In response to "Supplementary retirement income"with"asset Management"Is the target area,American Life Insurance GuideWhat the community has always used is "Open a life insurance account"Such an expression, not "Buy life insurance"Such a simple statement.

American Life Insurance GuideCommunity columnist Ben, With his unique point of view, on the three types ofLife insuranceWere compared.Through this comparison process, we hope to help readers understand,Why don't we say "buy insurance", And only use the expression "open a life insurance account".

1. Savings and dividend policy account – WholeLife

以New York Life Insurance CompanyFor example,Savings and Dividend InsuranceIs important for the companyLife insuranceproduct.

The process of purchasing the company’s savings and dividend-type life insurance policy by the insured is the most vividmetaphorYes, the policyholder first opened a financial account in New York Life, and then deposited premium funds, tacitly "buying" "shares" in the company of New York Life1.

Insuring this type of insurance,It means that the two steps of "opening an account" and "selecting the investment target" are combined into one.

Since then, life insurance companies have obtained income through the operation of the premiums raised.The annual financial status of a life insurance company is directly linked to the annual dividends that policyholders can get.The annual dividend amount is also determined by the life insurance company, which is also the origin of the name "dividend insurance".

Key words:The dividends of the income of the insurance policy are only related to the operating conditions of the life insurance company underwriting.

Market share of 2020Q1 savings and dividend insurance policies:35%

(>>>Recommended reading:Statistics|What type of life insurance are Americans buying in Q2020 1 )

2. Index policy account-IUL

Take GermanyAllianz Insurance GroupFor example, the core life insurance products of the North American branch of the group areIndex insurance.

The policyholder purchases the index life insurance policy product issued by the company, which is equivalent to the policyholder opening a financial account in this financial institution. Allianz Life Insurance Company of North America provides account holders with a variety of index strategy options.

The policyholder needs to make a choice: which index strategy should be placed in the funds deposited in the policy account.This selection process is similar to the "stock selection" of buying stocks.

The policyholder needs to make a choice: which index strategy should be placed in the funds deposited in the policy account.This selection process is similar to the "stock selection" of buying stocks.

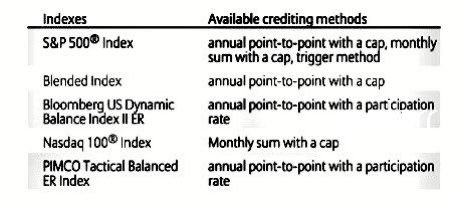

Different life insurance companies provide different index strategies for policyholders to choose in their respective index insurance product accounts.

In the whole process, "opening an account" and "choosing an investment strategy" can be seen as two sequential steps.

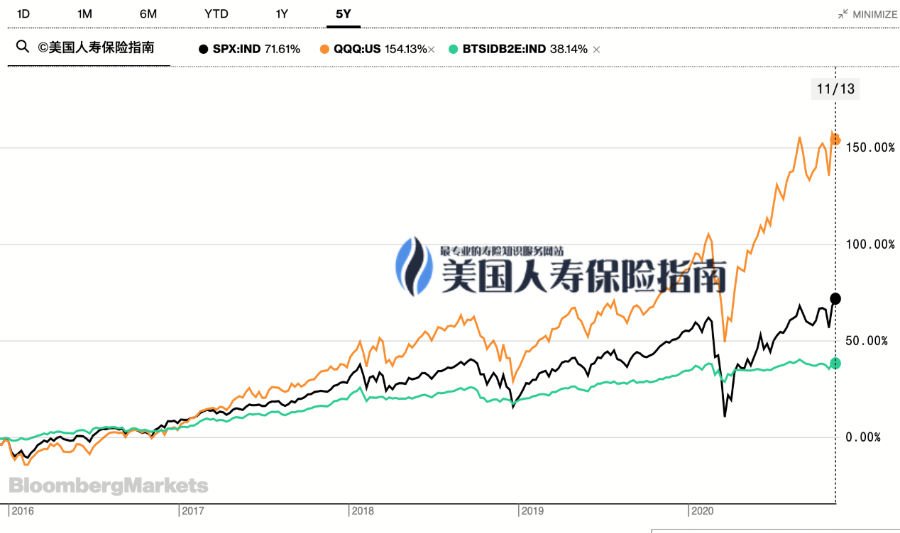

As shown in the figure above, there are five indexes provided by Allianz Life Insurance Company for policyholders to choose from. The figure below shows the five-year average market trend of some indexes.Life insurance companies will be based on different indices,Provide additional functional strategies.

“0%保底”的默認計息率,是指數型保單賬戶的特點。2020年12月過後會有部分產品提供0.9%-1%的保底策略。

Key words:The interest calculation of the policy is linked to the performance of the public market index and the choice of the policyholder.

Market share of 2020Q1 index policies: 27%

(>>>Recommended reading:Popular Science|What is the cap rate of return Cap of American index insurance?What good is it for me?)

3. Investment-linked insurance policy account-VUL

VUL insurance, also calledInvestment-linked insurance, The market share increased from 6% to 7%.We arePacific Life InsuranceTake a certain VUL product under the company as an example.

The purchase of this investment-linked life insurance policy account by the insured means that the insured first opens an account in this financial institution.Since then, in this account, Pacific Life Insurance Company has provided a series of funds and investment products to choose from.

At this time, the policyholder needs to choose the investment target of the premium funds. The whole process is similar to the "stock selection" of buying stocks.

"Opening an account" and "selecting investment targets" are also steps before and after.

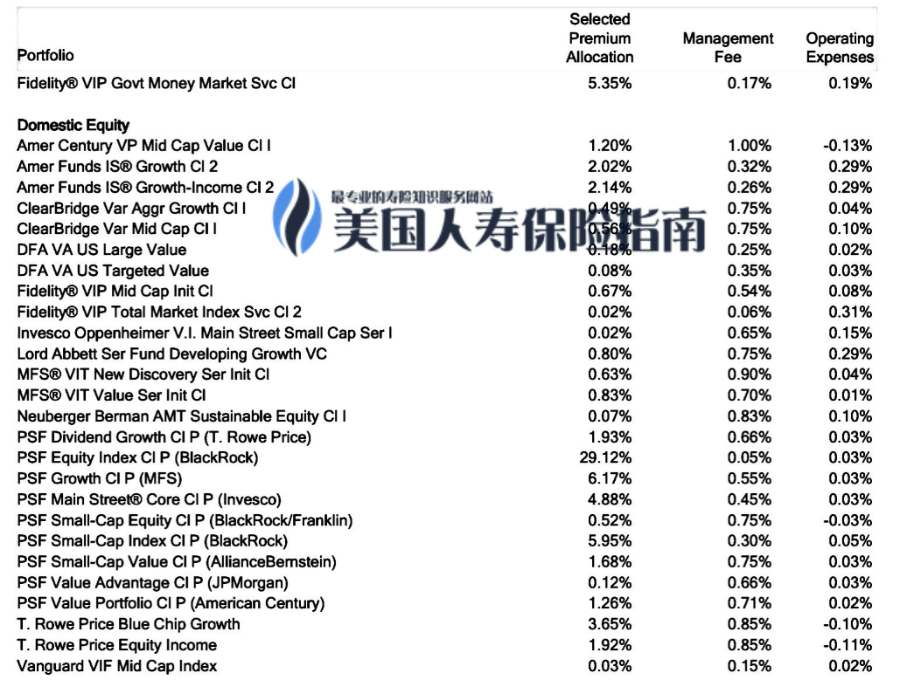

Different life insurance companies provide different choices of funds or investment products in their investment-linked insurance policies.As shown in FIG,On the left are the investment products that can be selected in the policy, The right side shows the different investment productsRelated management fees.

Different life insurance companies provide different choices of funds or investment products in their investment-linked insurance policies.As shown in FIG,On the left are the investment products that can be selected in the policy, The right side shows the different investment productsRelated management fees.

More policy cash value potential is a feature of investment-linked policy accounts.

Key words:The income of the insurance policy is linked to the performance of the investment target or the fund, as well as the choice of the policyholder.

Market share of investment-linked insurance in the first quarter of 2020: 7%

Article summary

American cash value life insurance is a powerful financial product.Different types of life insurance, similar products issued by different life insurance companies, have different features and cash value growth potential.

Reasonably use and play these features and potentialsTo help us realize the "Retirement income"with"Inheritance of wealth"The goal is our reason for applying for a cash value life insurance policy.

(>>>Recommended reading: Strategy|What are the 5 financial goals that life insurance can help us achieve?)

From the unique point of view of the author of this article,Applying for a cash value life insurance account is actually the same as opening a 401(k) account, IRA account, or even Robinhood stock trading account.

Finally, end the topic with the sharing of a netizen.

This netizen said he went to Robinhood account today"Recharge"$15 USD. The term "recharge" is very vivid. Our cash value life insurance account also needs to "recharge" premiums, but while "recharging", don't forget to learn and understand where the income of the policy account comes from.

(End of the article)

appendix

1. The Whole Life products mentioned in the article refer to Participating Whole Life.