With economic globalization, it is obvious to all around the world that Chinese people are getting richer and richer.More and more Chinese are going abroad, leading "haitao" to become a trend, talking about quality and cost-effectiveness, or bringing back some items that cannot be bought in China.And the shrewd Chinese will certainly not let go of life insurance as an important part of family financial management.

I don’t know when, many smart and rich people have quietly focused onAmerican Life InsuranceAbove, as the first choice for dollar asset allocation, large-amount life insurance policies have become their secret possession.thatBenefits of American life insurancewhat exactly is it?What is so good about American life insurance?This article will explain in detail.

Why choose life insurance in the United States?

Benefit 200. After more than XNUMX years of precipitation in the US insurance industry, the operation is extremely standardized and there is no risk of bankruptcy.

The biggest benefit of American life insurance is the maturity of the industry.Speaking of life insurance in the United States, it is a long story. From the birth of the first insurance policy in 1762 to the 21st century, there has been a history of more than 200 years. It can be said that American insurance is a mature and developed market.

The United States implements a dual regulatory system of the federal government and the state government for the insurance industry. The federal government and the state government have their own independent insurance legislative powers and management powers.Every product of every insurance company needs to pass the approval of dozens of state regulatory agencies before it can be put on the market.

American insurance supervision mainly includes ensuring that insurance companies have the financial resources to fulfill their insurance commitments. The insurance laws of each state stipulate the statutory minimum capital and surplus standards for the establishment of insurance companies. When the capital and surplus of the insurance company do not meet the minimum standards set by the state, the regulatory agency will Intervene.For those who cannot bear the risk, reinsurance companies are still responsible. This double insurance mechanism is reassuring. Therefore, insurance companies in the United States have not gone bankrupt so far.In addition, there is market behavior supervision to ensure that prices, products and transactions are reasonable and fair.

Benefit XNUMX: U.S. insurance premiums are the lowest in the world

One of the great benefits of American life insurance is that the premiums are the lowest in the world.The U.S. insurance industry has a long history, and it also means fierce competition. According to statistics, there are currently more than 800 insurance companies in the United States. Such a high number of insurance companies makes U.S. insurance premiums the cheapest in the world.In horizontal comparison, under the premise of the same amount of insurance, the maximum difference between the premium of the US policy and China is as high as 5 times, and that of Taiwan is 2 times. What is the concept?In other words, under the same conditions, the premiums in the United States are only one-fifth of China and one-half of Taiwan's! (Related premium comparison reports)

The life cycle table adopted by American life insurance is up to 125 years old. Coupled with a stable investment environment and transparent investment channels, under the influence of these factors, insurance costs are lower, so insurance premiums will be relatively cheaper.

Benefit three, IUL insurance product concept is advanced, not in Asia

The third benefit of American life insurance is that the concept is leading the world.If you buy life insurance in Asia, the products are nothing more than term life insurance, lifetime life insurance, and savings-sharing universal insurance.In addition to these three in the United States, there areIndex Universal Insurance和Investment universal insurance.For customers in Asia, these products have not yet appeared.

Index universal insurance is a kind of guaranteed investment insurance. The advantage is that it can obtain the same return from the stock market without losing money. Therefore, it has won the favor of more and more Chinese.At present, such advanced products have not yet appeared in the Chinese market.

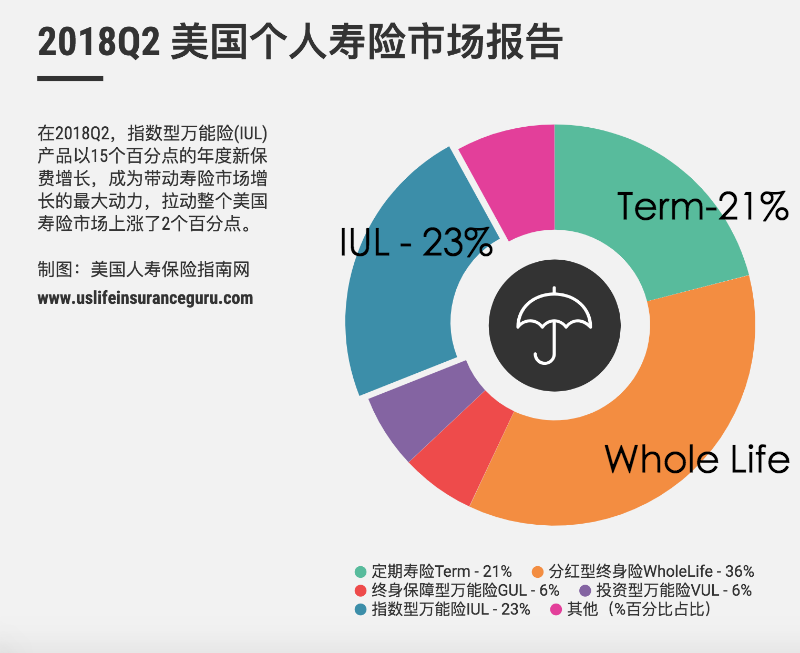

According toLIMRA's latest data, Indexed Universal Life Insurance (IUL Indexed Life Insurance), the product with the largest growth rate in the US financial industry, has occupied most of the US insurance market and is the most mainstream life insurance product in the US.

Benefit XNUMX: American insurance emphasizes reputation, and insurance claims are simple

Another advantage of American life insurance is that it emphasizes credibility and is easy to settle claims.As mentioned earlier, American insurance companies have experienced more than 200 years of precipitation, and many American insurance companies are veritable "century-old shops."Standard words and timely settlement of claims, do not play word games, it is natural for people to die and lose money.It has never happened in the United States that insurance companies make excuses for not paying or deliberately delaying the settlement of claims. If there is a dispute over the settlement of claims, the law will definitely favor the insured.Most insurance industries in Asian countries have only a few decades of history.Especially life insurance, from this point of view, is not comparable to the American insurance industry.

U.S. insurance implements a policy of "strict advancement and lenient treatment". Generally, underwriting is relatively strict, which takes a long time, but it is very efficient in compensation.The procedure for claim settlement is very simple in the United States. You can apply for claims as long as you submit a death certificate and a death claim application form.On the other hand, some Asian countries are relatively unskilled in the claim settlement system because of the relatively young development of the insurance industry. In addition to providing a lot of original materials for claim settlement applications, the phenomenon of denial of settlement often occurs.

Benefit five, diversify investment in value-preserving property

The fifth advantage of American life insurance is that it can "hide money."Eggs cannot be put in the same basket at the same time. Many people understand this strategy. Of course, those savvy rich Chinese are very skillful. As a channel to diversify investment, buying American insurance is the most basic and most secure way.Moreover, the latest type of life insurance, which is only available in the United States, also has investment functions. It is flexible to deposit and withdraw money. Another advantage is that it can be withdrawn 100% tax-free.

in addition,American Life InsuranceThe cash value of the above is not subject to lawsuits and is protected by judicial immunity.

Benefit six, insurance claims can also be used to offset inheritance tax

The sixth advantage of American life insurance is that it can hedge inheritance taxes.Many Chinese come to the U.S. to buy a house based only on the price and location, but many people may not know that after the death of a non-American, his investment in U.S. assets or real estate inheritance tax is only $6, and the tax rate for the portion exceeding this $6 is as high as 40%. After a person passes away, he must pay the inheritance tax in cash within 9 months before he can inherit the property.But if there is life insurance, this worry does not exist.

In addition, wealthy and far-sighted families in the United States usually use life insurance to help their children save.The government allows $14,000 per year to be exempted from reporting.Some parents and grandparents can use this opportunity to help young children buy insurance savings, plan for wealth to be passed on to the next generation, and wait until the old age to raise the cash value and have a basic quality of life guarantee.

Recommended reading: Buy a house or buy insurance?Investment strategy comparison column

Benefit XNUMX. Effectively evade CRS

The seven major benefits of American life insurance are tax avoidance.For non-U.S. residents, a strong advantage of U.S. insurance isCRS.Since the United States has not joined the CRS, foreigners’ insurance accounts in the United States do not have to worry about getting information from the tax authorities of other countries.

There are so many benefits and advantages of American insurance, but not everyone is suitable for buying American insurance. After all, American insurance has certain threshold requirements.

But for the following 7 groups of people, American insurance is indeed a good choice:

1. People who need overseas asset allocation and avoid CRS

For friends who have high-value assets overseas, an alternative method is to transfer the assets to a country that is not in the CRS exchange country, such as the United States.Investment products in the United States are very diversified. As a financial product, insurance is the simplest to configure. It not only has high security, but also has the functions of high leverage and high yield. Not only will wealth not shrink, but it will greatly increase.

2. Immigrating to American families

For families who have immigrated to the United States, American insurance is an out-and-out rigid demand product. From medical treatment and retirement to rational use of life insurance to avoid high inheritance taxes, insurance is indispensable in every link.

3. Families who intend to immigrate to the United States

For customers who are considering immigration, they should plan their insurance earlier, rather than rush into the United States after landing.If you don't, you will be abolished.In particular, American life insurance should plan before immigration, so that you can handle tax and wealth inheritance issues more easily in the future.

4. Families of American international students

As the world's largest educational country, the United States attracts tens of thousands of students to join the army of studying abroad every year.In fact, if you have children studying in the U.S., you can also give your parents extra points when applying for U.S. insurance, making it easier for parents to pass underwriting when buying U.S. insurance. After parents purchase insurance, they can choose to pass on their wealth tax-free to their children. You can withdraw U.S. dollars in cash to provide your children with entrepreneurial funds and wedding expenses, killing two birds with one stone.

5. Families going to the U.S. to have children

More and more families have traveled far and wide to choose to go to the United States to give birth, in fact, to give their children an extra life choice in the future.The United States undoubtedly has the best educational resources in the world, but the high tuition fees also discourage many people.MEBO family can useAmerican InsuranceWith the high-yield characteristics, buying a U.S. life insurance policy not only gives the family an extra protection, but also can withdraw the money in the future to fund the children's education.And after one hundred years of his own, he can also leave a large amount of compensation for his children to achieve a completely tax-free wealth inheritance.

(>>>Recommended reading:Can children and newborn babies buy life insurance in the United States?What kind of insurance should I buy?What are the advantages and disadvantages of buying life insurance for children?)

6. People who want to buy high insurance coverage

In fact, many high-net-worth customers are usually pursued by major insurance companies, but once these high-net-worth customers really decide to insure high-density insurance policies, domestic insurance companies will find it difficult to undertake the next step, and they often need to jointly underwrite with multiple insurance companies. The process is complicated and the physical requirements of the insured are extremely high, and the final result is often time-consuming and laborious, and the underwriting cannot be passed.

In comparison, American insurance companies are much more capable of underwriting high-value insurance policies. A single insurance company can insure Chinese residents about 1500 million U.S. dollars, which is about 1 million yuan. Underwriting only requires regular medical examination + financial certification. Just letter.And even for higher insurance coverage, there are corresponding solutions.

In addition, the advantage of low premiums in the United States is even more prominent in large-value insurance policies.Therefore, high-net-worth individuals need to insure large-value insurance policies. Whether in terms of cost performance or underwriting conditions, American insurance should be one of the first choices.

7. People who want to buy the cheapest insurance

American InsuranceKnown globally for its high cost performance, men in their thirties can fully achieve a leverage ratio of more than 10, that is, they can buy more than 100 million US dollars in insurance with a premium of 1000 million US dollars.The advantage of low premiums in the United States is even more prominent in large insurance policies.thereforeHigh-net-worth individualsIf you want to insure a large amount of insurance policy, no matter from the comparison of cost performance or underwriting conditions, American insurance should be one of the preferred products.

In the face of interest rate hikes in the U.S. dollar and depreciation of the renminbi, more high-net-worth individuals are looking for tools for family wealth management and risk management abroad.American InsuranceAs a financial product that combines these two functions, it is naturally the best configuration choice.