Before the annual tax filing deadline on April 2022, 4, the current US President Joe Biden announced the annual household income and tax situation.From the documents disclosed by the White House, we can get a glimpse of which US President Biden boughtLife insurance companyThe product.

The President's Annual Household Income and Insurer Investment Dividends

The 79-year-old U.S. President Biden and his wife Jill Biden filed a joint tax return, with an adjusted gross income of $610,702.

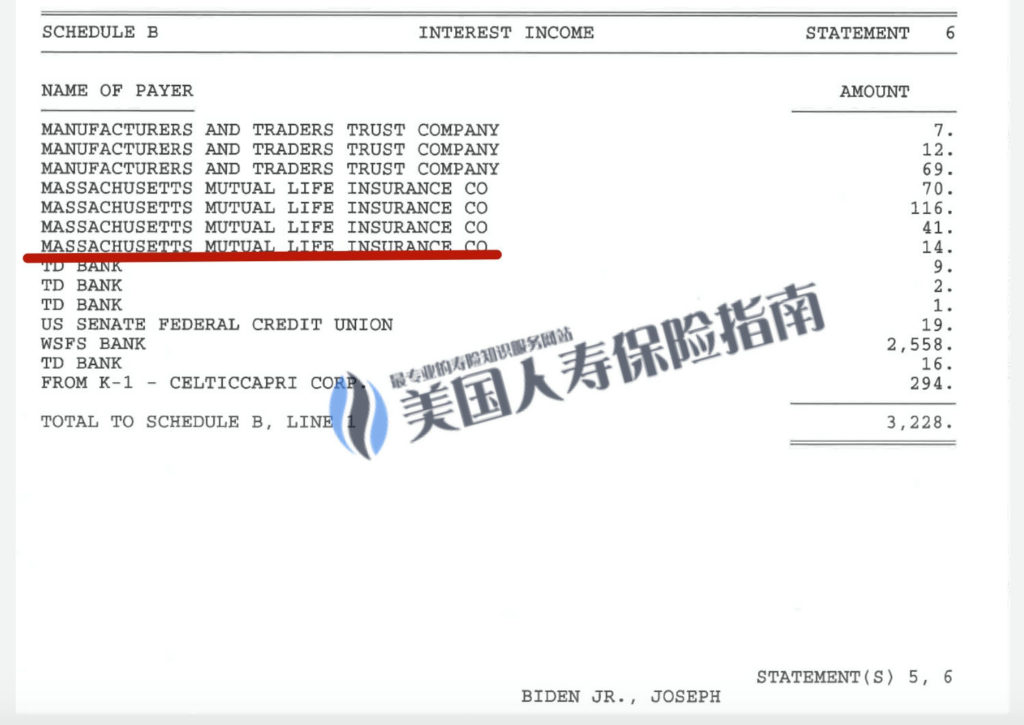

According to the President's family financial information released by the White House on April 2022, 4, the Biden family holds multipleMassMutual Life Insurance(MassMutual) company's contract, the specific annual investment income is as follows*.

As we can see from the picture above, President Biden holds 4 accounts from Massachusetts Mutual Life Insurance Company, and each insurance company account received investment income income of $70, $116, $41 and $14.

Massachusetts Mutual Life Insurance Company, referred to asMuss Mutual, referred to in Chinese asWantong Insurance, or MassMutual Wealth Management, MassMutual Insurance (Evaluation).

(>>>Related Products:[MassMutual 10 Pay Whole Life Insurance] MassMutual 10 Pay Whole Life Insurance|User Evaluation_Product Manual_Performance Description)

Speculation on the type of policy held by President Biden

When Biden was running for president, he also specifically disclosed that he held 6 life insurance contracts.

It is speculated that the purchase by President Biden is most likely to participate in the dividends of MassMutual Insurance Company.Savings dividendsThis type of policy, and choose to continue to invest dividends in the insurance company.

Gains from such investments are included in taxable income*.It is worth noting that not all savings-participating insurances are policies that participate in the company's dividend-sharing nature. (End of full text)

(>>>Related reading:What is the income of the U.S. president's family in 2020?How many life insurances do you have?)

(>>>Related reading:What life insurance did the Hillary Clintons, the former president's family, buy?)

*.”Will I be taxed on the growth of the cash value of my life insurance?”, Equitable Life Insurance Company, 12/2016, https://equitable.com/life-insurance/questions/taxes-if-policy- pays-dividends