"Voya Insurance announces that it has sold its personal life insurance business", "KKR takes over the Global Atlantic financial and insurance group built by Goldman Sachs for $44 billion"Digging deep into the news of these mergers and sales of American insurance companies, private equity began to appear in our vision. Today, the topic shared by the American Life Insurance Guide©️ is,As an insurance applicant, is it a good idea to apply for insurance with a Private Equity insurance company?

What is Private Equity?

Private equity refers to private equity investment (Private Equity, PE for short).From the perspective of investment methods, PE investment refers to equity investment in private companies through private equity. The future exit mechanism is included in the transaction implementation process, that is, through listing, mergers and acquisitions or management repurchases, etc. Profit from selling shares.

2020Global Atlantic saleKKR & Co Inc (KKR.N), is the well-known PE group.

What other US insurance companies have PE dominated?

Private equity giant Apollo Global Management (Apollo Global Management, APO.N) Before KKR entered the insurance industry, it first opened a path for PE to enter the insurance industry.

According to Reuters, nearly half of Apollo's permanent capital management fee profit has come from the asset management of insurance groups and insurance networks, including Athene Holding Ltd (Athene Insurance and Annuity), which is common in the Chinese community. This financial insurance group.The assets of this insurance company have accounted for half of the total assets under management of $3160 billion.

Unlike KKR and Global Atlantic, Apollo Group only holds a third of Athene.

Another giant, the Blackstone Group, also manages the investment portfolio of the FGL Holding Group-FGL Insurance Group, which manages US$289 billion in assets, has just changed ownership of Fidelity National Financial Inc (Fidelity National Financial Inc) last month.

What is the relationship between PE capital and policyholders?

As early as 2019, Bloomberg had warned that, "Everything is PE"It took 1 year to track the entry of PE capital into the health insurance industry.The story in between (Click to understand), maybe asLife insurance industry policyholders和Every reader who cares about the quality of our living environmentreference.

Private equity enters a company, industry,The ultimate goal is to chase profit.There is nothing "wrong" with this kind of investment and transfer.According to a Bloomberg report, in the field of health care, the private equity method is to first acquire a company, then drastically reduce costs, and finally sell for profit-such operations are usually concentrated in 3 to 5 years.It can guarantee an annualized rate of return of 20% to 30% per year.

Bloomberg reported that the company itself became more like a product, circulating in the capital market together with customer resources and value.After the new investors took over, they kept reducing costs and expanding their scale.And rounds of acquisitions, mergers, and reorganizations have brought the game of drumming and passing flowers to the last link-hope that the biggest player will take over, such as KKR, Blackstone, or Apollo.

The quality and water standards of the "standardized" products that end customers can actually get and the corresponding services they can enjoy can be imagined.

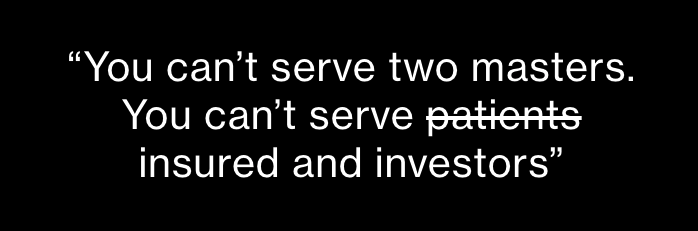

The article also pointed out at the end that in the process of private equity participation in the health insurance industry, due to the nature of chasing profits, patients who originally needed medical services may become victims of medical service groups controlled by capital.

Finally, there is our reader poll survey link,In your opinion, is it a good idea to insure a life insurance company dominated by PE?

appendix

01. “Everything Is Private Equity Now”, 10/03/2019, Bloomberg Businessweek, https://bloom.bg/2DbJmuy

02."How Private Equity Is Ruining American Health Care", 05/20/2020, Bloomberg Businessweek, https://bloom.bg/3jJ0CIp

03. “KKR to take over Goldman Sachs-backed insurer Global Atlantic”, 07/08/2020, Reuters, https://reut.rs/39yQ8GQ