In the previous post, we shared some knowledge about insurance, which introducedIndex Universal Life Insurance Products in the United States (Index Universal Life-hereinafter referred to as IUL), you can follow the stock market index to get income without losing money, and have tax concessions. As a way of guaranteed and guaranteed investment, it has gained more and more people’s favor. At present, this type of financial products is only available in There is in the US market.

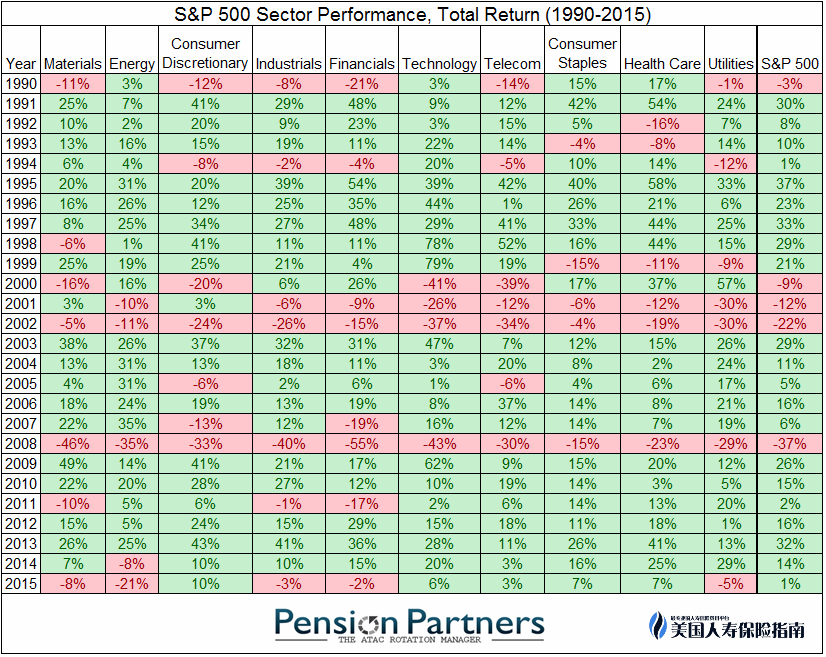

Everyone also knows that the annual investment income of Hong Kong insurance depends on the performance of the insurance company’s investment department. The mainstream index life insurance in the US market does not directly participate in the stock market, and uses low-risk bond investment + options. Large indexes (S&P 500, Stoxx Europe 50 Index, and Hang Seng Index) are the targets, and earnings follow the stock market, and the annual yield is open and transparent.

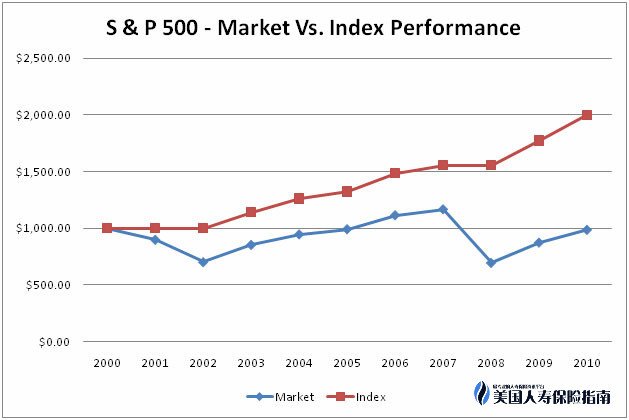

That is to say, when the index rises, the insurance income also rises (the return rate of return is limited every year-each insurance company has different regulations), but the index falls, but insurance can guarantee that the return rate is zero at the worst, and no money will be lost. The annual income is around 7%-8%.

Many people will ask,Will the risk of the linked index be great?If there is an economic crisis and the index drops sharply, once the expected rate of return cannot be achieved for many years, the cost of insurance will erode the principal I invested, and the insurance policy may become invalid.Today I will answer this doubt for everyone,While displaying the historical return data of the index, it also quotes the analysis of professional investors, A detailed description for everyone to eliminate concerns.

Historical return data display

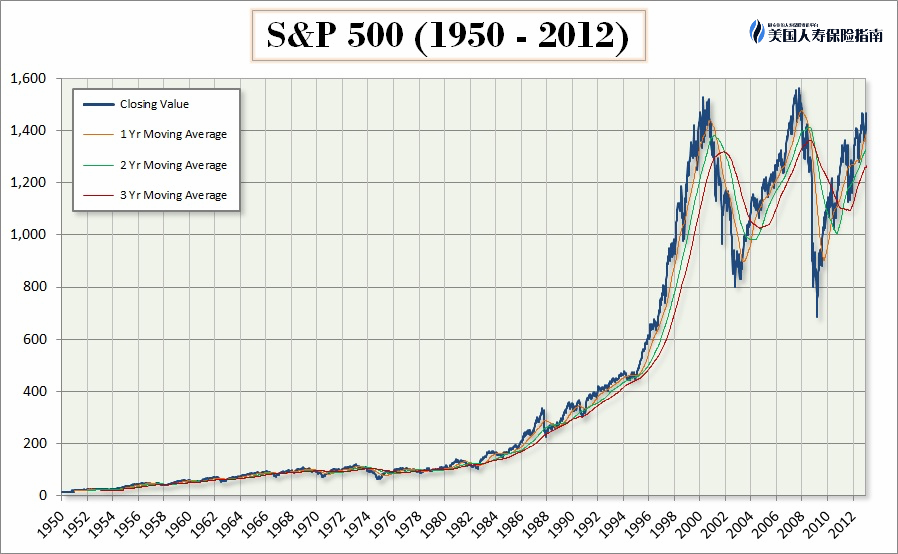

What everyone is most worried about is the perennial bear market in the economic crisis index, what should I do if the expected return is not achieved?So let's take a look at the past historical records first, and see how the index situation was when the economic crisis occurred in the past?Here we take the S&P 500 index, which can be linked to the IUL products of various insurance companies, as an example.

*The dot-com bubble occurred in 2000, the Iraq war and the September 911 incident, and the financial crisis in the United States

*The subprime mortgage crisis was fermented in 2007, and the 2008 stock market crash began a new round of economic crisis

From the above chart, we can clearly see that the S&P 500 did experience a short-term decline during the economic crisis, but it quickly rebounded and continued to rise.This also proves that the U.S. stock market is a long bull and short bear trend. This andThe "short bull and long bear" situation in China's stock market is completely different.The performance of the 200-year historical return on assets of the US stock market also proves that stock prices generally have a long-term historical trend of continuous upward growth.

從上表中我們也能看出,過去20多年標普500的除了在2001年前後3年和2008年大跌之外(IUL在指數大跌虧損時,保證保本收益為0%),其餘年限的收益還是相當穩定的。如果Using the data of the S&P 500 Index over the past 50 years, starting a fixed investment for 20 years at any point in time, the average annual return can reach about 7%.Therefore, if your IUL universal life insurance product is linked to the S&P 500 index, you do not need to worry about the economic crisis that will affect the index year-round decline, and the insufficient cash value in the policy will make your policy invalid.

Recalling the 2008 economic crisis in the United States

When the financial crisis struck, the entire Wall Street was dumbfounded. It is not an exaggeration to describe it as "the sky is falling apart."

In 2007, the subprime mortgage crisis fermented. On September 2008, 9, Lehman Brothers collapsed. It has long been regarded as triggering a domino effect and causing many other companies to collapse: Merrill Lynch was hurriedly sold to Bank of America;American International Group (AIG) received rescueThe net asset value of money market funds fell below one dollar for an unprecedented rate; Goldman Sachs and Morgan Stanley nearly collapsed and became bank holding companies; when AIG was faltering, the government finally discovered that the entire U.S. economy would not work unless it was saved. The government decided to implement a $7000 billion Troubled Asset Relief Program (TARP) to help the entire banking industry out of its predicament.

Feng Lei, a veteran investment banker who has been active on Wall Street for many years, recalled that the most panicked moment in the market at that time was in February 2009.Nenghui will discuss the nationalization of the banking system. For American society, which has always believed in the market economy as its supreme belief, it seems like an instant collapse of belief. "

However, "fortunately, Bernanke soon said that he would not carry out nationalization, but would stress test the banking system," Feng Lei said. "Then U.S. stocks also began to bottom out. Everyone was impressed on March 3. At that time, the S&P 9 index fell to 500 points at the lowest point. This day was the starting point of the eight-year bull market in US stocks.

How to judge the starting point of the bull market?Feng Lei said: "In fact, one of the most important indicators for real market players is the Chicago Board Options Exchange Skew Index (CBOESKEWIndex) known as the "Black Swan Index". SKEW (slope) reflects the market's decline and increase in the S&P 500 Index. The difference in probability. The smaller the slope, the higher the market believes that the stock market’s chance of rising is higher than the chance of falling, which means that the options market is more bullish on the stock market.”

He recalled: "In March 2009, the slope was very flat. We knew that the market had really bottomed out, and we didn't even need to look at economic fundamentals." He said that CBOESKEWIndex has the strongest trading liquidity and the most participants, almost All hedge funds and mutual funds will participate, so they are highly sensitive and more suitable for detecting the starting point of long-term market trends.

Sure enough, starting from March 3th of that year,U.S. stocks continued to rise. Even though the European debt crisis broke out and suffered a correction in the middle, the pattern of the bull market has never changed, and it has been the case so far.

QE and U.S. stocks eight-year bull market

"Those who were still skeptical of the sustainability of the bull market in 2009 did not realize one thing-you never bet against the central bank. This is also the golden rule of the industry." When the central bank's assets and liabilities The watch has expanded all the way to 4.5 trillion US dollars, it seems that the stock market has no reason not to rise.

Data show that the Fed purchased a total of US$1.725 trillion in assets during the first round of QE. From March 2009, 3 to March 1, 2010, the S&P 3 index rose by 31%; during the implementation of QE500, the US stock market expanded In the new round of gains, the S&P 37.14 index rose by a maximum of 2%; by the end of June 500, the Fed had purchased US$28.3 billion of US long-term Treasury bonds through the third round of QE and purchased US$2011 billion of mortgage-backed securities every month.On the day QE6 was launched, the U.S. dollar was sold off. The three major stock indexes of the New York stock market all rose by more than 6000%, the international gold price hit a record high in 400 months, and the international oil price rose by 3%.

Among the constituent stocks of the Dow indexed by FactSet,自2009年熊市探底至2017年3月3日,最知名的美國上市企業股價漲勢如虹:蘋果股價累計漲幅989%,聯合健康保險上漲752%,耐克上漲457%,迪士尼、波音和杜邦漲幅分別達到559%、482%和347%。金融類股中,維薩VISA上漲524%,J.P。摩根大通上漲303%。

The next question is definitely what my friends are most concerned about!

Regardless of the past, the future trend is related to my policy!

Will the U.S. stock market continue?

The U.S. stock market in the eight-year bull market has developed to the present, and Wall Street has spread a "golden rule"-"Rely on the central bank eight years ago, and rely on Trump eight years later." "Finally, the market is looking forward to Trump, and this is also the case. Why did U.S. stocks rebound after Trump’s election? The market sees opportunities,” Feng Lei told reporters. “As the central bank begins to raise interest rates, for traders, it may be possible to say, “Trump is now the only one in the world. Players"."

At the moment, for US stocks, the market is divided into two factions-one thinks that the bull market is exhausted and a callback is imminent; the other thinks that once Trump's deregulation, tax cuts, and infrastructure investment can be truly implemented, plus the development of science and technology , Then the United States will usher in another "Renaissance"-style development.

In the short term, a correction is not impossible, but it does not mean the end of the bull market.As of the close of March 3, the annual return of the S&P 10 index was as high as 500%, and Trump's contribution after the election was as high as 17.33%. On September 11, the Federal Reserve announcedThe start date of the gradual reduction of the US$4.5 trillion balance sheet.Although the initial impact is limited, as the "scaling down" advances, its long-term impact still needs to be vigilant.In the medium and long term, the “shrinking balance sheet” will directly affect the supply and demand relationship of U.S. Treasury bonds and promote the rise of U.S. Treasury yields, which are one of the important benchmarks for global asset pricing.In addition, the “shrinking of the balance sheet” will tighten the liquidity of the U.S. dollar and put pressure on the appreciation of the U.S. dollar. Considering factors such as the return of funds to U.S. dollar assets, emerging markets will face greater challenges in the devaluation of their own currencies and capital outflows.

Risk-controllable choice is critical

Although we can only predict current economic policies and trends based on past historical data, there are still traces to follow.

The fundamental reason for the long-term slow development of the U.S. stock market still comes from the outstanding economic fundamentals of the United States.In the nearly 80 years from the early 2008s to the 30 financial crisis, the U.S. economy has developed very steadily, with an annual GDP growth rate of about 4%, which is already relatively high in terms of its economic development level and volume.Although the 2008 economic crisis had a great negative impact on the US real economy and stock indexes, the quantitative easing policy of the Federal Reserve and the growth and development of the Internet economy in the past few years, especially in the past two years, from consumer confidence index, non-agricultural employment rate to manufacturing Industry data, housing prices are picking up, and all kinds of economic data are verifying that the U.S. economy has emerged from the crisis and is undergoing a slow recovery.

Since the United States has very strict supervision over the stock market and has a very strict review policy on listed companies, even Buffett highly recommends long-term investment.Purchasing life insurance is also a kind of long-term investment in disguise, so in summary, the risk of index-linked insurance products is relatively small, and there is no need to worry too much about the index.

Recommended reading: "List of 5 types of life insurance in the United States, introductory knowledge, advantages and disadvantages"

This article is from the Internet, edited and published by this site.