(美國人壽保險指南網 08/09/2019 訊)權威聯邦機構 NAIC(全美保險專員協會)在2019年7月25日,發布了對美國人壽保險公司2018年度的財報統計報告。通過對報告的解讀,insurGuru©️Insurance AcademyHope to help policyholders understand the answer to this question.

Life insurance company's asset portfolio

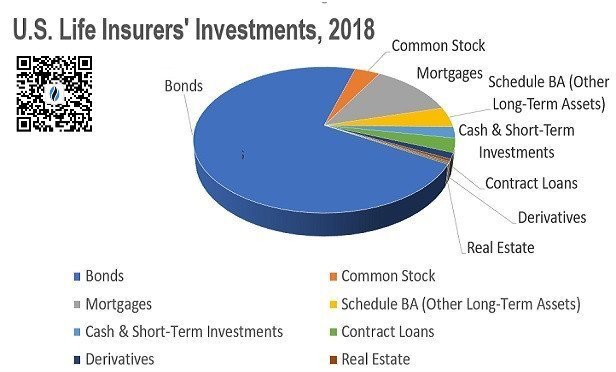

The report reveals that as of the end of 2018,American Life Insurance CompanyThe proportion of the investment portfolio is shown in the figure below:

The report stated thatLife insurance companies in the United States still use more than 3/4 of the money to buy bonds.But this year, investment in mortgage loans has grown rapidly (the gray part of the chart above).

As of 2018, the United StatesLife insurance companyA total of $4.2 trillion in cash and investment assets are held, an increase of 2017% from 1.3.

Bonds held by life insurance companies rose just 0.6% to $3 trillion.

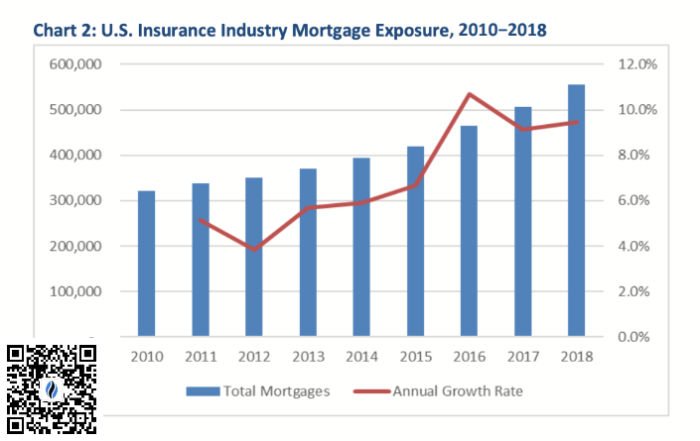

The growth driver is mortgage investment

American LifeInsurance companyInvestment in mortgage loans increased by 9.3% to $5220 billion.The increased mortgage investment of $440 billion is equivalent to approximately 17 households’ home loans.

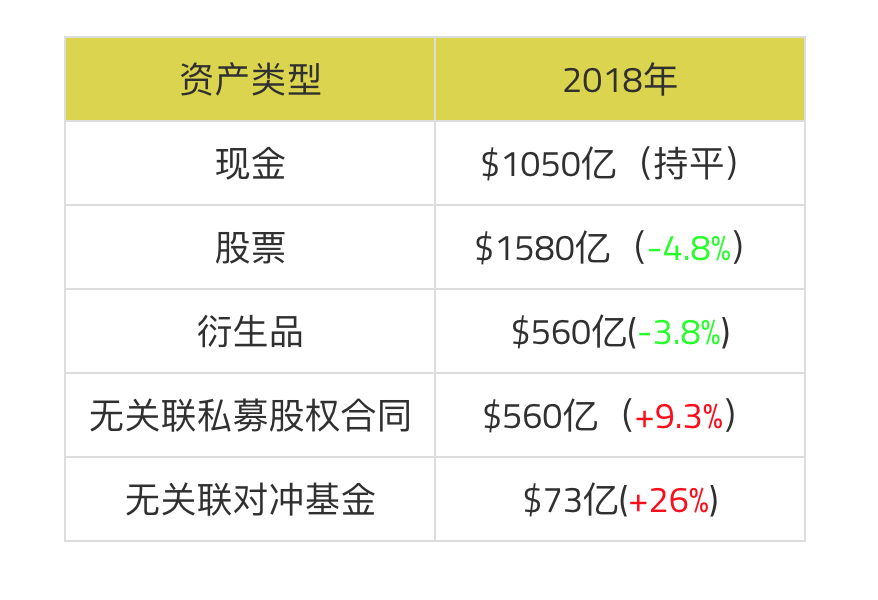

The following is a table of other asset holdings of American Life Insurance Company at the end of 2017 and 2018:

The following is a table of other asset holdings of American Life Insurance Company at the end of 2017 and 2018:

NAIC expert Michael Wang pointed out that due to the long-term low interest rate situation,American Insurance CompanyForced to consider buying assets instead of corporate bonds.

NAIC expert Michael Wang pointed out that due to the long-term low interest rate situation,American Insurance CompanyForced to consider buying assets instead of corporate bonds.

"Although these types of assets generally have higher yields than listed corporate bonds, they are less liquid, less transparent, and price volatile."

Life insurance companies pay more attention to long-term benefits

The business of life insurance companies is mainly to provide customers withLong-term protectionTherefore, life insurance companies themselves rely heavily on long-term investments—especially investments in bonds—to support their products.

The report pointed out that life insurance companies in the United States account for approximately 94% of the total mortgage loans held by all types of insurance companies in the United States.Life insurance companies in the United States account for 70% of the total bond holdings of all types of insurance companies in the United States.

Partly due to the requirements of insurance regulatory authorities, the funds invested by life insurance companies in common stocks are far lower than that of property and accident insurance companies.

By the end of 2018, American property and casualty insurance companies had invested $5830 billion in common stocks, while American life insurance companies had invested only $1580 billion in common stocks.

>>>Recommended reading:Why can index insurance IUL follow the rise but not fall, and what is the investment principle behind it?

(American Life Insurance Guide Edit report)

appendix:

01."Growth in US Insurance Industry's Cash and Invested Assets Slows in 2018", 07/25/2019, NAIC, https://bit.ly/2Kzrrhl