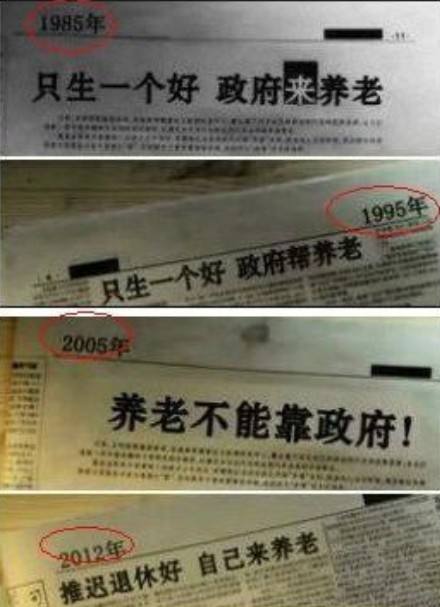

Today’s topic starts with a picture commented on by the People’s Daily:

from"Only give birth to a good one, and the government will take care of it"(1985) to "Only give birth to a good one, the government helps to provide for the elderly"(1995), to "Don't rely on the government for old-age care"(2005), then to "It’s better to postpone retirement and take care of yourself"The screenshots of the above series of newspapers circulated on the Chinese Internet are a very representative historical change and have also caused countless complaints from people who eat melon.

from"Only give birth to a good one, and the government will take care of it"(1985) to "Only give birth to a good one, the government helps to provide for the elderly"(1995), to "Don't rely on the government for old-age care"(2005), then to "It’s better to postpone retirement and take care of yourself"The screenshots of the above series of newspapers circulated on the Chinese Internet are a very representative historical change and have also caused countless complaints from people who eat melon.

After more than 20 years of persevering in the operation of dumping the pot for the elderly, the editor has to admire such a godly operation...

So in the U.S. Empire, what is the routine of the U.S. government?Can we count on the social security pensions of the U.S. government to live on? Today, let’s take a look. In the U.S.,Can Retirement Relying on the GovernmentThis pit.

So in the U.S. Empire, what is the routine of the U.S. government?Can we count on the social security pensions of the U.S. government to live on? Today, let’s take a look. In the U.S.,Can Retirement Relying on the GovernmentThis pit.

First of all, the regulatory documents of the U.S. imperial government make it very clear that in order to receive a social security pension, you need to meet the requirements for receiving a social security pension.

we are at""Four Points" New Immigrant Families Must Know to Get Retirement Benefits in the US "This column has a detailed explanation. In one sentence, no matter who you are, you have to work and pay taxes for 10 years.

Secondly, just meeting the conditions is not enough. The amount of social security pension you can receive is linked to the amount of tax paid when you work.

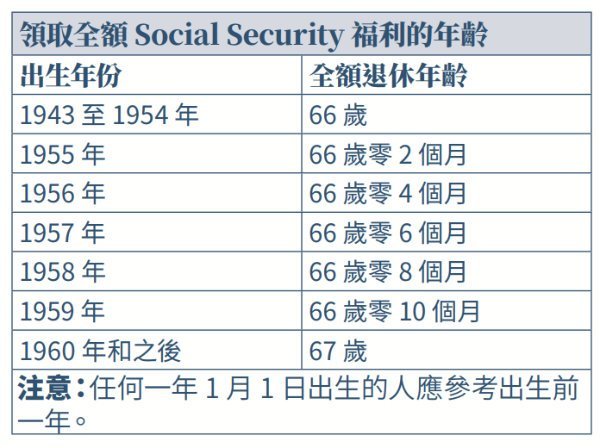

At last,"It’s better to postpone retirement and take care of yourself"The U.S. government is playing even more slippery way. The retirement age will directly determine how much money you can get from the social security pension.

The simple and straightforward official statement is, that is to say, even if you step into the threshold of receiving social security pensions, how much money you can get, there are still conditions.

The picture below is an official Chinese chart issued by the US Social Security Bureau. The current situation is that for people born in 1960 or later, if you want to get the full pension, you have to work at least until the age of 67.

However, it is not the point, nor the point, to get a full pension until the age of 67.

However, it is not the point, nor the point, to get a full pension until the age of 67.

The following part can completely dispel your illusion of "relying on the U.S. government for old-age care": In 1974, the U.S. government passed the "Employee Retirement Income Security Act" (ERISA), which made it clear that social security, including old-age care, is not the government alone. The government cannot take over everything, but the joint responsibility of the government, employers and individuals.

Key words:

"It's not the government's business"

"The government cannot do everything"

"Personal Shared Responsibility"

Since the U.S. imperial government wants to throw away the old-age pension, what is the purpose of social security and old-age security?

The official explanation made it very clear that this is an insurance for all people. The U.S. imperial government provides basic protection and benefits to U.S. retirees and people with disabilities.

At the same time, the U.S. imperial government repeatedly emphasized,Please do not completely expect social security pensions to provide for the elderly, please do not completely expect social security pensions to provide for the elderly, please do not completely rely on social security pensions to provide for the elderly,We are just "guarantee."

If you are surprised, then we use the data to speak. According to the latest data released by the U.S. Social Security Administration in 2018, the median monthly pension received by Americans from social security payments is only$1,461.And this figure is basically the monthly salary limit of the lowest hourly-paid employee in California.Imagine that a retired old man who still needs to pay for medical insurance costs only getsStateLife at the minimum wage level will be so difficult.

If you are surprised, then we use the data to speak. According to the latest data released by the U.S. Social Security Administration in 2018, the median monthly pension received by Americans from social security payments is only$1,461.And this figure is basically the monthly salary limit of the lowest hourly-paid employee in California.Imagine that a retired old man who still needs to pay for medical insurance costs only getsStateLife at the minimum wage level will be so difficult.

Since there was a law as early as 1974 that clarified the line of responsibility, the old-age pension is not a government business, so I want toDecent retirement, No one can help you, it's all on your own.

The next question is, on our own terms, what choice do we have?What are the retirement income channels that can allow us to plan and build as soon as possible?

(>>>Recommended reading: gadgets|The American Personal Pension Smart Calculator, how much do I need to save every month?)

RetireGuru©️ Retirement College subdivides common post-retirement income channels, which are mainly composed of the following 7 types:

- Social Security Pension Income

- Annuity income

- Securities investment income (stocks, mutual funds, bonds, ETFs, etc.)

- Life insurance policy income

- Real estate or rental income

- Retirement account income (Qualified or Non Qualified)

- Home reverse loan income

The income sources of most of you and me after retirement come from these 7 different channels.Each type of retirement income has its own advantages and disadvantages, and it is also suitable for different groups of people.There is no way that is absolutely better than another.

Especially for the immigrant groups of a certain age, since they have entered a completely different social system halfway, there is not much time left for us to understand and integrate into this system.

In the process of participating in life, after a certain period of time, some immigrant groups will find that the operation of some life systems is completely different from the original concept, and it is easy to be in a passive position.

As we analyzed above, even if the new immigrant groups who join the "game" halfway in order to meet the most basic requirements of social security benefits, they may have to pay a higher "cost" than other groups who have automatically entered the rules since they were young.

Therefore, abandoning the illusion of "relying on the government for the elderly", understanding the real rules of the social game, making correct plans for personal and family finances as soon as possible, and achieving the goal of "reliance on the elderly and medical care for the sick" is actually a matter of fact. Very urgent matter.

And the point we share this article is,Starting from the planning of retirement income, establish the concept of relying on one's own for the elderly, and introduce 7 different ways of income after retirement that are common in American society, so as to help readers understand this goal-oriented, top-down, and integrated financial Conditions, age, risk tolerance and other factors, carry out a combination of retirement income planning concept.

After understanding these income channels, we can combine our actual life and income situation, compare the advantages and disadvantages of different channels, and build our own as soon as possible.Retirement Income System, And began to make this system work.

The recommendation of RetireGuru©️ Retirement College is to have at least three of the effective sources of income before retirement or when planning to retire early.

After reading this article, do you feel that the issue of retirement care is really far away from you? (Full text ends)

>>>Click to enter [Retirement Annuity Self-Service Plan Design]<<

(>>>Related reading:Column | "What to do?" Mr. Annuity Vol.12 )