deadline, submit the form and money to the tax department by mail or online submission (e-filling).

※For general wage earners (W2 income), they usually get a tax rebate from the government (Federal & State) after filing a tax, because at the time of receiving their salary, they have already been withheld higher than the tax payable (Tax Withholding) , So you can get a tax refund (Tax Refund) after you declare your income tax. ※

★ WHO│Who needs to declare income tax?

U.S. citizens

Foreign residents with legal right of abode

a) Those with permanent residency, such as green card holders

b) Residents with E status

c) Residents with H status

d) Those who have been in the U.S. for more than 183 days within three years (non-U.S. immigrants, but with U.S. income)

★ WHAT│What kind of income needs to be declared?

All income earned in the world must be declared as follows: salaries, commissions, remuneration, fringe benefits, tips, stock purchase options, interest, dividends, partnership dividends, capital gains dividends, pension income, unemployment compensation income, Game profit, foreign income

●Unemployment benefitsGold should also be declared.

●Federal tax isGlobal taxation.But not double taxation.If part of the income has been taxed in another country, the tax paid can be directly deducted from the tax payable in the income tax table (foreign tax credit).

●U.S. targetsOverseas incomeEveryone has a certain amount of tax allowance each year.

The 2017 tax filing eligibility requirements for most taxpayers are applicable:

★ WHEN│When should I declare?

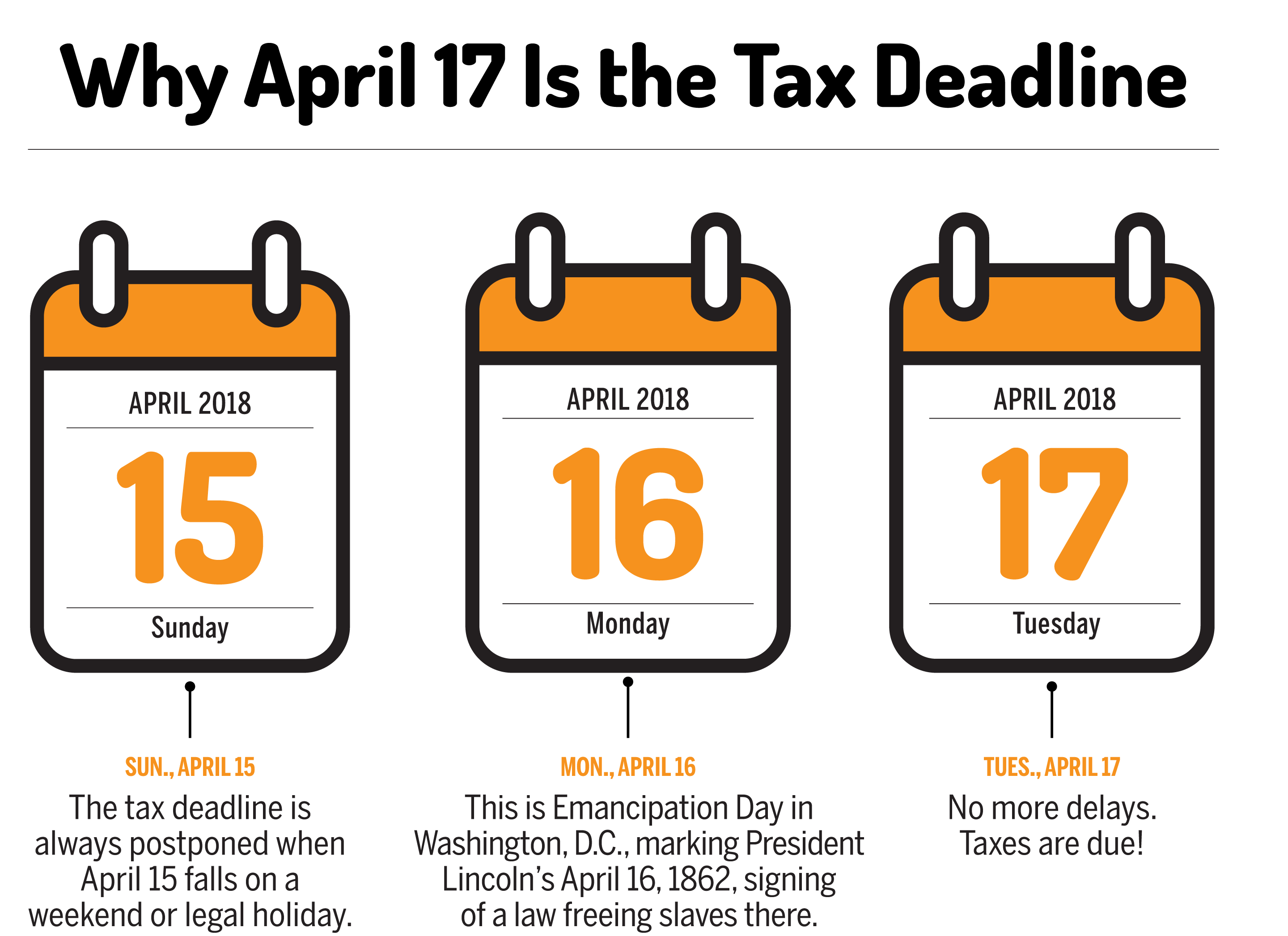

annual4 AprilIs submittedFederal and state taxesThe deadline for the declaration form.(⚠The deadline for filing in 2018 is 4/17/2018)

If the deadline falls on a Saturday, Sunday or a statutory holiday, it will be postponed to the next working day.If the mailing address of the envelope is correct and the postmark date is before the deadline, the tax return is deemed to be filed on time.

Late declaration:

●若無法準時於4/15前報稅者,可申請延期6個月申報(至10/15)。若要取得自動延長6個月的報稅時間,必須在報稅截止日前(4/15)提交4868表。However, the taxpayer must still submit the tax to the IRS on time before April 4., Otherwise you will be charged the interest of the overdue tax and the late fee will be added (in other words, deferred declaration will not extend the tax deadline).

●If you are a U.S. citizen or foreign resident and meet the following conditions before the normal tax filing deadline, you can extend your tax filing and payment for two months (until 6/15).There is no need to apply for an extension of the tax filing time limit :

(1) Live in a country other than the U.S. and Puerto Rico, and the principal place of business or job is not in the U.S. or Puerto Rico, or

(2) Serving in the military or navy outside the U.S. and Puerto Rico

★HOW│Declaration form (Federal tax & State tax)

Federal tax and state tax filings are different, but the tax filing process of the two is similar. The state tax filing process is not as complicated as federal tax. Paid tax filing software usually also provides the function of filing state tax.The following is a separate introduction to the forms that should be filled out for federal and state taxes.(※Some states are not required to pay state tax.)

【Federal Tax】

The relevant forms for U.S. citizens to declare federal taxes are: 1040, 1040A, and 1040EZ.

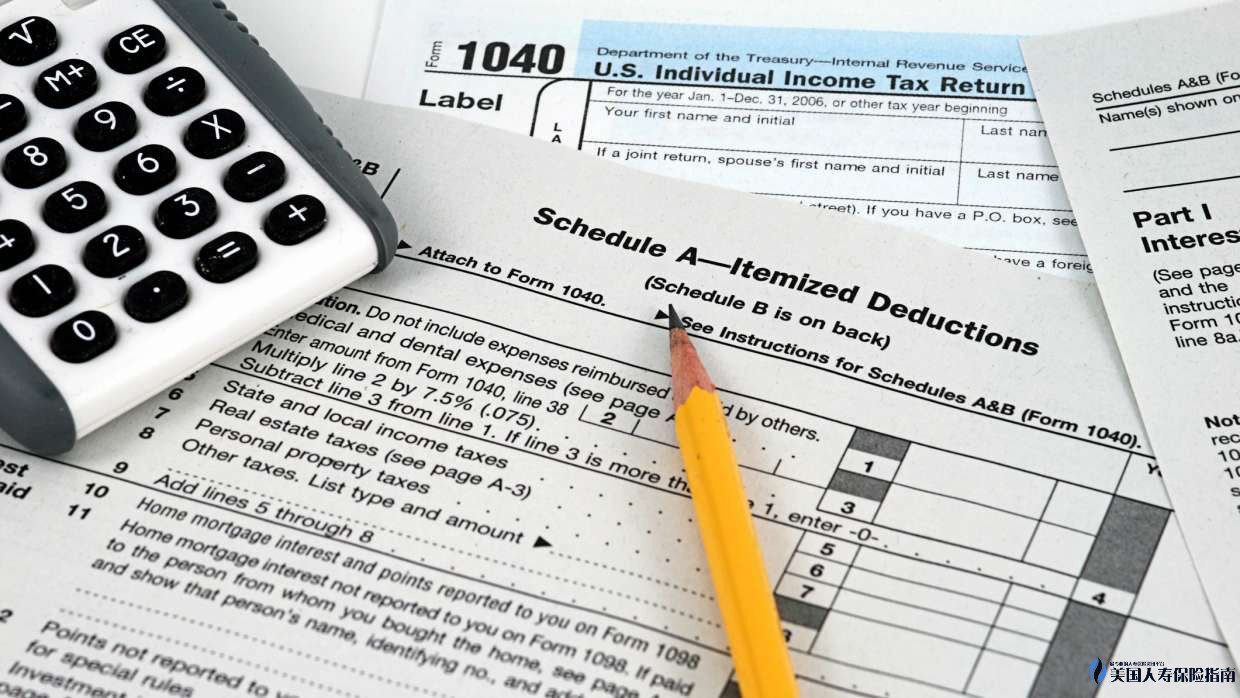

●Form 1040 is the standard version of the tax return,而1040EZ和1040A則是1040的簡化版本。所有人皆可使用1040進行報稅,即便是符合1040EZ或1040A的使用條件。

●1040EZ and 1040A have restrictions on the source of income, and they are also more restricted on tax-free income deductions (Deductions) and tax credits (Tax Credits).If 1040 can provide more tax deductions, it is the most cost-effective for you to use 1040 for tax declaration.

●Others that may be related to personal income tax returns include "Corporate Income Tax Return-Form 1120 (US Corporation Income Tax Return)", "Small Company Income Return-Form 1120S (US Income Tax Return for an S Corporation)", "Limited Company" Report-Form 1065 (US Return of Partnership Income)" etc.

●Standard tax return form, 2 pages in total.

On page 1, it is Gross Incomes (Gross Incomes), minus personal adjustments (Adjustments), the remaining amount is Personal Adjusted Gross Income (AGI).

On page 2, there are personal allowances (Exemption) and personal income deductions (Deduction).After subtracting these two items from AGI,The remaining amount is Taxable Income, and then according to the tax rate, Calculate the income tax payable.

You can choose Standard Deductions or Itemized Deductions. (Please see the supplementary explanation at the end of the article)

All taxpayers can use Form 1040 to file tax returns, Regardless of whether it meets the conditions of use of 1040EZ or 1040A.

●1040 has several attached tables. The following lists some of the more commonly used ones. Please refer to IRS for detailed instructions.

─ Schedule A (Schedule A), Itemized Deductions for individuals.

─ Schedule B (Schedule B), Interest and Ordinary Dividends.

─ Schedule C (Schedule C), Personal business income (Profit or Loss From Business).

─ Schedule D (Schedule D), Capital Gains and Losses.

─ Schedule E (Schedule E), Rent income, company surplus distribution, etc. (Supplemental Income and Loss).

★HOW│How to declare (federal tax & state tax)

You can choose to file online, fill out the form and mail it yourself, use professional tax filing software, or have a professional accountant handle it.

Online declaration of E-Filing

Federal tax:IRS online tax filing service

State tax:Please go to the free declaration system on the official website of each state government, such as the online tax declaration service of the California state government

Online tax refund progress query

Federal tax:You can check the progress of the federal tax refund online.

State tax:You can directly check on the official websites of the state governments.

Generally, it takes about 7-14 working days to receive the tax refund for online tax filing, and it takes about 1-3 months to mail a paper copy. You can check the progress online at any time.

Those who mail paper copies of state taxes should be aware that the receiving address (PO BOX) for "getting a tax refund" and "requiring tax" may be different, such as California.

All paper copies must be signed before sending.

★HOW | How to reduce the deduction of taxable income (Deduction)

→ There are two methods: "Listing Deduction" and "Standard Deduction".

Standard Deductions

- It will vary with the taxpayer’s income, age, tax filing status, blindness and inflation, and the standard deductions are different each year.

- Not everyone can use the standard allowance.

- If the enumerated deduction method has been used, the standard allowance can no longer be used.

Additional standard deduction

If you are 65 or older at the end of the tax year, or if you lose your sight before the last day of the tax year, the taxpayer can receive additional tax allowances.

─ If you or your spouse are 65 years of age or older or blind at the end of the tax year, you can claim additional standard allowances by checking age or blindness on Form 1040A or Form 1040.unavailableForm 1040EZ (income tax returns for single or joint tax filers without dependents) to declare additional standard allowances.

Standard deduction for dependents

If another taxpayer can declare you as a dependent, your standard tax deduction limit is (1) $1,050 or (2) your income plus $350, whichever is higher (but the total tax exemption cannot be Exceeding the basic standard allowance for your tax filing status, the above figures are2017The data).

Who can not enjoy the standard deduction

- Married and filed separately, the spouse uses the enumerated deduction

- The individual has changed his fiscal year cycle, so that the cycle of filing tax returns is less than 12 months.

- Estates, trusts, general trust funds, partnerships

- There are non-resident foreigners or foreigners with dual identities during part of the year, but standard deductions are available for the following exceptions:

- The non-resident alien married a U.S. citizen or resident alien at the end of the tax year, and their spouse chose to jointly file taxes as a U.S. resident for the entire tax year.

- An individual who is a non-resident alien at the beginning of the tax year becomes a U.S. citizen or resident at the end of the tax year because he married a U.S. citizen or resident at the end of the tax year and chose to file taxes jointly with his spouse as a U.S. resident throughout the tax year.

- Individuals who were non-resident foreigners or foreigners with dual status in the current year.If a non-resident alien marries a U.S. citizen or foreign resident before the end of the year, and he/she chooses to pay taxes as a U.S. resident.

Itemized Deductions

If your enumerated deduction is higher than the standard deduction, or the standard deduction cannot be used, the enumerated deduction method will be used.

Use Form 1040, Schedule A (Schedule A of Form 1040) to list and fill in.

List deduction items

- Taxes You Paid:Income tax or sales tax, real estate tax, personal property tax, etc. paid by the state and local government.

- Gifts to Charity : Charity Donation.

- Medical and Dental Expenses:Part of the amount of medical and dental treatment expenses.

- Interest You Paid:Such as mortgage interest.

- Casualty and Theft Losses:Uninsured disaster theft loss, etc.

- Job Expenses and Certain Misc. : Unpaid employee business expenses, etc.

We are an American team with professional insurance planners, accountants and lawyers.Provide one-stop efficient and high-quality services for high-net-worth customers, overseas students and new immigrant families in the United States.

Scan and add the QR code below to contact me at any time