For life insurance companies, it's all about "risk" business.

When we apply for life insurance, the premiums we pay regularly will be collected by the insurance company together with the premiums of other customers and put into aasset portfolioTake care of it to pay for the insurance money that it needs to pay.

The insurance company accepts the risk that a client may die earlier than expected, and thus fails to collect sufficient premiums from this client's policy.

(>>>Related reading:Popular Science Post|What is the asset portfolio of an insurance company?Where do our insurance premiums end up?)

An example of a claim

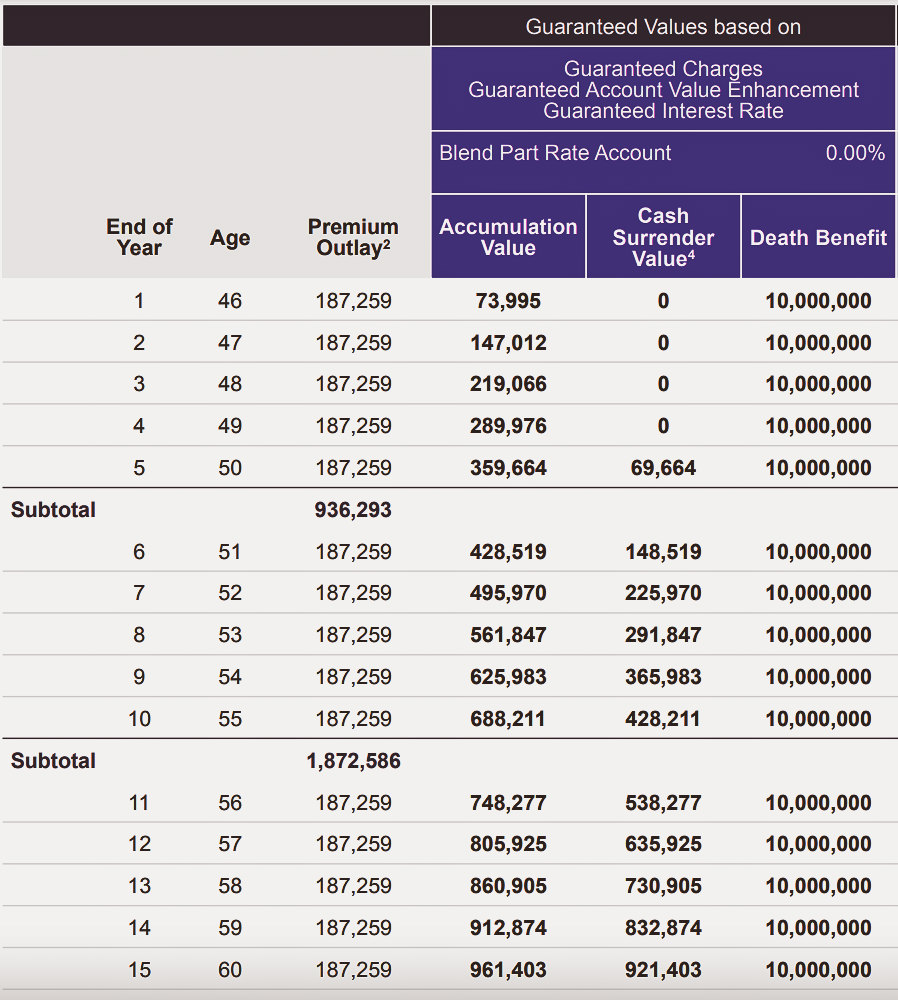

For example, a young 45-year-old woman applied for a claim amount of1000 USDwhole life insurance.

As shown in the figure below, the annual target premium given by the insurance company is more than US$18.

The above picture is not a contract, nor is it used to promise or predict actual performance. It is only used to illustrate the meaning of "underwriting" in this article.

The above picture is not a contract, nor is it used to promise or predict actual performance. It is only used to illustrate the meaning of "underwriting" in this article.

If she dies in the second year, the insurance company will pay her family a $2 million death benefit.

Let's do the math, for the insurance company it only charged for two years,A total of about $38 in premiums, but $1,000 million has to be paid.

In the event of a large number of customers passing away prematurely, the risk that an insurer may face is,The money to be lost may exceed the premiums collected and other investment income.This, during the COVID-19 novel coronavirus, inThe Life TankRecord-setting claims data for U.S. life insurersnews reportbe reflected.

That's why insurance companies go out of their way to understand policyholders' health risks and price each policy accordingly—This process is called "underwriting".

(>>>Related reading:Breaking the century-old claims record, American life insurance companies pay death benefits to a century-old high )

Factors that affect premiums are:

- Health status: age, smoking status, personal medical history (eg, cancer, cardiovascular disease, diabetes), family history (eg, cancer, cardiovascular disease, diabetes), blood pressure, cholesterol, weight

- Lifestyle: Alcohol and drug use, criminal record, driving record, hazardous occupations, private flying

- Policy type: claim settlement type, wealth management type, or hybrid hybrid type

Explanation about underwriting:

Our premium pricing will depend on the following:

- Type of insurance applied for

- Claimed death benefit amount

- How risky the insurance company thinks we are

When applying for life insurance, we are required to provide a detailed health history and usually undergo a short medical examination.

Even if it is an application for exemption from medical examination, the insurance company may require or directly query our medical records through big data, ask and judge lifestyle behaviors that may affect our life expectancy, such as drinking or not, or drug use or risky hobbies, such as Skydiving, diving and more.

A life insurance underwriter will review all of this information to determine how risky we are.Then they will decide whether to approve the insurance application. If the application is approved, the underwriter will determine the premium we need to pay.

In this link,Life insurance broker和Life Insurance Financial AdvisorNot involved in the "approval" and "pricing" process.

Existing health conditions will not affect our application for insurance, but it is very important to be honest when filling out the application and answering health questions.

Article summary

Life insurance is simple and straightforward, and most of us understand the value of a policy—paying premiums to the insurance company while we live, and protecting our loved ones financially when we die.

Many people just don't understand why premiums vary so dramatically from person to person.Everyone's insurance choice, health status and lifestyle may affect the cost of life insurance premiums.

In this article, I explain the many factors involved in evaluating and pricing life insurance coverage, a process known as "underwriting."From the perspective of an insurance company, in addition to ensuring the economic and health status of the policyholder, the insurance company must also ensure that it can fulfill its promise to pay customers at any time and maintain sufficient capital reserves (full text).