(American Life Insurance Guide 03/29/2022 News) Global insurance giantAIG (American International Group)Officially announced that its life insurance and pension divisions will be listed independently under the new company brand name "Corebridge".

Insurance giant's reform movement

AIGThe Life Insurance and Retirement business unit is one of the nation's largest providers of retirement solutions and insurance products.

AIG's current CEO Zafino, and former CEO Brian Dupero, It took many years to completely reform the huge AIG.

On March 3 this year, the current CEO Zafino officially announced the progress of the reform of the life insurance and retirement business sector, and named it "Corebridge".

Corebridge has filed a listing document on the New York Stock Exchange and will trade under the ticker symbol "CRBG".After the listing, AIG will continue to hold more than half of Corebridge's shares.

Corebridge has filed a listing document on the New York Stock Exchange and will trade under the ticker symbol "CRBG".After the listing, AIG will continue to hold more than half of Corebridge's shares.

The size and IPO price of Corebridge's public offering have not yet been determined.

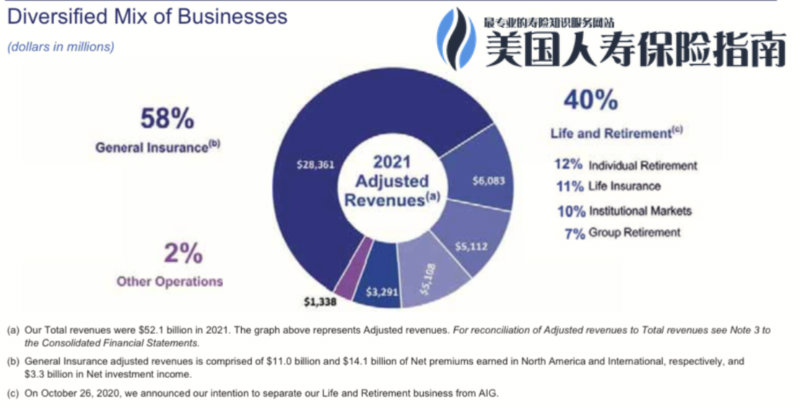

According to the filing, AIG's Life Insurance and Retirement business unit will have revenue of $2021 billion and net income of $230 billion in 74, a sharp increase from $150 billion in revenue and $6.42 million in net income in the same period a year earlier.

BlackRock, Blackstone's long-term asset management alliance

Earlier, AIG announced an agreement with BlackRock Investment Management Company (BlackRock) to professionally manage the assets of AIG's insurance companies.

Ahead of the deal with BlackRock, the world's leading alternative asset manager, Blackstone, signed a deal with AIG for $22 billion for its life insurance and retirement business unit 9.9% stake.

According to Bloomberg, such an alliance has forged a "long-term strategic asset management relationship" and is expected to grow its life and retirement portfolio from an initial $6 billion to $500 billion within six years.

Does not affect the commitment of the original policy

After the independent listing of AIG Life Insurance and Retirement Business Unit, the three life insurance companies under AIG Life Insurance and Retirement Business Unit will continue to remain unchanged to provide services to investors.

“As Corebridge, we will continue to proudly partner with financial and retirement professionals to help their clients feel confident and motivated today, and in control of their tomorrow.”. —Kevin Hogan, CEO, Life Insurance and Retirement

In the past 3 years, AIG has invested 200 billion through the "AIG13" program to modernize and digitize the company's overall workflow.

For AIG life policyholders, the experience of digital management of insurance accounts in the past year has seen significant changes.

We will continue to wait and see whether the digital experience of policyholders can be further improved as AIG's life insurance divisions spin off and operate independently. (End of full text)

*This press release is not an offer to sell any securities, or an invitation to subscribe.