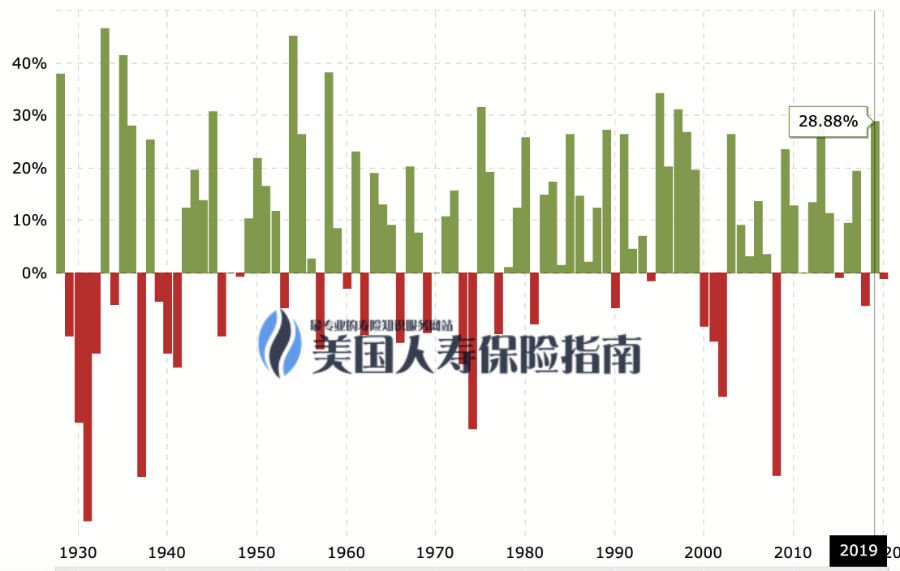

According to CNBC data, in the past 2019,S&P 500 IndexIncreased by 28.9% for the year1.

In the same periodNational Life( Nation-wide ),Lincoln National Life( Lincoln ),Pacific Life( Pacific Life),Allianz Life Insurance( Allianz ) Etc.Asset managementLife insurance companies, the income of policy accounts held by their policyholders has also risen. Among them, the 2019 interest rate of some index strategy policy account holders, evenReached more than 20%.

(>>>Recommended reading:Interview|"I thought the decimal point (rate of return) was wrong", 2021 index insurance posted income statement )

However, the same market environment,Some policyholders have an annual policy interest rate of only 6-11%, while other policyholders have an interest rate of 15% or even 20%+.The same type of insurance policy account, different company issues, the policyholder’s income accrual feelings are completely different, why is this?

"Comprehensive Protection" vs "Asset Management"

With the further segmentation of the American life insurance market, various insurance companies and products on the market have gradually differentiated in two directions.One is focused on providing "comprehensive protection" and has a certain ability to accumulate wealth; the other is focused on "asset management" and is known for its strong global asset management capabilities and investment strategies.

For the "full protection" American insurance policy products, due to the more protection provided, the insurance cost will naturally increase evenly, plusProduct revenue cap valueIn addition to the limitation of the bond yield held by the company, the ability of cash value growth is relatively limited.

Benchmark, a comprehensive protection policy account

We use one of the most common "comprehensive protection" products in the Chinese community: Southwest Life Insurance (also known as:National Life) As an example.The figure below points out that as of June 2020, Southwest Life’sIndex return cap valuefor9.75%, Which is lower than the industry evaluation average 0.25%.

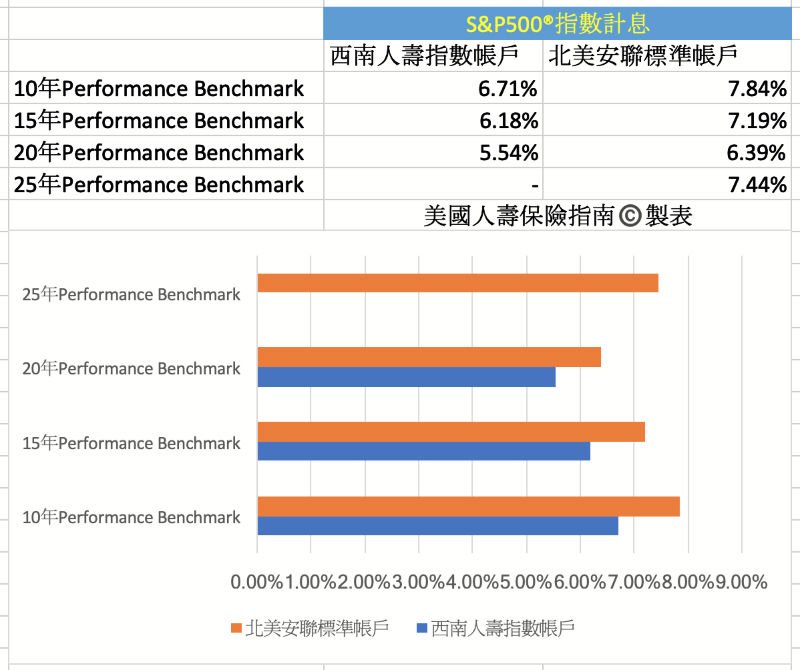

Under the influence of the maximum revenue cap of 9.75%, if you look back at the past market performance, thenThe average yield of benchmark held for 20 years is 5.54%.

The picture above is a specific description,Yellow partThis column is for each yearS&P500 IndexThe actual trend;Blue arrowThis column represents the interest accrual under the current cap value of income accrual. For example, in 2003, the market rose by 26.38%, the accrual of policy income reached the cap value, and the accrual of income was locked at 9.75%;Red portionRepresents the average annual interest accrual of the policy for 5 years, 10 years, 15 years, and 20 years respectively.

Asset Management Policy Account Benchmark

If you look at the 20-year cycle, in the end, the average performance of such policy cash value accounts of policyholders will be significantly lower than similar products from “asset management” insurance companies.

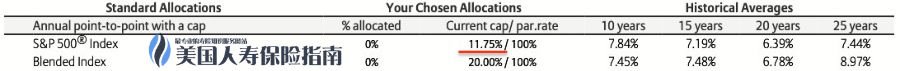

Our main business is "asset management"Allianz Insurance Company of North America(Allianz) of the policyStandard Basic AccountComparison example.The figure below points out that as of June 2020, the standards of Allianz North AmericaIndex return cap valuefor11.75%, Which is higher than the industry evaluation average of 1.75%.

Under the influence of the 11.75% maximum return cap, if you look back at the past market performance, in the historical rate of return in the figure above,The 10-year average rate of return on the benchmark is 7.84%, and the average rate of return on the 20-year policy is 6.39%.

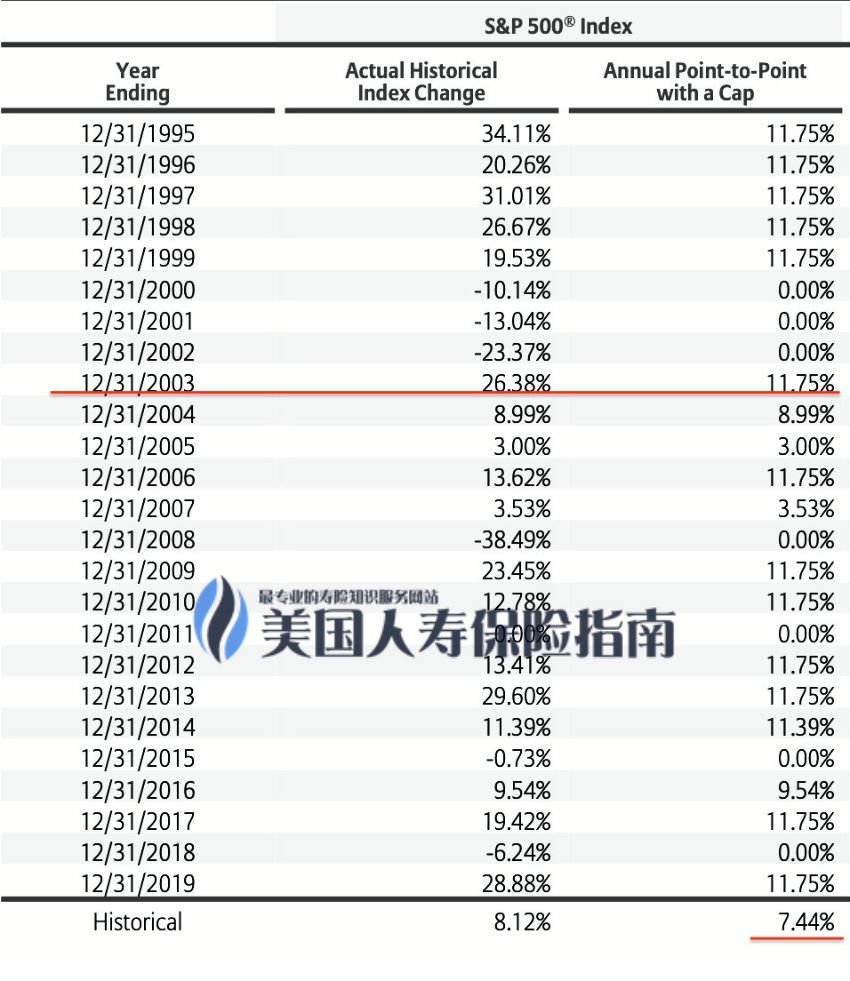

The above picture is a detailed description of the past 25 years.Column 2Every yearS&P500 IndexThe actual trend;The row of large red horizontal lines reflects the current year's cap value and the current year's interest calculation: For example, in 2003, the market rose by 26.38%, and the policy income reached the cap value, and the interest calculation was locked at 9.75%;Red horizontal line partRepresents the average annual interest accrued for a 25-year policy.

The above picture is a detailed description of the past 25 years.Column 2Every yearS&P500 IndexThe actual trend;The row of large red horizontal lines reflects the current year's cap value and the current year's interest calculation: For example, in 2003, the market rose by 26.38%, and the policy income reached the cap value, and the interest calculation was locked at 9.75%;Red horizontal line partRepresents the average annual interest accrued for a 25-year policy.

Through a simple comparison, we can see that the "comprehensive protection" policy product,Can provide more protection, such as covering cancer, stroke, heart disease and other claims.And “asset management” policy products,Even the most basic standard account has stronger wealth appreciation potential.As shown below.Due to space limitations, this article will not continue to evaluate the performance of Allianz North America’s select accounts and dividend index accounts.

Now, the problem is coming. Whether it is a comprehensive protection product, an asset management product, or a 7/3 ratio or a 5/5 ratio comprehensive product, the mature financial insurance market in the United States provides us with a choice of products. It's too much.As policyholders, how can we choose?

The American Life Insurance Guide Community Views

in"American Life Insurance Guide Insurance Strategies (XNUMX)"The article pointed out that which product to insure depends on our own actual needs.

A large amount of premiums are deposited in the "asset management" policy account. When we are facing some special major changes during our lifetime, we are faced with holding huge insurance policies.But it may not help at all in the dilemma.

And a large amount of capital is injected into the "full protection" policy product, which is another kind of"Extensive" insurance with extremely low capital utilization efficiency, The wealth increase obtained is another unsatisfactory result.

From a professional point of view, comprehensive protection, and stronger asset management and wealth appreciation potential, the two do not actually conflict. Avoiding the tasteless products and design schemes in the middle is the key, and the professional management and maintenance in the later period is also An essential link.

There is still a lot of experience and Tips to follow in the selection of insurance products and program design.Our view is, Seeking and professional independenceInsurance Consultant Broker (Broker)The joint cooperation is a better choice.

In the wealth planning range of $500 million to $800 million insured amount, professional brokerage companies in the life insurance guide community analyzed and explained more refined design solutions to editors, helping policyholders to significantly improve premium efficiency and achieve the same annual premium.Take into account guaranteed benefits and increase "asset management" ROITwo major advantages,American Life Insurance Guide©️ will also be demonstrated in the next evaluation column. (End of full text)

(>>> Evaluation|"Other people's home" insurance "makes 20%" a year, but why do I only have less than 10%?Demystifying the policy income under the influence of Cap )

(>>>Popular science posts | What are the 4 most common index strategies in American index insurance and retirement annuities? )

(>>>Recommended reading:What is meant by "full coverage" life insurance for cancer, stroke, and heart disease claims? )

appendix

01. "Stocks post best annual gain in 6 years with the S&P 500 surging more than 28%", 12/31/2019, CNBC, https://cnb.cx/2ZyAwzR

*This article uses legends and figures, derived from the specific policy contract documents actually held by different policyholders and the data indicators provided by insurance companies to consumers when the article was published. This article is not a recommendation for insurance, but is only used to educate and explain to policyholders Purpose.