In our daily life, in fact, we often consciously or unconsciously use leverage to purchase large and expensive items: such as using bank loans to buy cars, houses, yachts, or investment properties, or even borrowing for Flip House.ThenU.S. Life InsuranceCan I use credit leverage to buy as a retirement fund?How effective is the risk stress test?

Jim, a senior life insurance broker from RFN who specializes in policy financing projects and has more than 20 years of experience ininsurGuru©️Insurance AcademyContributed to share his experience.Here is the text:

What is leverage?

In our daily life, in fact, we often consciously or unconsciously use leverage to purchase large and expensive items: such as using bank loans to buy cars, houses, yachts, or investment properties, or even Flip House.

The purpose of choosing premium financing is also to maximize the leverage effect.

How to use leverage and American life insurance policies to reserve retirement funds?

So, using the same logic above, weThe insurance policy can be used as the only collateral for the loan, borrow from the bank, and use the credit funds to pay the premium, thereby buying a life insurance policy with a larger amount of cash value. This is premium financing.The cash value in this policy can be used as a source of tax-free retirement funds.

If the leverage and policy structure are properly designed, the cash value in the policy will accumulate over time, and the cash value in the policy account can exceed the cost of premium loan financing.

3 to 1 leveraged financing plan

a typicalExponential policyThe premium financing plan is as follows:

- The insured person pays 5% of the premium each year for the first 50 years

- The borrower pays another 5% of the premium each year for the first 50 years

- From the 6th year to the 10th year, the policyholder does not have to pay any premiums

- The borrower pays the full premium from the 6th to the 10th year

- By the 10th year, the policyholder has paid a quarter of the total premium

- The interest rate is LIBOR + 1.75%~1.85%

insurGuru©️Insurance Academywill beNext article on policy financingIn the column of, show a detailed insurance policy case.

Risk stress test of insurance policy financing

When we determine whether the premium financing strategy is suitable, we need to understand the performance of the strategy in the market.The purpose of the stress test is to evaluate how the two factors of "policy assets" and "policy loans" interact with market changes.

The purpose of simulating these stress conditions is to help us answer the following questions:

A. Can the average annual interest obtained by the index policy exceed the cost of the loan (using the actual example of the market index in the history)

B. If there is a Great Depression in the future, how will my policy perform?

C. If the future interest rate is as high as in the 1980s, what will be the cost of my loan?

D. How long does it take to borrow money to put into the insurance policy before paying off the loan?

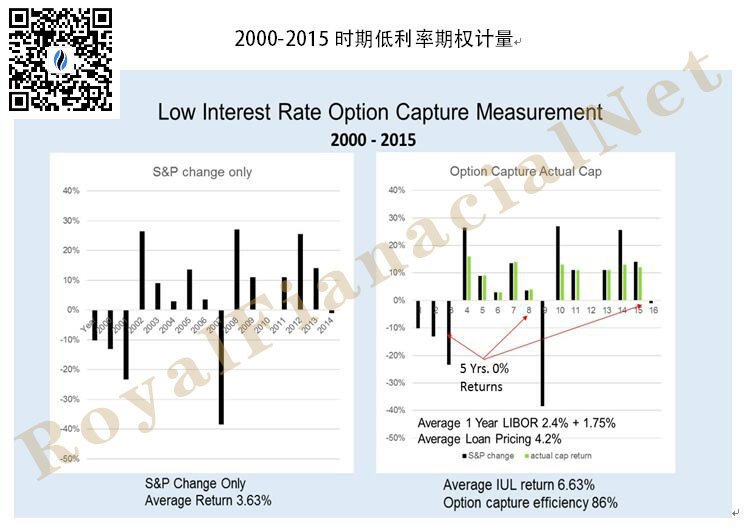

A. During the 2000 years from 2015 to 15, we can see from the chart above that we can use bank funds continuously for 15 years (average annual interest equals 2.4% + 1.75% = 4.15%), and the annual average policy income is 6.63%, which is greater than each year The interest on the funds borrowed from the bank can be repaid by the customer in the 15th year, and the customer can fully own the cash value in the insurance policy.

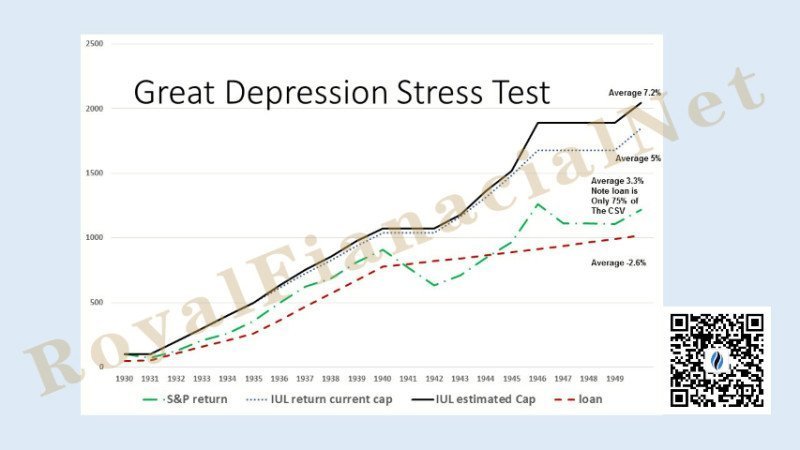

B. What we need to do next is to isolate the severe economic period of policy growth and see how this affects the design.We simulated the Great Depression, because from 1930 to 1935, our insurance policies would only grow by 0%.If we look at the 15-year time frame, 15 out of 9 years will have a policy return of 0%.So we asked, how does this compare to the cost of borrowing during that time?

When looking at this chart, we found that the policy was finally restored and there were sufficient funds to repay the loan and obtain additional policy benefits.This truly tells us that there is no need to panic even during the most depressed period of the economy, because history tells us that no matter how short the market rises and falls, over time, market confidence will eventually recover.

In this test, we usedIndex insurance, Using predicted interest rates and rates.The loan interest rate uses the average of the New York and St. Louis Fed reserves and adds +1.75%.

At the same time, because a higher interest rate will result in a higher policy cap, we use the current Cap cap value of the policy.The cap value may vary depending on the product or policy strategy and other complex factors.The calculation of S&P's rate of return only compares the changes in the S&P index, and does not calculate dividends.

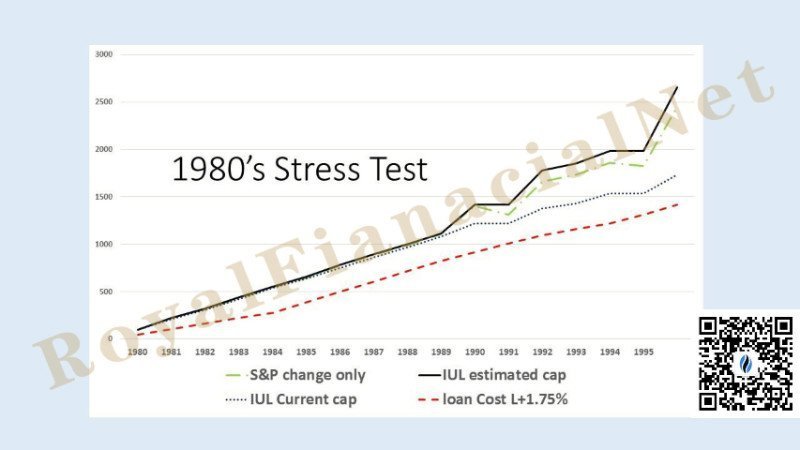

C. The interest rate surge in 1980

Looking back, the worst time to borrow money was in the early 20s, when borrowing costs soared to 80%.Our simulated insurance policy financing strategy plan showed that the stress test was also passed during this period.The growth rate of the policy cash value of this strategy was able to keep up with the higher borrowing costs at that time and eventually surpass the borrowing costs.

When observing the above chart, we found that the planning strategy ultimately has sufficient funds to repay the loan and obtain additional policy benefits.The stress test during this time period tells us that although the market has risen and fallen, from a long-term historical perspective, the market will always resume growth over time.

When observing the above chart, we found that the planning strategy ultimately has sufficient funds to repay the loan and obtain additional policy benefits.The stress test during this time period tells us that although the market has risen and fallen, from a long-term historical perspective, the market will always resume growth over time.

D. How long does it take to borrow money to put into the insurance policy before paying off the loan?

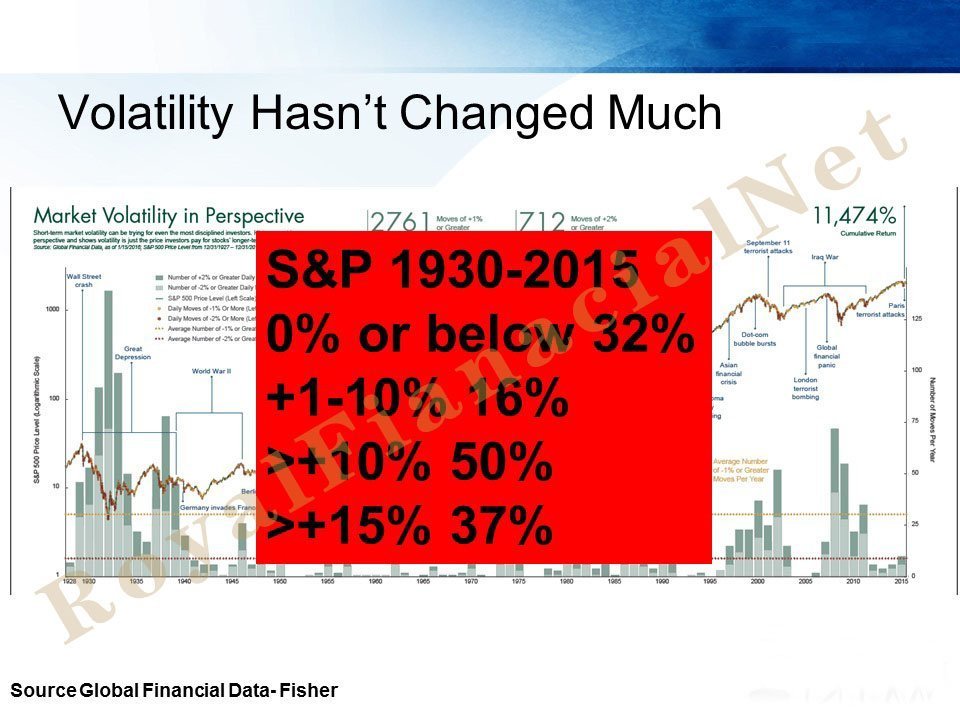

Finally, due to the ups and downs of the market, we want to know how long it takes to regulate the impact of fluctuations.We believe,A successful strategy requires a time span of at least 15 years.

Although running these historical stress tests does not guarantee what will happen in the future, the simulation evaluation of the premium financing strategy shows that this strategy can still achieve the goal of the customer's original strategy in each bad economic period in history.

Can I do premium financing?What are the conditions?

The following are the conditions for meeting the premium financing, involving the coverage, age range, income requirements, and related rights and interests, etc., and are only for reference by subscriber accounts.

Article summary

The policy premium financing strategy is a professional and powerful tool-based financial strategy. The entire process involves banking departments, trust management agencies, legal service agencies, tax service agencies, financial insurance companies, andLife insurance brokerSuch multi-party collaboration has a relatively high degree of complexity and specialization.However, if this strategy is used correctly, it will help policyholders to obtain extremely high benefits and protection at the same cost.If readers meet the basic conditions of premium financing and have requirements in this regard, please be sure to seek professionalLife insurance brokers help.

(>>>Recommended reading:Comparison of advantages and disadvantages and risk evaluation of family supplementary retirement income plan through premium financing )

American Life Insurance Guide insurGuru©️Insurance Academy will be inNext columnIn, continuePolicy financingFor evaluation of actual cases, insurance brokers and industry financial advisors are also welcome to contact us to discuss research solutions.

Click to visit:Case Study of USD Asset Allocation Financing (XNUMX): How much more can I get after large-sum insurance policy financing?

(Edited and released by the American Life Insurance Guide Network)