Introduction: At the beginning of 2021, American retail investors and institutions "squeeze" the AMC and GameStop stocks that became popular in the battle. The company's stock price has increased by more than 20 times in one year, and it has also become the main force to promote the rise of small and medium-cap indexes.As American insurance policyholders, can we get a share of it?After reading this article, you may have new inspiration.

(©Credit REUTERS/Dado Ruvic/Illustration/File Photo)

(©Credit REUTERS/Dado Ruvic/Illustration/File Photo)

text

traditionalSavings dividend insurance(Whole Life) andAnnuity Insurance, The annual dividend of the policy depends on the performance of the life insurance company that issued the policy;Exponential life insurance(Indexed Life) andIndex Annuity Insurance(Indexed Annuity), the annual interest of the policy,Depends on the open market performance of different indexes.

| Traditional Life Insurance & Retirement Annuity Insurance | Index Life Insurance & Retirement Annuity Insurance | |

| Dividends & interest-bearing income depends on... | The operation of an insurance company | Performance of different market indexes |

In this type of life or annuity policy contract, multiple index strategies are provided.The annual income of an insurance policy no longer depends on the performance of a certain insurance company itself, but on the increase and decrease of different indexes.

The following is caused byAmerican Life Insurance Guide©️ Organized, the most common 4 standard index strategies, which contain different constituent stocks for policyholders to choose and refer to.

S&P 500 Index

S & P 500® – Also known as the Standard & Poor's 500® Index. S&P 500® is a market capitalization weighted index that tracks the performance of 500 major companies listed on the American Stock Exchange.

The Standard & Poor’s 500® Index is widely regarded as the best indicator of U.S. large-cap stocks, and it is also one of the most popular American life insurance products.The most used index strategy. The SP500 index has more than 11.2 trillion U.S. dollars in index or benchmark assets, of which index assets account for about 4.6 trillion U.S. dollars.The index includes 500 leading companies in the market and covers approximately 80% of the market capitalization.Companies to be tracked are selected by the committee and must meet certain criteria before they can be added to the list of companies in the S&P 500® Index.

The SP500 index has more than 11.2 trillion U.S. dollars in index or benchmark assets, of which index assets account for about 4.6 trillion U.S. dollars.The index includes 500 leading companies in the market and covers approximately 80% of the market capitalization.Companies to be tracked are selected by the committee and must meet certain criteria before they can be added to the list of companies in the S&P 500® Index.

The constituent stocks of the SP500 index includeAmazon, Apple, Tesla, Pfizer, Disney, Google, JPMorgan & Chase, Bank of America, Berkshire Hathaway, Coca-Cola ?And other well-known enterprises.

75% of index insurance holders chose the S&P500 index. --2019Q4 LifeTank(Original report)

NASDAQ-100 Index

NASDAQ-100® – 又稱為納斯達克100指數。NASDAQ-100®是美國納斯達克交易所里100隻最大型本地及國際非金融類上市公司組成的股市指數。與標準普爾500指數不同,納斯達克100指數成份股中,There are no financial institutions. The 100 non-financial stocks in the Nasdaq 100 index are mainlyHigh-tech growth stocks with larger market capitalization, It reflects the overall Nasdaq market or the index of US high-tech trends.

The 100 non-financial stocks in the Nasdaq 100 index are mainlyHigh-tech growth stocks with larger market capitalization, It reflects the overall Nasdaq market or the index of US high-tech trends.

The Nasdaq 100 Index is the main index of the Nasdaq. Its 100 constituent stocks have high-tech, high-growth and non-financial characteristics. It is a representative of American technology stocks.

It is worth mentioning that in the Nasdaq 100 index, the good performance of these high-growth stocks is brought about by their own endogenous high growth, especially innovative businesses, rather than extensional growth such as asset injection. .Judging from the top ten weighted stocks of the Nasdaq 100 Index, they are mainly high-tech companies, most of which are companies in the computer industry, includingApple, Amazon, Microsoft, Google, Cisco, IntelAnd many well-known companies.

The Nasdaq 100 Index, together with the Dow Jones Industrial Index and the Standard & Poor's 500® Index, is known as one of the three major indexes that reflect the trend of the US stock market.

In the US market, some brands of life insurance products provide NASDAQ-100 index strategies. — LifeTank

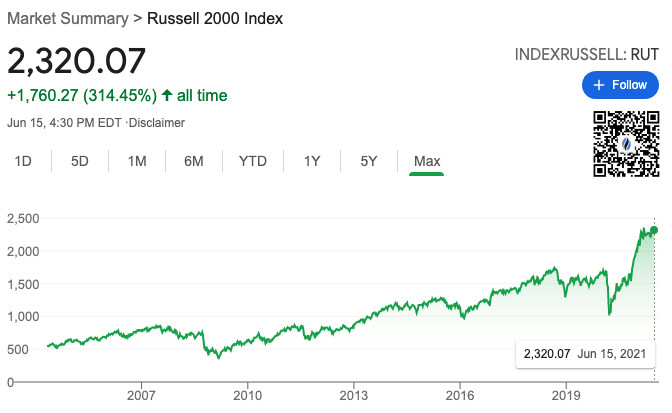

Russell 2000 Index

Russell 2000 - Also known asRussell 2000index. Russell 2000Be2,000 small market capitalizationCompanyComposition of the stock marketThe index was founded in 1984 by Frank Russell. Since the Russell 2000 index represents the market value index of small and medium-sized stocks in the market, it is generally believed that the index is a relatively comprehensive stock index that specifically covers small companies with growth potential.

Since the Russell 2000 index represents the market value index of small and medium-sized stocks in the market, it is generally believed that the index is a relatively comprehensive stock index that specifically covers small companies with growth potential.

The Russell 2000 index is highly variable.When investors are keen to invest in small capital stocks, the index performs well.

At the beginning of 2021, aGameStop, AMC, etc.The company is a constituent stock of the Russell 2000 index.

Hong Kong Hang Seng Index

Hang Seng Index – The Hang Seng Index (English: Hang Seng Index) is an important indicator that reflects the Hong Kong stock market. The index is calculated from the market value of many constituent stocks of the Hang Seng Index. The constituent stocks of the Hang Seng Index are Hong Kong's blue chip stocks.Which includesHSBC Holdings, China Unicom, Tencent Holdings, Hang Seng Bank, Alibaba Health, AIA, Xiaomi Group, China LifeAnd many well-known companies.These constituent stocks represent more than half of the market value of the Hong Kong Stock Exchange.

The constituent stocks of the Hang Seng Index are Hong Kong's blue chip stocks.Which includesHSBC Holdings, China Unicom, Tencent Holdings, Hang Seng Bank, Alibaba Health, AIA, Xiaomi Group, China LifeAnd many well-known companies.These constituent stocks represent more than half of the market value of the Hong Kong Stock Exchange.

Article summary

It’s important to note that for the above-mentioned indexes, the life insurance company that issued the product will provide aCap capped income accrual value, Different insurance products have different income caps.Generally speaking,The cap value of the income of life insurance products is higher than the cap value of the income of annuity insurance.

In addition to the most common indexes above, differentLife insurance companyWill also provide an additional exclusiveMarket volatility control index, Used to manage the risk of large fluctuations in the market and achieve long-term target yields.This practice has gradually becomeAmerican Life Insurance MarketSome of the representative indexes are:

- Bloomberg US Dynamic Balance Index II

- BNP Paribas Multi Asset Diversified 5

- Credit Suisse Balanced Trend 5%

- Fidelity AIM Dividend Index

- JPMorgan ETF Efficiente 5 Index

- ...

The common market index, coupled with the market volatility control index of different brands, gives every insured person seeking asset appreciation or wealth inheritance a full choice.even,American Life Insurance Guide©️ think,We have too many choices, or even too many, which has turned into a dilemma.This is also a life experience that does not exist in a resource-poor social environment.

Therefore, the American Life Insurance Guide website has always advocated"LBYB" principle, In the way of "knowledge interaction", select the policy asset allocation portfolio and provideInsurance College和Case evaluationFor reference to policyholders.In the actual insurance process, we also need to combine our own age, actual risk tolerance, specific retirement planning, and professionalInsurance Advisor BrokerWith the assistance of, through a detailed understanding of the performance indicators of different insurance products and the historical conditions of actual operation, rational decisions can be made to find an insurance plan that can truly protect family assets. (End of full text)

(>>>Recommended reading:Review | 2022 Best Returning IUL Index and Insurer Ranking)

(>>>Recommended reading:Comparison|Index annuity and fund annuity, which annuity insurance is better? (Version 2022))

(>>>Recommended reading:Evaluation | What is the most profound experience and lesson of the 14-year account operation record of the New York Insured Life Insurance Policy?)

(>>>Related reading:Evaluation|"Other people's home" insurance "makes 20%" a year, but why do I only have less than 10%?Demystifying the policy income under the influence of Cap )

(>>>Related reading:Knowledge Sticker|How to buy American annuity insurance?How much does it cost to receive 2 per year?)

(>>>Recommended reading:Popular science posts | How to find the best "interest rate" American annuity insurance?)